The AFR reports that Alinta is finalising its bid for Liddell, energy minister Josh Frydenberg says by the end of April, so any day now. That was in response to the announcement by AGL the day before that it will build the 252-megawatt gas-fired plant near its Newcastle Gas Storage Facility, completing construction at the end of 2022, for the cost of $400 million:

Above is an artist impression of a similar facility in South Australia.

Frydenberg was not impressed.

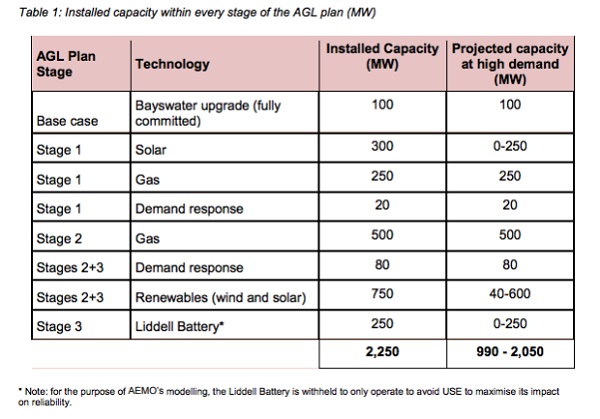

Indeed this table from the post AGL doubles down on Liddell plan shows the gas generator as belonging to Stage 1 of the $1.4 billion replacement plan:

The centre-piece for those looking for a steady supply of energy is arguably the 500MW gas plant in Stage 2, which would produce 500MW, rather than the 750MW renewables component in Stage 2+3 which would produce 40-600MW under “high demand”.

AGL’s problem appears to be that to justify spending on such a large plant it needs commitments from major customers to buy the electricity. The problem appears to be this:

- The minister also pointed to the support of large industrial companies such as Tomago Aluminium, BlueScope Steel, Brickworks and others that have come together under the banner of Manufacturing Australia “and are working with Alinta to purchase this Liddell plant”.

“Working with Alinta” is probably over-stating the case. Ben Eade, CEO of Manufacturing Australia said (reported on 4 April):

- any firm contracts were a long way off, describing the body’s stance as “support in principle of any credible party that wants to run that asset beyond 2022.”

We are told that Alinta chief executive Jeff Dimery has been given the nod from the company’s owner, Chinese conglomerate Chow Tai Fook Enterprises:

- to explore a potential $1 billion investment that would include the acquisition price and spending needed to keep the plant running an extra seven years until 2029.

Alinta’s estimate of what it takes to restore Liddell is bound to be less than the $920 million AGL claims as necessary, but it is hard to see Alinta putting enough on the table to temp AGL to sell.

It’s worth noting that Manufacturing Australia’s needs may well be described as ‘baseload power’ and they probably fancy that coal will be cheaper than gas. They may have overlooked the fact that coal is in short supply. As I posted last September:

-

The crunch point is that NSW generators have to burn more coal than their long-term coal supply contracts cater for. So supply is tight for a number of their power stations. Miners are flat strap supplying their export contracts, there are some problems with rail capacity, and Glencore is having a barney with the CFMEU.

Angela Macdonald-Smith reported on 26 April:

EnergyAustralia, another rival to AGL, is also progressing plans for a new gas power plant at its Tallawarra site south of Sydney.

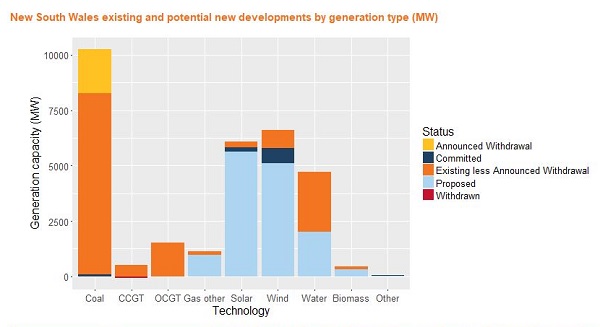

Hard to know how relevant that is. From the AEMO site that monitors energy generation:

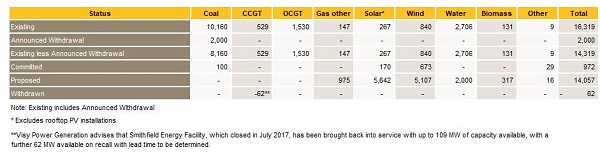

That was at 18 March this year. Plenty of new power proposed, especially wind and solar. Here is the corresponding table:

The table shows 2000MW of coal to be withdrawn. No doubt that is Liddell. If so it is probably only 1680MW at best, the capacity rating given to Liddell by AGL.

Against that there is 100MW of coal committed, no doubt Bayswater, plus 29MW ‘other’.

The table shows 975MW of gas proposed. Chances are the 750MW of that consists of the two AGL Liddell replacement gas stations.

The 2000MW of hydro power is likely to be Snowy 2.0, which is not mainstream power, but should probably be seen in relation to rooftop solar contributing to the grid (not shown) and firming in part the combined 10,749MW of wind and solar proposed. There is also 333MW of biomass and ‘other’ being proposed.

After Liddell the only coal power station likely to close before 2032 is Vales Point, an old clunker sold in 2015 by the NSW government to Sunset Power International for a token $1 million, which then-NSW treasurer Gladys Berejiklian said was “above its retention value”. It now is valued on its new owners books at $730 million, having produced $380 million worth of electricity sales in the past financial year.

Remember that AEMO calculated that if AGL only expanded Bayswater by 100MW and completed the Silverton wind farm, and nothing else new came on board, the shortfall would be 850MW based on a world champion security standard of 0.002% in outages in any one financial year. Proposed gas and biomass alone make up 1308MW of what should be ‘baseload-like’ power.

The only way a crisis in supply will emerge is if the Commonwealth through the National Energy Guarantee (NEG) is actually successful in stopping renewable energy development in its tracks. Then a ‘crisis’ will be the prospect of 200,000 homes losing power for up to five hours once in every three years, no more than a couple decent SEQ summer storms.

There is a lot of humbug being spoken in the politics of Liddell, which would be funny if not so serious.

Update: As an update, from RenewEconomy AGL rejects Alinta bid for Liddell, Coalition goes nuts.

There is further discussion on the Climate clippings 223 thread.

Perhaps we need to be talking more about solar thermal with molten salt storage and backup molten salt heating. Makes more sense in the longer term and there is no problem with fuel exports being given preference over domestic power suppliers needs.

I can understand why some manufactures want cheap baseload power. However, those who want very cheap power should be looking for opportunities to use the very cheap surplus power that can be produced by solar and wind.

I’ll wave my hand at pumped hydro too JD. I don’t know why it is not discussed more.

Here is some more info:

https://arena.gov.au/blog/the-energy-innovators-andrew-blakers/

I’m going to double down on the link I just posted:

https://arena.gov.au/blog/the-energy-innovators-andrew-blakers/

The second of two embedded video’s is full of facts and insights into pumped hydro. Please look at it, especially the second video, that is very insightful.

Blakers is a hero. I wish he was as well known as, say, Fred Hollows RIP or Dick Smith.

Thanks Ambi

I’m just praying that Jumpy does not crucify him (Blakers) for being a government-funded visionary pointing a way to a carbon free energy future.

I’ll check those links later this afternoon.

From Angela Macdonald-Smith on 5 April:

(Emphasis added)

Thse fossils want a guarantee that coal will have ongoing acceptance to avoid the ‘risk’ that it won’t.

John D, the companies involved would lie easier in bed if they had the predictable costs of firmed solar and wind in prospect. They are too stupid to know it, I suspect.

Geoff H

Jump’s got us all rattled.

I fear what he will do with Chow Tai Fook.

(Sounds like a very tasty Chinese takeaway in town, offering a full range: eat in or go away.)

Chow down or Tai off.

Nothing to do with energy supplies: rather, fundamental science and technical innovation.

An unsung hero is John Bolton, RIP.

Yorkshireman.

If you’ve seen “The Dish”, he was played by Sam Neill.

Yep, the Parkes radio telescope.

See: Radio Astronomer. John Bolton and a New Window on the Universe, by Peter Robertson; NewSouth Publishing, 2017.

Brian:

This is why I keep rabbiting on about competitive bidding for power supply or capacity contracts including the renewable auctions that seem to be driving much of the world’s renewable power capcity.

John D I’ll come back to reverse auctions in a forthcoming post.

Geoff H, Blakers video you directed us to should be compulsory viewing by politicians, energy CEOs, Rod Sims of the ACCC, all politicians at all levels of government, and all the NEM crew – AEMO, who I think know, AMC, AER ans ESB.

Blakers bottom line is that it is only politics stopping us from getting to 75% cuts in emissions across the board at negligible net cost by 2033. The best realistic offer we’ve had to date.

People can stop quoting BZE 2010 and start quoting Blakers 2017.

Blakers, excellent.

And on the battery side have a look at

https://youtu.be/71xsolL7X7c

And call…

Luke Cassar

Mobile : 0414 476 636

Email : l.cassar@naturalsolar.com.au

…for definitive information on the deal that completely pulls the rug out from Turnbull’s arguments.

Why we need to hurry everything up….

https://youtu.be/SIBoJWDAg00

It is time for anyone who wants to be sure that they will survive the future to begin to review how much food they have stored in their house. We have been sleep walking into a corporate day dream that everything will stay the same forever, that our day to day food supply is secure. There is a line that says the average American is just two pay checks away from bankruptcy, well the same applies to the average Australian household for food security.

Go to Arctic News website to see the full extent of the horror show we have lined up.

Earlier this morning news broke that Alinta says it has lobbed formal bid for AGL’s Liddell power station. The Australian appears to have broken the news first. The SMH has also reported on this news, link here.

AGL isn’t going to sell Liddel for all of the obvious reasons to do with enabling a competitor all the way through to the value of the site and its ready connection and availability of in place trained staff. Freydenberg has set himself up to be disappointed.

Freydengerg should put his efforts to encouraging the local coal Bergers to spend some of their easy money on building coal to gas facilities to supply AGL’s new gas plant rather than wing and moan at AGL’s superior business model.

Bilb: My understanding is that coal to gas will create more emissions than using coal directly to make power. We really need to reduce our addiction to fossil carbon and start by not building fossil power plants.

There used to be a brown-coal-to-gas plant near Morwell, called “the Lurgi”.

The rumour that The Goons’ “dreaded Lurgi” originated there is without foundation, but should be promoted by the poorly named Monash “Brains” Trust, since they love all things lignitian.

In 1950s Melbourne many families burnt “coke” in home heaters. I recall it was silvery grey, low density and arrived in sacks.*

The flue in the loungeroom gradually acquired a dark brown stain as something in the flue gases condensed out. Horrible air pollution outside, doubtless.

* we were told the coke was a by-product of extracting gas from coal….

Apologies for describing an ancient technology.

(It’s one of the things old codgers do.)

On the issue of the risks see the latest report – https://reneweconomy.com.au/energy-reliability-risks-so-small-they-are-barely-visible-29136/

Thanks for the link, doug. If people want to follow the documentation, you can read hundreds of pages linked from here.

In short the AEMO Reliability Panel has looked at the Reliability Standard in their four-yearly review. They have recommended no change, but commissioned a whopping Ernst and Young report along the way.

The story is that prospective outages from ‘unserved energy’ are a mere one 300th of the standard. Effectively there is no problem. Seems that:

Here’s AGL’s announcement to the media and the ASX on the Alinta bid, also available at the ASX:

Alan Kohler reported that it wasn’t an actual offer, but an indication that if it was it would be $250 million.

Seems that according to AGL:

As a shareholder I have access to reports on listed companies, which I can’t quote directly. It seems that Alinta is offering only a little more than the expected average net cashflow each year from Liddell between now and 2022.

That’s net of expenses. Alinta can’t be serious.

I’ll be astonished if AGL accepts the offer.

JohnD

That depends upon which power system is used. If AGL instal the Siemens 61.5% efficient gas turbines with their stated intention of using gas for the reason of response support for wind and other renewables then the marginal loss in efficiency is less important and it keeps everyones interests srviced. Remember the gas consumption power phase is a transitional one towards the final fully decarbonised economy. Further if the gas to power AGL’s plant was otherwise to come from coal seam gas then there are losses and leaks from that process. Which is worse? Freydenberg’s plan is to keep a 30% efficient plant running purely to keep his coal mining friends happy.

The coal to gas option with the Siemens gas turbine to me stacks up as the best option from that tangle of vested interests. And again this is a transitional phase . To me the best solution is the battery stabilised rooftop distributed solar model.

What is the value of the intelligence parameter in our energy situational equation? Probably just 5%.

Our stupid and disfunctional Australian governments have spent some 2 billion dollars on the pipe dream of clean power, while at the same time demolishing our car industry. Consider the potential returns had those funds been otherwise committed? Its never too late to learn from mistakes, are you hopefull of that happening?

I would question whether rooftop solar is going to supply the power required by large manufacturers.

I read somewhere that the Stage 1 gas 250MW plant was mainly to supply peaking electricity. However it would be presumed that the 500MW plant would be operating in a more continuous mode.

Remembering that Blakers said pumped hydro is one 10th the cost of big batteries, solar, wind and pumped hydro would seem an obvious alternative.

AGL in part wants to get out of coal because too much of the company’s generation is coal. They may be heading for a situation where they have too much gas.

Alinta, OTOH, wants to get market share in east coast generation on the basis of old coal. This is high risk to the point of stupidity unless they get bipartisan protection for using coal well into the future.

This is actually a crime against humanity. I can’t see Labor playing along. Nor COAG, where the NEG requires consensus approval. All states and the ACT have to agree.

“This is actually a crime against humanity. I can’t see Labor playing along” That is getting to the right attitude on this recognising the urgency with relation to the rate of change of the Environmental Degredation.

Industry are not beyond fitting up their own rooftop solar. I know of several that either have, or are in the process. Business gets the opportunity when they build new facilities or relocate to new premisis. Remember that much of the “factory” space in Australia is either warehousing, commercial or retail, and the electricity demand is substantially reduce relative to heavy engineering. One company that I know of is a sheetmetal business running 4 high power lasers, 4 cnc benders, a combination turret laser, a powder coating plant and a bunch of smaller machines and hand tools. They believe that they can get most of there energy from the roof.

It is not as clear cut as you might imagine. The real issue is how to manage non solar periods. I believe that. This will be handled, as I have said many times, by user generated power from mains gas (ie on demand stored energy), remembering that this power also generates hot water, and potentially hot air via exhaust (power coating and other processes). Sound too complicated for industry? It is just another system to have beside the air compressor, the liquid nitrogen tank, the chemicals reclamation system, etc. In other words industry does what it needs to do, no biggie. There are real bonusses for Strata style factory blocks where the off peak unit can be sized to provide for the whole unit set amounting to a micro grid.

Remember that the goal here is to decarbonise the whole economy. Turnbull is trying to make this a “cost of electricity” argument after the LNP effectively drove the price of electricty to the levels that it is, and reducing emissions is that not part of their agenda having made the bogus claim that that has been handled with soil carbon. Total BS, and a real con job being played on a disinterested (they think) and gullible public.

By the way the Hunter Valley open cut mine holes might be able to be used for pumped hydrop storage, but they are not the 275 metres depth that is required.

I have to fly, BilB.

Yes, and the wholesale price of electricity is only about 25% of the bill.

Exactly. Any variation in the cost of production is entirely marginal.

Brian (Re: APRIL 29, 2018 AT 9:56 PM):

I think it’s a compelling presentation, but the information doesn’t include any cost comparisons with concentrated solar thermal with molten salt thermal storage (CST+MSTS) technology.

I note that the presentation on the YouTube Blakers’ video (at time interval 00:15) says the Innovating Energy Summit at Parliament House, Canberra, was on 14 August 2017, which I think is significant. On the same day, RenewEconomy.com.au posted an article headlined Giant solar tower to provide all S.A. government electricity needs, which stated (bold text my emphasis):

In the YouTube Blakers’ video (at time interval 07:47) a figure is shown headlined Cost of electricity including hourly balancing, comparing $/MWh costs for PV & wind + PHES + HVDC + spillage for 2016, 2017 & 2020s. The South Australian CST+MSTS project $/MWh generating costs are competitive with Blakers’ figures for PV & wind + PHES + HVDC + spillage for 2020.

I think the $/MWh generation costs of CST+MSTS for (according to BZE eminently feasible) 200-220 MW capacity generators with 17 hours thermal storage have the potential to be significantly cheaper than SA’s project Aurora’s contracted $78/MWh maximum figure – perhaps making CST+MSTS significantly cheaper than PV & wind + PHES + HVDC + spillage.

Indeed, but it needs to be updated to include the latest actual (and projected) costs for new CST+MSTS technology.

BZE’s Stationary Energy Plan 2010 needs to be updated to incorporate the latest costings for generation and transmission technologies. “Blakers 2017” also needs to be updated. But that does not detract from the general message – that 100% renewable energy electricity supply for Australia is the only option available now that’s long-term sustainable, timely, affordable, reliable, and complies with the requirements of the Paris Climate Agreement for net-zero carbon emissions by 2050.

BilB (Re: MAY 1, 2018 AT 6:42 AM):

Gas-fired electricity generation is not “transitional” – it needs to be phased out in a timely manner, just the same as coal-fired electricity generation. And the appropriate mix of technologies are clearly available and affordable now (according to Blakers, that you have stated is “excellent”) to achieve a decarbonised electricity generation sector, in a timely manner.

You’ve got to be joking, surely? Let me get this straight: You think it would be a good idea to mine more coal, then convert it (with plants yet to be built) into gas to feed “the Siemens gas turbine”? Do you have a vested interest in Siemens, or coal-to-gas technology? What are you thinking?

Then you say in a later comment (at MAY 1, 2018 AT 11:07 AM):

You appear to me to be promoting the continuation to consume gas and coal in one comment and then say the opposite in the next comment. Are there two different people making comments under the same handle “BilB”? There seems to be a logical dissonance occurring in your statements.

The key, I think, is the meaning of the word “transition”.

Not the immediate and utter elimination of emissions, but the steady and strong reduction of emissions.

That’s fair as an aim, I think.

The calendar in our place reads “2018”, not 2030 or 2050.

You want technical figures to be updated. Good.

So if the Siemens turbine is the best now available, can’t another contributor here, likewise “update” and advocate it as a better gizmo than whatever is being used now?

Better, not perfect.

Best available, not perfect.

The good is not always the enemy of the best.

Individual action does not necessarily preclude or obstruct general, collective action.

Collective progress should leave wriggle room for individuals to do even better than the average, or the mandatory minimum.

I reckon it’s a sad fact – merely an observation, mind you – that individuals can be irresponsible or visionary; that collectives can be oppressive or pioneering.

Nudging in a good direction by the majority might, just might, have a greater effect than spectacular trail blazing by a minority.

Cumulative effects of change are well worth noting. Setbacks too. It’s very complicated.

Lead times, lag times……

Ambigulous (Re: MAY 1, 2018 AT 7:16 PM):

Yep. No argument from me so far. Then you say this (bold text my emphasis):

So I ask you to explain how consuming more coal for coal-to-gas processes (which are more emissions intensive) to feed “the Siemens gas turbine“, and continuing to consume more gas, is providing “the steady and strong reduction of emissions“?

Then you say:

David Spratt tells us:

I take from this that we are already locked in for 1.5°C warming. And this:

I ask you: Do you think David Spratt and the people/studies he cites are wrong? Do you think humanity has plenty of time to stuff about? I don’t.

Fine, if it fits in with the imperative: “the steady and strong reduction of [carbon] emissions“. What BilB is advocating (i.e. coal-to-gas and continuing to consume more gas) goes against that imperative.

My advice to you is: If you are in a hole, and you wish to get out of it, stop digging!

Briefly

No I do not think our species has ample time to stuff around. I applaud your efforts to try to convince politicians of the peril, citing engineering and financially educated spokespeople.

The sooner we can see reductions (secular trends, not temporary effects due to recession or warm Northern winter or sudden price shocks) the better.

GeofM,

Gas is an important part of the transition to renewables. It is even an essential component of the Hybrid Solar Thermal systems for extended no solar periods. The 600 MW Siemens Gas Turbines (combined cycle) at 61.5% peak efficiency so far are sufficiently effective to fill the gap and provide rapid reaction to changing loads and delivery.

Yes Coal is the dirty word but you assume that the gas plants in the future will not be powered with bio fuel making them fully renewable.

Over 10 years ago I put forward the 3 cent per unit levy as a means to deliver a renewable transition at the maximum rate while retaining low power costs. This was a no brainer. Levies are a very effective tool used by governments to manage contingencies. Howard created one to pay out Ansett employees. Queensland repeatedly creates them for flood and storm damage recovery. So a levy is not contentious. The main reason why such a methodolgy was not adopted was simply because there were too many noisey vested interests, not the least of whom were the economists who wanted to experiment with “market mechanisms”.

The reality is that gas powered plants are already on order for the Liddel site and there is nothing I or you can do about it. We just have to navigate a renewables solution around shit field being laid down by the mentally vacuous LNP ideology.

We are already at the 1.5 C point when Arctic Warming is fully factored in. That is why every conversation I have is that there has to be a royal Commission into Australia’s Response to the Threat of Climate Change. With out that we will flounder through another 20 years of disorganised and misguided efforts.

I’m amazed though that you have never asked a question about PVT’s nor mentioned them in your many detailed evaluations.

Good point about renewable sources of gas in the future BilB.

BilB (Re: MAY 2, 2018 AT 4:33 PM):

I think gas is not a “transition” energy source – renewables are the transition energy sources. Humanity must phase out the burning all fossil fuels to achieve the steady and strong reduction of carbon emissions in a timely manner – there’s no time or resources to waste to build any new, or maintain existing assets in the medium to long-term for gas-fired electricity generation.

Not according to BZE’s Stationary Energy Plan (2010) – Section 3.4 Other renewable energy sources for energy security backup includes these statements (bold text my emphasis):

The BZE report discusses the use of biomass from wheat crop waste as one option. The total backup energy required for the ZCA2020 plan is only 93 PJ/y or 15.5% of Australia’s wheat crop residue (energy density estimated at 17.1 MJ/kg). Woody biomass (e.g. woodchips and/or crop waste) would be pressed and extruded into pellets or briquettes, which have a higher energy density and lower moisture content, making transport and storage more economical. CST backup only requires an estimated 5.3 million tonnes per annum of biomass pellets. Biogas is mentioned for industrial methane gas supply only, and is not intended for CST backup.

BilB, rather than promoting Siemens Gas Turbines, why don’t you promote Siemens (and/or General Electric) 220 MW supercritical double reheat Steam Turbine and Generator sets for CST? In the BZE report, on page 51, under the heading Turbines — High efficiency, Fast start, it includes:

Per BZE, CST can provide rapid ramp-up and reaction to changing loads and delivery, with zero carbon emissions (excluding biomass backup). CST can be constructed quicker than gas-fired power stations – South Australia’s project 150 MW Aurora CST was approved earlier this year and is scheduled to be operational in 2020, whereas AGL has just committed to their 252 MW gas-fired power station that won’t be operational until the end of 2022. And Aurora CST is now cost-competitive with gas – gas will inevitably become uncompetitive in a ‘post-peak gas’ world.

Comment continues…

…comment continued:

I’m taking notice of what BZE (and others, including Steven Blakers – see Blakers video at time interval 09:14) are saying – no room for oil, gas and coal for electricity generation, land transport, and low temperature heat, which eliminates about 55% emissions (per Blakers). Biogas is reserved for industrial processes (per BZE).

I think you’re probably correct. The evidence I see suggests AGL’s investment is highly likely to become “stranded” long before its intended retirement, perhaps even before it becomes operational if a global ‘post-peak gas’ world arrives before 2022 (which I think is quite possible, likely due to declining US shale gas production), ramping up global gas prices and making gas-fired electricity more expensive/uncompetitive. See my comment here.

I suggest you read through the technical sections of the BZE Stationary Energy Plan – I think it still has technical merit, but the costings are without doubt no longer valid – way over the top, particularly for CST. It is one solution for Australia’s electricity generation and transmission, and is not necessarily the best solution given technical developments and cost reductions of generator technologies since the report was published, but I think it’s still certainly ‘in the ball-park’.

I think CST with adequate storage, without question, should be a major contributor to Australia’s electricity generation mix.

Yesterday, I rang the BZE office to suggest that BZE should publish a major revision to their 2010 Stationary Energy Plan, particularly with respect to costings, and was advised that others have made similar suggestions, but there were other more pressing priorities and there was no intention to do so presently. There have been more recent studies, including one commissioned by the AEMO (July 2013, in response to BZE’s report) and the UTS:ISF report 100% RENEWABLE ENERGY FOR AUSTRALIA: Decarbonising Australia’s Energy Sector Within One Generation (March 2016). Unfortunately, renewable energy developments are progressing so fast that by the time a new report is published, the information within, particularly with respect to costings, is likely to be stale. But that’s no excuse for inaction – emergency action is required now.

Siemens SST-700/900 Economical dual-casing steam turbine for reheat applications, link here. The brochure includes (bold text my emphasis:

A reference application includes the BrightSource Energy Ivanpah Solar Energy Generating System in California’s Mojave Desert. This facility includes 3 separate units each with:

Steam turbine: SST-700/900

Power output: 123 MW(e)

Inlet pressure: 160 bar(a) / 2321 psi

Inlet temperature: 550° C / 1004° F

And then there’s this brochure from General Electric for Steam Turbines STF-600 Series, link here.

GM: The BZE stationary energy plan was about proving that the technology was already there to go to 100% renewable stationary energy while supplying the demand as it was then. This was at a stage when for years the cheap power was base power and industry had adopted to that.

The world is different now and a new report would have to be a massive study that probably should be done by someone bigger than BZE.

Having said that it is worth noting that a solar thermal plant is going to be built at Augusta. Seems solar thermal can still be competitive as a self contained baseload or slowish reponse peaking under the right circumstances.

I am with you John D, we live in a rapidly changing world which requires a mixture of technologies and approaches.

This is smart, aimed to fill a gap in the Australian market for renewable energy systems at small commercial scale (100-500 kW) that can be easily moved and temporarily deployed (for days, months or up to a few years). Only needs a container full of batteries too and another one for clever demand control and efficiency gadgetry, for example who says we should solely stick to 240 AC .

For example I was looking at second hand 5kW panels with micro inverters on board which made me think if there would be an easy way to configure these as stand alone unite to drive my 3phase irrigation pump.

Overall it used to be said that up to 50% renewables without storage was OK in a grid. I noticed that Blakers still holds that view. SA is already there, so has to and was while Weatherill was there serious about firming, smoothing and backing up renewables.

I think the manufacturers currently served by Liddell are not up to speed with developments in energy, have swallowed the propaganda promoted by the government and are taking a reactionary stance yearning for the good old days when coal was king.

Some companies, like Telstra, are being proactive, looking to generate their own power with renewables, others like Glencoe in Mt Isa just sit there and grizzle. Mt Isa is not on the NEM and is supplied mainly by gas, which is not local and I gather rather expensive. Yet they are sitting in one of the best solar provinces on the planet.

AEMO is actually doing some forward planning, which is to be my next climate post.

Geoff M, if you keep an eye on the NEM, NSW is often the mendicant state now, and the final balancing comes from gas in Qld.

“But that’s no excuse for inaction – emergency action is required now.”(Geof Miell)

What ever differences of opinion there may be on some details, this is the absolute truth.

In today’s The Australian, an article headlined New coal power stations ‘no match for renewables’, reports on comments by Energy Security Board chairwoman Kerry Schott.

RenewEconomy reported on May 2, Schott speaking at the 2018 Future Thinking conference, hosted by the Energy Users Association, where she said:

The Australian article includes responses from Josh Frydenberg, Tony Abbott, and Barnaby Joyce.

I note that it has been reported that Barnaby Joyce has said:

It seems Barnaby has his facts wrong. Per BP Statistical Review of World Energy 2017, in 2016:

USA had the world’s largest proved coal reserves at 26.6% global share;

Russian Federation had the world’s second largest proved coal reserves at 17.6% global share;

China had the world’s third largest proved coal reserves at 12.8% global share; and

Australia had the world’s fourth largest proved coal reserves at 8.6% global share.

What would Barnaby know?

It’s a bit difficult for governments to ignore Schott’s comments – good on her for making them.

?? Could it be “coal reserves per capita”????

All right, I too have never heard of such a measure, but with Barnaby you never know.

🙂

BTW,

We keep our per capita share in the shed, under lock and key.

It’s the only responsible course of action.

Correction to my comment (at MAY 4, 2018 AT 12:34 PM):

In my haste to deliver my comment I misquoted the wrong edition from BP Statistical Review of World Energy. The data quoted in my previous comment is from the 2016 (65th) edition for the year-2015.

For the 2017 (66th) edition, for the year-2016:

USA had the world’s largest proved coal reserves at 22.1% global share;

China had the world’s second largest proved coal reserves at 21.4% global share;

Russian Federation had the world’s third largest proved coal reserves at 14.1% global share; and

Australia had the world’s fourth largest proved coal reserves at 12.7% global share.

China boosted it’s proved coal reserves significantly from 114.5 billion tonnes at the end of 2015, to 244.01 billion tonnes at the end of 2016, and changed rank from 3rd to 2nd place with the Russian Federation.

Australia also boosted its proved coal reserves from 76.4 billion tonnes at the end of 2015 to 144.818 billion tonnes at the end of 2016, but held its rank place at fourth.

Barnaby’s reported statement:

…would be correct if he was talking about USA – perhaps Barnaby thinks Australia is part of USA?

I suspect Barnaby was referring to Australia, in which case his statement is factually incorrect (for data for either 2015 or 2016).

In today’s paper edition of the Lithgow Mercury is an article headlined Council to lobby for coal, online article here. The article begins with:

I rang the Lithgow City Council (LCC) today to request to speak to the Mayor’s PA – not available. In reference to LCC’s intention to lobby for more coal, I left a message for the LCC Mayor & his PA to draw attention to today’s The Australian article reporting Kerry Schott’s statements, and Ian Dunlop’s op-ed last week on fiduciary responsibility. I won’t hold my breath waiting for a reply from LCC.

In the Lithgow LGA, there are 4 active coal mines:

Springvale underground coal mine – 5.5 million tonnes per annum max extraction rate – likely exhausted in 2024;

Clarence underground coal mine – development consent expires in 2026;

Airly underground coal mine – 1.8 million tonnes per annum max extraction rate – development consent to 2035;

Invincible open-cut coal mine recently approved to reopen for 8 years only.

Angus Place underground coal mine is currently ‘mothballed’ with its development consent expiring in August 2024. I suspect Angus Place mine probably has only a decade of coal reserves remaining.

BTW

Several Latrobe Valley residents have told me that the announced coal-to-hydrogen project is

politicians’ bull dustvery unlikely to lead to a full scale plant.Recently at least two Victorian “carbon capture” schemes failed to receive Vic Govt handouts, having failed to meet technical targets.

In the Socialist Republic of Victoria, Jump, government subsidies are not always thrown around with abandon.

From what I can make out Australia is the largest exporter of coal, by a fair margin.

As an update, from RenewEconomy AGL rejects Alinta bid for Liddell, Coalition goes nuts.

There is further discussion on the Climate clippings 223 thread.

It is important to understand that proven reserves are reserves where enough exploration drilling has been done to be reasonably certain that there is an economic product. Proven reserves don’t tell you what potential reserves are.

John Davidson (Re: MAY 24, 2018 AT 2:43 PM):

Per Wikipedia, for Proven reserves:

If the resource is not economic to extract, then it will likely stay in the ground. And if there are no buyers for the resource, then there can be no profitable enterprise and the resource will stay in the ground.

In Saturday’s (May 26) SMH paper edition was published an article by Cole Latimer & Peter Hannam about AGL working towards transforming a Hunter Valley coal mine into a pumped hydro storage power plant, online link here. The article includes:

The updated online article includes a reference to the Kidston pumped-hydro project.

Interesting to see whether it proceeds, considering Professor Blakers’ comments about optimizing vertical heights between upper and lower reservoirs.

Geoff M I have always understood that pumped hydro needed about 200 – 250 metres vertical. I suppose you could use less by increasing flow volumes but that would reduce generating time.

JD might be able to comment on that??

Geoff, I’d have to check again, but I think he said 150m as a ‘head’ works OK, but there were so many sites available they didn’t look at those less than 300m.

They have a very small hydro at Wivenhoe dam. I think the water is released for environmental purposes, to provide some stream flow. The dam is full at 67m, so it’s always less than that. It provides power for 43,000 light bulbs.

The access, infrastructure and availability of the transmission network matters, and there is one hole already there, so it may all work out. Chances are they know what they are doing.

Brian, I first read about the height a year or more ago and the article mentioned 200+ metres. I would think that the cost per unit of power would be lower for a higher head, at least up to a point. If Blakers 22,000 sites are thinned by say, 80% that still leaves about 4,400 sites to choose from and I think his limen was 200 metres.

Another thing I like about the pumped hydro is that there will be many choices of locations, so the chance of being close to existing power transmission facilities is pretty good.

I see in The Australian today Pauline Hanson railing against Snowy 2, and being outraged there are no plans for new coal-fired power. Incredible.

Also, a report that Craig Kelly could lose LNP endorsement. If so he says he would move to the crossbench and do mischief from there I guess. It would also upset the Monash Monsters too.

GM: Would be surprising if AGL was talking about pumped hydro without checking drop height was within the practical range. Water clarification and pH control is not all that difficult or costly if it is required so I can’t see this being a stopper either.

Geoff Henderson (Re: MAY 28, 2018 AT 1:09 PM)

Brian (Re: MAY 28, 2018 AT 2:07 PM):

See Professor Andrew Blakers’ YouTube.com video Q&A session, link here, in answer to the first question (from time interval 0:15).

Why settle for 120 metres when there are higher heads not that far away? Double the head, then you double the power and energy, but you don’t double the cost.

Then look at the second question: What makes a good pumped-hydro site? (from time interval 0:40) and Blakers’ answer.

On yesterday’s ABC Insiders programme, link here, from time interval 50:09, the subject of AGL being under pressure to sell Liddell power station was mentioned.

A video clip of Barnaby Joyce and an audio clip of Tony Abbott commenting on the subject were played.

Then AFR‘s Phil Coorey made some interesting comments. The NSW Liberal government sold Liddell in 2014 to AGL. The ACCC warned the government “don’t do it”, because it said it was “anti-competitive”. The Federal Liberal government rewarded the NSW Liberal government for “asset recycling”. Phil Coorey said:

Indeed. Check it out.

Yes, I remembered Blakers said there was usually a good site on the next hill.

I’m thinking there may be special considerations at Muswellbrook, like the mine site has to be made good anyway.

It’s Idemitsu’s mine. They may be obliged to repair the site.

Then the Muswellbrook shire has an obvious interest. It’s clearly not a case of going out to find a pumped hydro site.