Barrie Cassidy has called it a breathtaking shift in economic management.

Laura Tingle took the gloves off in an article Being governed by fools is not funny:

A bit like the old story of the frog that gets boiled alive because the temperature of the water in which it sits rises only gradually, we don’t seem to quite be able to take in the growing realisation that we actually are being governed by idiots and fools, or that this actually has real-world consequences.

We finish the week with a Prime Minister who has lost his bundle and is making policy and political calls that go beyond reckless in an increasingly panicked and desperate attempt to save himself; a government that has not just utterly lost its way but its authority; and important policy debates left either as smouldering wrecks or unprosecuted.

When debt under Labor reached 13% of GDP Abbott characterised it as a “disaster”, likely to send the economy down the Greek path. Suddenly, with 20% of his 2014 budget savings stalled in the senate, we have “done the heavy lifting” and the prospect of debt 50 to 60 per cent of GDP “is a pretty good result looking around the world”.

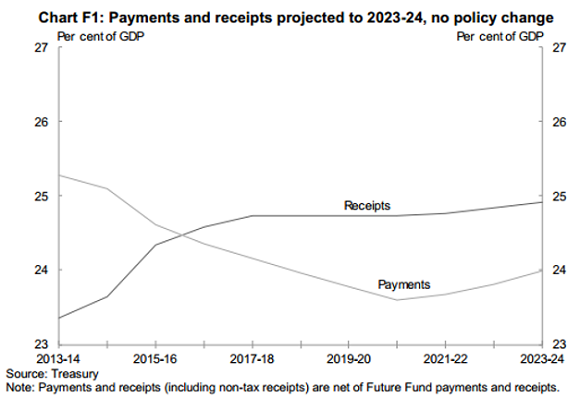

Here’s the graph of the forecast underlying budget cash balance from the Intergenerational Report:

It shows the “currently legislated” path reaching a deficit of 6% of GDP in 40 in years.

Here’s Abbott, pointing to the wrong line, showing us that we’ve done the heavy lifting:

Standard and Poor have warned that if debt, federal and state, goes beyond $30 billion we can expect to lose our prized AAA credit rating.

Laura Tingle and Phillip Coorey say that the federal budget’s forecast bottom line has gone backwards by at least $80 billion since the Coalition came to office.

Abbott and Hockey would have us believe that the bottom line on that graph represents the legacy from Labor. In fact the following set of graphs from Tingle’s article shows the deterioration in the hands of Abbott and Hockey. The first set on the left represent Labor’s legacy:

To emphasise the point about Labor’s legacy, this is the 10-year projection from the Pre-Election Fiscal Outlook (PEFO) prepared independently by Treasury and Finance and published under the charter of budget honesty in August 2013 before the last election is shown:

That’s from this post.

Laura Tingle says that Labor’s focus groups keep throwing up the word “idiot” in relation to Tony Abbott. Swinging voters in Western Sydney in polling commissioned by Fairfax described the Prime Minister as “incompetent, an international embarrassment and a fool”. She thinks that there are “signs that our political system really is in deep trouble – not as a polemic point, but in a very real sense.”

Peter Martin tells us that:

In Labor’s last financial year in office, spending exceeded revenue by 5.4 per cent. This year it will exceed it by 13 per cent.

The budget does have to be fixed. The Reserve Bank Governor, Glenn Stevens, recently warned that in a recession a deficit of 3% of GDP will quickly balloon out to 6 to 7%. That allows no space for government stimulus of the economy.

Apparently Hockey has been sitting on a tax white paper for several months which is to be released next Monday, after the NSW election. Peter Martin looks to the savings available from super:

Treasury’s most conservative estimate has the concession for contributions to super funds costing $15.5 billion this financial year, climbing to $18 billion over three years. The tax concession for the earnings of funds costs $12 billion and is set to almost double to $22 billion. By way of comparison, Medicare costs $20 billion.

Peter Lloyd, Professor of Economics at University of Melbourne, puts forward some ideas, including:

- Eliminating negative gearing for housing investments

- Restricting the allowable deductions for depreciation and other business expenses

- Revising rules relating to income from trusts

- Tightening the rules for fringe benefit taxation

- Reforming the taxation of super contributions and income

- Reducing tax concessions for not-for-profit organisations

As he says, each one of these will meet objections from tax payers. But then the art of taxation was always plucking the goose without too much squawking.

A prime minister fighting for political survival appears to have thrown in the towel.

Update: I meant to mention that Labor had the budget remaining in surplus over the remaining part of a 10-year projection in order to show how Gonski and NDIS would be paid for, whereas Abbott/Hockey planned to slash schools and Hospital funding by $80 billion dollars.

Abbott is now saying that a surplus will be achieved within 5 years, whereas Mathias Cormann is saying “as soon as possible”.

Abbott has excelled yet again, he now can lie with his mouth either open or closed, adding his new skill of pointing at a piece of paper.

Looks like a successful act of reverse psychology.

For years he’s been rabbiting on about our economic and fiscal decline and been ridiculed in the media. ” What budget emergency ?”, ” Stop talking the economy down! ” and ” Debt and deficit scare campaign ” they said.

Yet with a simple ” You want big spending and deficits, you got it ” from Abbott we now have the ABC, left wing blogs and the ALP calling, no, demanding that we DO SOMETHING!! about our childrens debt and repayments.

Labor/greens were never going to realise a surplus ( even the 30 in a row of $10bill we need to stop paying interest to our foreign creditors) not even a paper thin one. No chance at all.

But now at least their side is begging for one, which is a major breakthrough.

Well played TA, you’ve finally managed to manipulate the folk that will never ever vote for you.

Only to you Jumpy, only to you.

Jumpy, be fair. Think about it!

Labor attempted to bring the budget into surplus in 2012-13. It failed with failing revenue. Their last official effort had the budget coming into surplus in 2017-17 as indicated in the charts above.

Labor had the budget remaining in surplus over the remaining part of a 10-year projection, to show how Gonski and NDIS would be paid for, whereas Abbott/Hockey planned to slash schools and Hospital funding by $80 billion dollars.

Abbott is now saying that a surplus will be achieved within 5 years, whereas Mathias Cormann is saying “as soon as possible”.

Abbott’s problem is that, as opposition leader, he made such a fuss about Labor’s debt after Labor had done the right thing to deal with the GST. Add to that all the dishonesty and attack dog behaviour. Labor is unlikely to resist the temptation to give a bit of what they copped back, especially since they won’t need to resort to porkies to mount those attacks.

It would be better for Australia (and the LNP) if Abbott is replaced with a credible leader who was not connected with the dishonest attacks when Abbott was leader of the opposition.

Jumpy, this TA you are welded to is the buffoon who, pre election, guaranteed an employment bonanza and a balanced first budget. So day one in the government seats distributes 18 billion dollars of borrowed money to his favourite LNP state friends before his prebudget assessment, then demolishes Australia’s auto industry and sets off a public servant sacking spree. What a genius. Then in brain fade two he kills off the only two significant revenue collectorion devices that were promoting employment on the one hand and giving a return for the one off export sales of Australian soil on the other. And THEN….he sets about upsetting as many world leaders as possible while selling our country down the river with a series of ill considered trade deals.

I fully expect to hear in tomorrows news that TA has taken to priceless treasures and ageless relics in our History Museums, destroying as much as he possibly can in the name of future generations. You sure know how to pick ’em, Jumpy.

I think that I read somewhere that the Pope is concerned that your dear Tony is merging the Dunce title with the word Abbott and this could by association damage the Catholic “brand”. Atlantic Cyclone Tony 2012 was a fizzer, but 2013 Pacific Cyclone Tony will be remembered for the trail of Australian damage for decades to come.

Bilb

Abbott is a big government, populist bullshit artist as I’ve said in the past here.

I don’t know about the $18 bill, so fill me in if you have evidence.

The autos were gone before Rudd 2, as soon as Rudd gave them a stack of our taxes and declared they’re here for 20 years, they announced they were leaving.

He sacked plenty of public servants ( as did CanDo ) which no tax payer even noticed the change.

The co2 tax raised stuff all after the compensation. Dickhead TA kept the compo ( face palm ).

The way the mining tax was drawn up by the big miners ? it raised nothing, I suspect with commodities at the price they’re at now we, the tax payer, would be paying them compo ( well done swany )

What foreign leaders did he upset that ALP didn’t ?

You have no knowledge of the trade deals to make a judgement, noone has, just like all past deals when they’re signed into law. ( that’s shitefull btw )

When comparing irrational, personal judgement on our PM, your negative outweighs any positive I may have by a factor of 10.

In other words, you’re another blinded by ” Abbott-hateitis ”

Get well soon.

Brian @ 4

Was the fall in revenue less, equal or more than spending ?

Labour were never going to get a surplus, projected or otherwise.

” Terms of Trade ” is money comin in V money goin out.

ALP had the highest in Australian history, yet the debt grew!

Unemployment low, yet welfare spend ballooned !

Interest rates at emergency levels, yet growth tiny !

ALP spends to get votes with borrowed money, alway have, always will.

Abbott has been able to cut SFA due to the Senate.

Perhaps you could show me the ” cuts ” that have past the Senate rather than ABC ” journalists ” regurgitating ALP question time gotchas from Hansard.

( Any tone you may perceive is probably due to your inferring that I don’t think and am not fair.I believe I do and am.)

Terms of trade lately.

Terms of trade historic.

Jumpy: The terms of trade were good but the gains were due to mining and the miners paid no GST on exports, somehow managed to minimize company tax payments and, in reality, provided remarkably few jobs. You have to separate government revenue from exporter income.

Both Labor and the LNP have squibbed on increasing government revenue to the point where governments at all levels can afford to do the job they should be doing.

John

Show me mining company tax or royalties revenues that have dropped under State or Federal ALP and I’ll consider your point relevant.

Mining companies payed %10 of GST on every good or service they used, just like you and I.

Consider the tax revenue payed by companies servicing and selling to mining companies also.

And their employees that splurged as well.

Jumpy: Mining company taxes and royalties drop as soon as the price they receive for their product drops just like you and I.

Exports are GST free and the exporter can claim back the GST paid to suppliers.

Mining employees do pay GST on many of the things they spend money on in Aus. Miners are well enough paid to spend big when they go overseas.

Jumpy.

Fairness: I got the impression that you said that the left placed no importance on bringing the budget back into balance. Clearly this is wrong. Labor left the shop showing a surplus in 2015-16 on the information available at the time.

There is a limit to how much research I’m prepared to do in a comments thread, so here goes.

From memory, from his book, Swan had to deal with revenue write-downs on some $180 billion dollars during his six years. Conversely, Costello had a tsunami of unexpected additional revenue coming at him of roughly double that.

Swan found savings to match, plus space for new initiatives, and had the budget heading for a surplus, on the information available. You can’t ask more than that. The record is one of prudence rather than wasteful spending, mindlessly repeated by those on the right. And dealing with the GFC, which the right airily dismiss.

If Laura Tingle says $80 billion has been added to debt, that’s over the 4-year budget outlook period, that’s good enough for me. She’s qualified in economics, has a background in financial analysis as well as journalism and doesn’t make shit up.

The $18 billion of debt BilB keeps quoting, was actually $16.9 billion in the first year at the time of this post, according to ABC FactCheck. It was $68 billion over the budget outlook period.

The biggest items were the one-off $8 billion to the Reserve Bank, from memory, and the 7 to $8 billion pa for the carbon price. More has since been added through Senate backdowns etc, for example GP co-payments and university funding.

It is all in here, Jumpy. The the good, the bad and the ugly, both ways.

http://www.abc.net.au/news/2014-06-12/joe-hockey-one-billion-a-month-interest-fact-check/5478480

….however, supporting information for what is happenng in the economy is also required. Information such as the fact that Howard surfed on the crest of an economic mineral boom wave. Labour had to cope with the economic trough GFC.