ABC Factcheck looked at Christopher Pyne’s claim that university graduates, over a lifetime, earn 75 per cent more than someone who doesn’t go to university. Factcheck found that the financial case for going to university varies considerably depending on who did the calculations, assumptions, the profession and the grades obtained. This post uses some of the Factcheck data to ask whether going to university makes sense. Continue reading Does getting a degree make sense?

Category Archives: Social Science and Society

Resolving the budget ‘crisis’

We definitely have a looming political budget crisis. Whether there is a fiscal/economic crisis is a separate question. First the politics.

Mark has an excellent post wherein he poses three alternative scenarios. I have only two, because I don’t see Abbott, Hockey et al being able to negotiate the maze that faces them in the senate. Nor do I see the Liberals changing leaders. There simply isn’t anyone. Hockey has broken his brand. Turnbull isn’t interested and not enough will have him. They couldn’t choose Morrison, could they, although his stocks are said to be riding high, having stopped the boats.

1. Abbott fails to negotiate important elements of the budget, such as eliminating the carbon ‘tax’, the proposed changes to Newstart and Youth Allowance, the changes to the age pension etc. As promised, Abbott would call a double dissolution election, after some bipartisan changes to senate voting practices. But note well, Antony Green for complex reasons says:

In my opinion there is not going to be a double dissolution in the near future, and even in the more distant future, I cannot see any possibility of a double dissolution before late 2015 or the first months of 2016.

2. Antony Green thinks that Abbott will only call a double dissolution if he thinks he can win. In this scenario Abbott fails to negotiate the senate, and the polls stay unfavourable. Abbott wimps out and limps on to a regular election in the second half of 2016.

I would discount the second option. Someone pointed out recently that when challenged, Abbott becomes more determined; if you like, more pugilistic. Moreover it would be manifestly foolish to struggle on with a government that lacks authority in the parliament and can’t effectively govern without Clive Palmer, who would maximise his leverage.

Of course, the polls might change. Apparently the feedback from the electorate to the party room was horrendous. For example the Oz gives us a taste:

JOE Hockey’s friends say he has been taken aback by the poor response to his budget from Coalition MPs. Well, Treasurer, you’d be horrified to know what some of them really think.

“There’s been no narrative. It’s been all over the shop. One minute we say there’s an emergency, the next there’s $8 billion for the Reserve Bank, $12bn for fighter jets, and we’re still splashing out on the paid parental leave scheme,” says one.

Now the government is considering a budget ad campaign. Except that there won’t be any radio, TV or newspaper ads. The campaign will fill our letter boxes with letters and pamphlets. Apparently the recalcitrant and benighted voters need to understand that this was the budget that the country needed. Needed, that is, to fix the “Labor debt and deficit mess”. You’ll hear that phrase a million times before the next election.

Which brings us back to whether there is a crisis in the fiscal/economic sense.

Jacob Greber and Phil Coorey had an article on the front page of the AFR Budget crisis is real, says PBO:

Parliament’s independent budget adviser has rejected Labor and Greens’ claims the Abbott government has concocted a budget crisis, saying without action Australia’s debt will grow at one of the fastest rates in the developed world.

In remarks that effectively endorse government warnings that if left unchecked, gross debt would balloon to $667 billion, Parliamentary Budget Officer Phil Bowen said it was time to begin the return to surplus to protect the economy against future crises.

“It is time to start coming out [of debt and deficit], otherwise the longer you leave it the more exposed you become and the harder it is to wind it back,” he told The Australian Financial Review.

This is sad, really sad. On page 47, buried in the middle of a tiny opinion piece by Andrew Leigh we had the truth. Labor in the Pre-election Fiscal and Economic outline had the budget coming back to surplus in 2016-17 in an orderly way. Hockey plans to do it by 2017-18, with the most horrendous cuts.

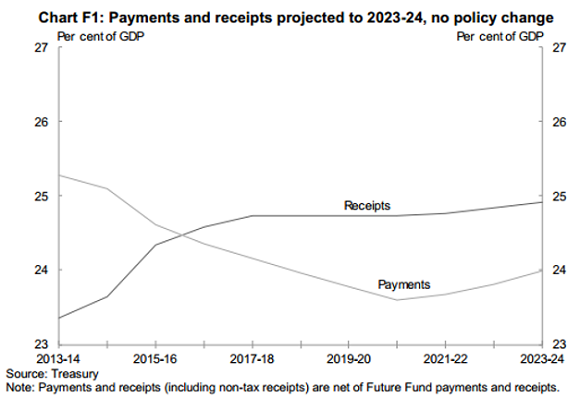

The document Leigh refers to was prepared by Finance and Treasury and released in August 2013 as part of the charter of budget honesty. Remember this table from ABC Factcheck?

Mainstrean journalists are too thick or too lazy to look at the facts. Instead they accept the LNP narrative.

With friends like that who knows what the polls will do?

Sensible people realise that there is no crisis, though we do need to bring the budget back to surplus within a reasonable time. After the confusion and sense of affairs out of control under Swan/Gillard, few seem to understand that finally, under Rudd/Bowen order had been restored. According to the independent umpire. Hockey has added the chaos and crisis in so far as it exists.

I’m inclined to think that Hockey/Abbott et al have fractured the basic contract with the people, that the people will not want to go back to the world of the pre-Whitlam era, which is where Trevor Cook compellingly thinks the reactionary tea party is aspiring to take us:

When they attack the so-called age of entitlement, they are really attacking the pillars of modern, Whitlamite Australia where concerns about access were more important than reducing the tax rate for business and rich individuals.

And the biggest stalking horse of all is Abbott’s efforts to get rid of Labor’s commitment to a national system of government and revert to a pre-federation style competition between increasingly impoverished states.

The intended victims of this charade are the poor and the middle class.

Abbott knows the states will be forced to cut spending – he wants them to do it.

Australia is at a turning point. And Abbott is no moderate, no centrist, not even a genuine conservative.

Perhaps the tea party utopia is best captured in this image from an anti-liberal site via Mark’s Facebook:

Cap super, says Richard Denniss

Treasury secretary Martin Parkinson says the superannuation system is being used as a wealth creation vehicle for the rich.

Paul Drum from Certified Practising Accountants Australia says there is nothing wrong with wealth creation as such. If you want to provide income for the future you need to create a pile of wealth. (By my calculations, for example, if you don’t buy a house and need to pay $400 per week in rent, then you’ll need capital of at least $416,000 with growth capacity at least equivalent to the CPI. Of course if you buy an equivalent dwelling it will cost you more than $416,000 in most places around the country.)

Drum says we need to look at equity aspects, but doesn’t elaborate.

Richard Denniss of the Australia Institute says we’ve created an intergenerational wealth transfer system rather than a retirement incomes system:

So if we want to create a system that helps the majority of Australians have slightly higher incomes when they retire, that’s fine, we can talk about that.

But the idea that superannuation is used as a tax minimisation vehicle of very high income earners to pay far less tax than we’ve deemed fair, and then in turn to pass tens of millions of dollars onto their children, this isn’t the retirement income scheme, this is a intergenerational wealth transfer scheme.

The Treasurer himself said that in 2050 the proportion of people getting a pension or part pension will be about the same as now – roughly 80%. As a retirement incomes system super is a failure.

Tax concessions for super are about to pass total expenditure on pensions and in a few years will exceed the GST. Something needs to be done.

Part of the problem here is that superannuation assets are not included in the will and are not sold up when a superannuant dies. The benefits simply flow on to the next of kin. Directly held shares, on the other hand, must be sold, triggering capital gains tax.

When one spouse dies the benefits go to the other. Also, if I’m right the other spouse could cash out the super, tax free.

Family trusts provide similar intergenerational tax free wealth transfer.

Richard Denniss says cap super, to limit the call on the public coffers.

That is one change among others that is certainly needed, but what should the limit be?

When super was an issue with the Gillard government in 2013, we were told that a pile of $1 million would provide a ‘comfortable’ retirement income of $50,000 for a couple who owned a house.

In calculating income from super the rule of thumb is that you can draw an income of 5% of capital, so $2 million could produce an income of $100,000 per annum. That’s about 50% above average household income. More than enough, I should think!

Do it, please, Labor, when you get the chance and ignore the cries of class warfare. The LNP are more likely to be concerned about those who ‘waste’ their super on trips away, then rely fully on the pension.

To GST or not to GST

Tony Abbott and Joe Hockey have been seen as herding the states and territories towards increasing the GST, rightly or wrongly. I suspect rightly.

Richard Denniss in the AFR says Forget GST, hit the rorts on super.

The Commonwealth government will collect $363 billion in taxes this year, with state and local governments collecting a further $83 billion in taxation. The GST accounts for around $51 billion, or 11 per cent, of total revenue. Increasing the GST to 12 per cent would collect an additional $10 billion or so. In an economy with a nominal GDP of $1521 billion and a population of more than 22 million it is, quite simply, small change.

If raising the GST is “the solution” then ‘the problem can’t be very big, which, of course, is exactly what the World Bank, the IMF, the OECD and the rest of the world have been trying to tell us. Australia is a low tax, low-debt country.

The pension is costing about $40 billion each year and is growing at 6% pa, only 1% faster than nominal GDP. Superannuation concessions, by contrast, cost about $35 billion, of which $13 billion flows to the richest 5%, and are growing at 12% pa.

Economists tend to favour taxing consumption, because it is efficient and less distorting than many other taxes. They tend to downplay the fact that it is regressive, once again selectively hitting those who can afford it least. They wave that argument away, saying that the needy can be compensated by increased transfer payments. Whether such payments would hit the mark is highly questionable. Moreover the better off in the community tend to see such payments as undeserving.

Denniss identifies other “rorts” such as the 50% capital gains concession, and the exemption of the family home, which can store massive value for the rich.

An alternative to increasing the rate is to increase the coverage. The list of exempt goods and services is actually quite large. I’ve copied it here for convenience:

- medical and other health services, hospital services, residential or community care and medical aids;

- education courses, course materials, student accommodation;

- child care services registered under the Childcare Rebate, eligible child care centres or other child care services

- exports of goods and services from Australia if exported within 60 days after the earlier of the day payment is received or the invoice is issued;

- religious services;

- non-commercial activities of charitable institutions;

- water and sewerage goods and services;

- sales of businesses as going concerns;

- sales of precious metals after refinement by the supplier and delivery to a precious metal dealer

- inwards duty free goods sales to a relevant traveller;

- sales of freehold interest in land or long-term lease made by a Commonwealth, State or Territory Government;

- subdivided farm land

- cars for use by disabled people.

I’m not sure about sales of precious metals and subdivided farmland, but I think Australia has its exemptions about right. It’s late but I can’t find food on the list. Most but not all food is exempt as explained here.

I’ve been explaining that Bowen and Rudd did not leave the budget in a mess (see ABC FactCheck). By adding $68 billion to the deficit, however, Hockey has created quite a mess of his own. Treasury boss Martin Parkinson explained that brave assumptions were required to fix it:

Prior to this budget, we were banking the house on 33 years of uninterrupted economic growth and there’s no precedent for that. We’re banking on another 10 years of fiscal drag and that being pocketed, and that has quite significant regressive impacts, and even then, we still don’t get back to surplus.

“Fiscal drag” means bracket creep.

Thanks Joe!

Tax the rich, I say. At least 80% for incomes of over half a million and a wealth tax for those who organise to have no income. Peter Martin points out that the wealthiest 75 have an average taxable income of $82.

Meanwhile NATSEM modelling has found that low earners do most of the heavy lifting:

The budget hits 1.25 million low and middle income families with children on average by about $3000 a year in 2017-18 while it actually benefits upper middle and upper income families through removing the carbon price, according to modelling done by NATSEM at University of Canberra.

That’s apart from the young unemployed, where a 26 year-old loses $6944.

Clearly there is a need for a thorough review of the total tax system, which Labor undertook and then largely ignored. That was a major blot on the legacy of Swan’s treasurership and the Rudd/Gillard years, having commissioned the Henry review and then largely ignored it.

Poll anger or a shift in the tectonic plates?

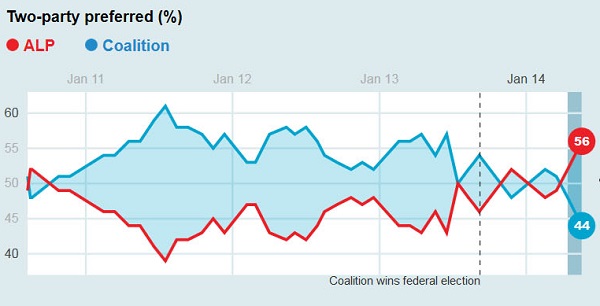

The polls are disastrous for the LNP. Nielsen is 56-44 to Labor, Newspoll is 55-45 and Morgan is a staggering 56.5 to 43.5. Historically Morgan tends to favour Labor, Nielsen was the most accurate at the last election.

The question is now whether these results represent short term anger at the budget or whether the tectonic plates have shifted. Laura Tingle comes out in favour of the latter:

Just every so often in politics there is a moment when you can almost hear the tectonic plates shift, and they don’t necessarily come with elections.

We saw one of these in 2010 when it emerged that Kevin Rudd was dumping his commitment to an emissions trading scheme.

The Fairfax-Nielsen poll suggests the 2014 budget is proving another such moment when politics can be turned on its head.

It is not just the dramatic slump in the government’s primary and two-party preferred vote, or the fact that Labor is, for the first time, the major beneficiary of this slump. It is not just that voters – in spectacular, angry numbers – think the budget is both unfair and not good for the country.

It is not even that Tony Abbott’s barefaced refusal to confront the fact he is breaking promises has enraged voters in a way that makes his position with them unrecoverable.

It is the fact that this poll suggests Tony Abbott and Joe Hockey will have little choice but to go back and rethink the entire political and economic strategy on which this budget is built.

Unfairness, not good for the country, broken promises, lies.

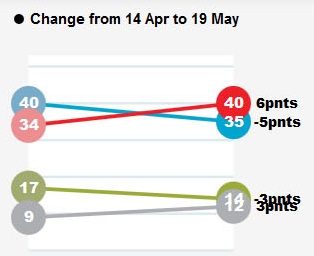

We are often told that Labor needs a 4 in front of its first preference vote in order to win. Suddenly it has one, for the first time since 2010, and the LNP doesn’t. There has been a cross-over:

Perhaps notably, the Greens have lost three points and the indies have picked up three.

This graph shows the Nielsen two-party preferred vote, ending with May 19:

Labor lost its way when Gillard announced the carbon ‘tax’ early in 2011. It looks as though there has been a shake-out since Rudd’s second coming, with the latest poll marking a decisive shift. Time will tell, but Tingle thinks the LNP will need to rethink it’s entire economic and political strategy.

In other aspects of the poll:

-

The only demographic where the LNP tops Labor is in the 55+, were it is now 43-39 to the LNP compared to 49-33 in April.

-

Shorten is now ahead of Abbott as preferred PM 51-40.

Abbott’s approval rating has gone from a net -7 to -28. Only 34% approve whereas 62% disapprove.

Shorten’s approval rating has gone from +2 to +12.

A staggering 63% say the budget is unfair, the first time ever there was a majority, compared with 33% who say it was fair. Gillard/Swan in 2013 scored 43-46.

-

53% thought the budget was good for Australia, again the first majority ever, compared with 42% who say it was good. Gillard/Swan scored 42-44.

Abbott said that the LNP was in a similar position after Howard’s first budget in 1996. He lied.

Abbott said there would be no cuts to health and education for several years. Again he lied. There will be $1.8 billion in hospital cuts from July.

Finally I want to emphasise again that Abbott, Hockey, Cormann and company are lying about Labor leaving a budget mess. This ABC FactCheck shows that Bowen and Rudd left the budget in good shape:

Elsewhere Mark’s excellent post stresses the unfairness of the 2014 budget and its attack on a foundational Australian value. It’s not too much to say, I think, that it has breached the social compact on which the Australian polity is based.

A crisis in trust

Politics is broken, is the shorter message of Mark’s post at The new social democrat. Mark, writing before Hockey’s budget speech predicted that the budget would be “horrible”.

He was right. There may have been a feeling that the bad news had been leaked early. In fact the true horror is being revealed in the detail coming out after the speech.The speech sounded like severe belt tightening with a raft of cuts (summary here). In the interview after the speech Sarah Ferguson nailed Hockey on at least two major points. The first is that ordinary folk will carry a bigger burden than the rich, not just proportionately, but in actual dollars. On one count $1400 for the rich and $3000 to $5000 for lower to middle income families.

In fact middle Australia, the poor, the young and the marginalised will be hammered in Hockey’s vision of an age of opportunity, rather than entitlement.

Take the young unemployed:

The Abbott government’s first budget revealed job seekers applying for Newstart or Youth Allowance, who have not been previously employed, will face a six-month waiting period of no income support before they are eligible for payments by undertaking 25 hours a week in the Work for the Dole program.

Once they have spent six months on the program, they will lose income support for another six months unless they undertake training or study.

People under 25 will not be eligible for the dole and instead will have to apply for Youth Allowance which is about $100 less a fortnight. Newstart and Youth Allowance will also be frozen for the next three years.

The hourly rate on Work for the Dole will be $10.20 for Newstart and $8.29 for Youth Allowance.

In the six months applicants for Newstart and Youth Allowance do not receive income support, they will be required to undertake government-funded job seeking programs.

For those thrown out of work Newstart will be limited. With some exceptions:

Newstart applicants will receive one month of income support for every year they worked before applying for the dole and exceptions to the six months…

I don’t think we can talk in terms of a general safety net any longer. We have instead active harassment in the name of stimulating greater personal responsibility. We are leaving a system where all are looked after in favour of a system where only the deserving are supportis severely conditional and incomplete.

Family payments will save a whopping $7 billion, but hardest hit will be:

Sole parents, single parents and parents of disabled children will be hardest hit under changes to family tax benefits, designed to save money and get primary carers back to work.

More harassment.

The second point coming out of the Ferguson/Hockey interview was that the Abbott government is intent on forcing the states to increase the GST by cutting the funding for schools and hospitals by $80 billion over the next 10 years. Hockey’s response was “States runs schools and states run the hospitals” and “All the GST goes to the states so it is up to them.”

That’s clear enough, but not what voters expected or were told to expect.

Mark quotes EMC research:

this week’s Essential Report suggests voters are expecting to take the fall for a budget emergency that is really just a false alarm.

Without believing the central premise of the budget, voters are left with a sick feeling they’ll pay for a budget that doesn’t fix the economy but rather punishes ordinary people in favour of the wealthy.

Mark says (read the whole post!):

The most important thing about this Budget is that it symbolises the brokenness of Australian politics. It’s a tipping point, a crisis moment for the political class.

Everything they [the Government] think they learnt in politics school is wrong, and the focus groups must be feeding this back. We can see this reflected through the inconsistent and panicked messaging from the government.Confected austerity economics will not work in a crisis of trust. Nor will “let’s all pull together” work in an age of upper middle class entitlement, generously fostered by John Howard’s electoral/fiscal calculus.

I still have some faith in Chris Bowen, who seems to me principled, articulate and genuine. I’d rather he gave the budget reply speech, but there is some hope for Shorten. He sounds less like a politician than many and that may eventually play in his favour.

Abbott has calibrated his message to mask his detailed promises about no cuts “full stop”. For example, he promised no cuts the the ABC and SBS, Instead $43.5 million is being taken out of their budget over the forward estimates. That’s 1% of general funding, plus cancellation of the Australia Network contract one year in, halving its budget. The ABC used the Australia Network funding to enhance its threadbare foreign coverage for the network generally.

Abbott is a silver tongued politician, master of slogans, but is sounding more and more like a salesman, inherently untrustworthy.

You don’t build a stronger Australia by shredding safety nets and increasing inequality.

Update: I thought I’d add here from this post the ABC FactCheck verdict showing how Hockey has added $68 billion to the deficit and essentially confected a budget ‘crisis’, as shown in this table:

See also Hockey’s morality play.

Also see Mark on Hockey’s social dystopia and John Quiggin on the mess of contradictions, meanness, trickiness and tribalism that is the Abbott-Hockey Government’s first budget.

On a mission to upset everyone

Having upset the rich with their ‘debt levy’, and with 72% of people thinking it a broken promise, Abbott and Hockey are on a mission to upset the rest of us by re-indexing the fuel excise.

Richard Denniss told the 7.30 Report that the tax was good policy.

Sinclair Davidson told Waleed Aly that if you must tax, then taxing consumption is better than taxing production. The fuel excise taxes consumption. He forgets that sole traders (like me) driving a ute or a van would pay the tax. Nevertheless the LNP backbencher Ken O’Dowd in the linked article appears to be wrong:

A Federal Government MP has spoken out against plans to raise the fuel excise, warning it will force up the cost of everyday groceries.

Farmers and miners don’t pay fuel excise. That tax concession is worth some $13 billion, which the Greens would like to abolish.

Davidson also pointed out that fuel excise was a regressive tax, it disadvantages the poor. Those with time to ring up are letting Mr O’Dowd know:

“The phones haven’t stopped, especially with our older folk. We got off on the wrong leg, talking about increasing the pension age, I don’t think it was explained too good. It really concerned a lot of old people that they were going to lose their rights.”

It hardly matters now what the budget detail turns out to be – the damage has been done.

Meanwhile company directors are losing faith. Only 30% of company directors expected the new administration to have a positive impact on their business decision making, down from 70% when the LNP took over. Furthermore:

This loss of confidence has also translated into a fall in the proportion of directors who believe the Federal Government understands business – from 55 per cent last year to 48 per cent now.

Fully 80% say that achieving a budget surplus in the next three years is not a priority.

Wayne Swan says he left the budget in good shape. Chris Bowen has been saying that Joe Hockey has doubled the deficit by changes to Government spending and changes to Government assumptions. The ABC FactCheck verdict:

Since the election, the official forecast deficit has doubled. The economic assumptions are different from those used before the election, and spending decisions have been made that were not in the previous forecasts. Mr Bowen’s claim checks out.

Here’s the table that tells the story:

The PEFO of August 2013, prepared independently by Treasury and Finance, shows a surplus for 2016-17. Leaving aside Hockey’s moral austerity crusade, it does appear that he has confected the crisis.

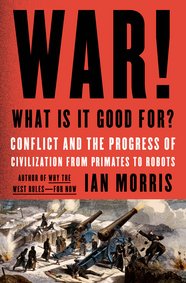

War is good for us!

Eventually, that is. Unless we are killed, starved, raped, maimed, robbed or otherwise damaged in the process.

The proposition is simple:

War has been good for something: it has produced bigger societies, ruled by stronger governments, which have imposed peace and created the preconditions for prosperity.

Through war humanity is now safer and richer than ever before.

That’s the central thesis of historian Ian Morris’s book War! What Is It Good For? according to his article in the New Scientist (paywalled). (There is a similar article in the Chicago Tribune.)

Mind you he says “war is probably the worst way imaginable to create larger, more peaceful societies” but “it is pretty much the only way humans have found.”

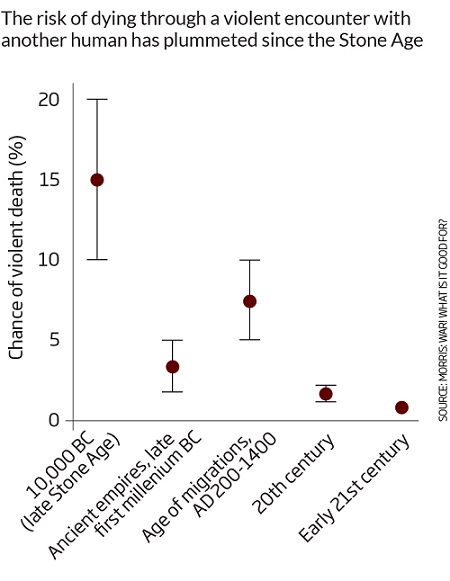

From our position in the 21st century we see the 20th century as the most violent ever. Indeed, Morris says, we killed between 100 and 200 million of our own kind. Yet 10 billion lives were lived in that century, meaning the the death rate from violence was only 2 to 3 per cent.

By contrast in the Stone Age an estimated 10 to 20% of people died at the hands of another human. Comparable was the experience of the Serbs in WW1 where one in six perished.

In traditional societies:

Most of the killing was on a small scale, in homicides, vendettas and raids, but because populations were also small, the steady drip of low-level killing took an appalling toll.

This graphic shows ‘progress’ over the millennia:

Since 2000, the United Nations tells us, the risk of violent death has fallen still further, to 0.7 per cent.

Ten thousand years ago people lived on average 30 years and got by on the equivalent of less than $2 per day. Now the respective global averages are 67 years and $25 per day.

Morris says that virtually every species is programmed for violence. Fukuyama in his The Origin of Political Order quotes archaeologist Stephen LeBlanc:

Much of noncomplex society human warfare is similar to chimpanzee attacks. Massacres among humans at the social level are, in fact, rare occurrences, and victory by attrition is a viable strategy, as are buffer zones, surprise raids, taking captive females into the group, and mutilation of victims. The chimp and human behaviors are almost completely parallel.

Humans, however, with more lethal weapons were more deadly.

Jared Diamond in his book The World Until Yesterday has several chapters on war, but I’d like to quote a study he cites of homicide over the period 1920-1969 amongst the !Kung people in the Kalahari. The !Kung are recognised as peaceable people.

The study identified 22 killing over 49 years, or less than one every two years. It’s just that the population under study was only around 1500. That makes the homicide rate triple that of the United States and 10 to 30 times that of rates for Canada, Britain, France and Germany.

Killing was a norm and in that society.

The graphic shows an increase in violent deaths during what Morris terms the ‘age of migrations’, from AD200-1400. This was a time when Fukuyama would say social/political organisation in Europe had moved beyond the tribal, but had not yet achieved the form of the modern state. It was not a time when the state competently and fairly extracted taxes from all and applied them consistently for the general good. Tom Holland in his book Millennium describes how rulers saw it as their mission to Christianise the heathen but they did this by plundering and bringing home the loot. There was a zero sum attitude to economic growth. You accrued great wealth by taking it from other people.

Castles became popular in the tenth century, not to guard against external threat, but as a base to plunder and extract tribute from the surrounding countryside. Knights were the primary agents, mailed thugs and at that time, Holland says, by definition in a state of sin.

People became increasingly competent at conducting war, with a map that was extremely fluid. During the Thirty Years War German territories lost about a third of their population. In Brandenburg, the seed state of Prussia, it was a half. Yet between times there were periods of peace and prosperity, with an increasing idea that the competent state was there to serve the welfare of the people.

Morris says we used war and killing, because for humans it was the only way. What he doesn’t appear to emphasise is the other side of human nature, the co-operative, altruistic side, which on his evidence is gradually triumphing.

By some counts we have only had the modern state in its full form since WW1.

I could be doing Morris an injustice, as I have not read the book. In The Wall Street Journal Felipe Fernadez-Armesto has some reservations.

Beware of right wing revolutionaries calling themselves conservatives

Rob Burgess had an interesting post in the May 2 Business Spectator on the commision of audit. He discusses the competing, and very different ideological positions dividing the political right as well as pointing out that “Australia has more to lose from radical change than just about any country in the world.”

The competing ideological divisions within the right wing of Australian politics might be described as:

- The revolutionary neo-liberal position that says that “the system is fundamentally flawed and needs fixing.” Their preferred fix are the radical steps required to remove the the restraints on our economy caused by the “dead hand of government.” Vs

- The conservative liberal position that says we are actually doing quite well and we should limit our efforts to incremental change. They might say something like: “In this situation it doesn’t make sense to be risking our gains by making unnecessarily dramatic changes. If you like: “If it aint broke why fix it?””

There is a similar division on the left of politics between those who want radical change (Think the end of capitalism) and those who favour incremental improvements.

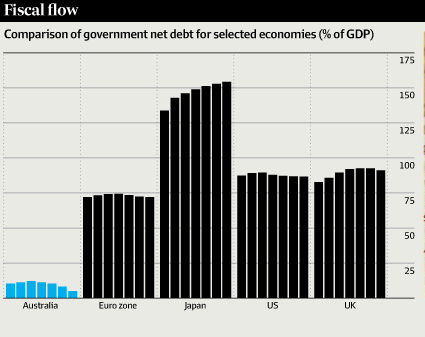

The key question here is whether the current state of the Australian economy really justifies the sort of radical fix advocated by the Audit Commission. A comparison between Australia and other developed countries might be a good start:

- According to The Conversation, Commonwealth net debt “is about 11% of GDP, the third lowest in the OECD (the average is 50%), and low by historical standards” Not a crisis.

- Rob Burgess provided the following:

- Combined federal, state and local tax rates ran at a bit over 30 per cent during the Howard years, dropping to about 27 per cent during the Rudd/Gillard years. (State taxes account for around 4 per cent of GDP, and local taxes (rates) hover around 1 per cent of GDP.) By comparison, Singapore’s total tax-to-GDP ratio is around 14 per cent, the US 27 per cent, Switzerland 29 per cent, and Canada 32 per cent. Not a crisis but it would be interesting to know the reasons behind the low Singaporean rate. It is worth noting that people may actually be better off in a “high taxing” country if the high taxes mean that the state pays for services that other, lower taxing countries make people pay for themselves.

-

In terms of GDP corrected for purchasing power parity (PPP) we rank 10th on the World Bank and IMF scales. We could do better. A key factor here is how expensive it is to rent/buy a house in Australia compared with places like the US or Spain where house prices were really hit by the GFC. In our case, the problem really took off when Peter Costello offered negative gearing to people who could afford to borrow money to buy investment properties. His first home buyer schemes also tended to push up the price of houses rather than help first home buyers. However, fixing home prices is no win territory. It is a bit challenging to please existing homeowners and new home buyers at the same time when it comes to prices.

-

Australia does much better when we use the ‘human development index’, which factors in longevity (as a proxy for good health), educational attainment, gross national income and, in recent years, measures of inequality. On that scale we jostle for the number one spot with Norway. Not 6th or 10th. Number one. Definitely not a crisis.

- Best news of all is that last year’s Credit Suisse survey showed Australia having the highest median wealth per adult citizen of any nation. Definitely not a crisis although inflated home prices may have helped a bit here.

Conclusion: Australia’s alleged budget crisis is either the product of a fevered imagination or a deliberate attempt by neo-liberals to justify the imposition of their questionable ideas.

None of this mean that there aren’t many things in Australia that would benefit from radical change. However, the case for these radical changes should be justified by fact based, logical conversations about the specific issues. Definitely not based on ideological assertions about the dead hand of governments or private is best.

Elites rule

The USA can no longer be considered a democracy, according to a Princeton University study. Researchers Martin Gilens and Benjamin I. Page argue that America’s political system is effectively an oligarchy, where wealthy elites wield most power.

Using data drawn from over 1,800 different policy initiatives from 1981 to 2002, the two conclude that rich, well-connected individuals on the political scene now steer the direction of the country, regardless of or even against the will of the majority of voters

They say:

“The central point that emerges from our research is that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy,” they write, “while mass-based interest groups and average citizens have little or no independent influence.”

This phenomenon has been a long term trend, at least from 1980, with no difference depending whether Democrats or Republicans were in power. The phenomenon is therefore part of the natural order of things, hard to perceive let alone change.

Ordinary folk also have wins, but only when the elites agree.

Questions raised include why, how do you define ‘elite’ and is the American experience replicated here?

As to why, I can only point to two factors. Firstly, the lobbying industry is alive and well. Big Pharma are said to have more lobbyists on Capitol Hill than there are politicians.

Secondly, I recall in reading about trade matters some 10 years ago that very few Democrat senators were not dependent on business support to finance their campaigns.

In this interview author Martin Gilens identifies the role money plays in the political system and the lack of mass organizations that represent and facilitate the voice of ordinary citizens. Interestingly they found that

policies adopted during presidential election years in particular are more consistent with public preferences than policies adopted in other years of the electoral cycle.

As to defining elites, I would have been interested in the policy preferences of the top one or two percent, who are the real elites in my book. This exchange was enlightening:

Would you say the government is most responsive to income earners at the top 10 percent, the top 1 percent or the top 0.1 percent?

This is a great question and it’s not one we can answer with the data that we used in the study. Because we really don’t have good info about what the top 1 percent or 10 percent want or what issues they’re engaged with. As you can imagine, this is not really a group that’s eager to talk with researchers.

John Davidson drew to my attention this post by Matt Cowgill. Defining the elite by income is no simple matter.

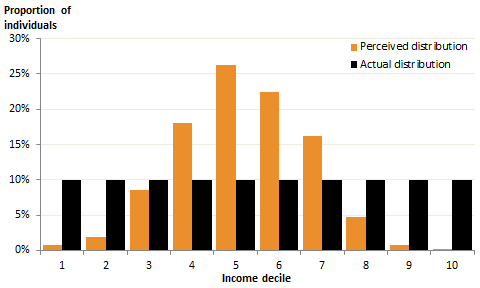

First we have perceptions of income versus reality:

Some 83% of people think they’re in the middle four deciles of the income distribution, whereas by definition only 40% can be. It seems most of us think we are middle class. The rich especially have little idea of how privileged they are.

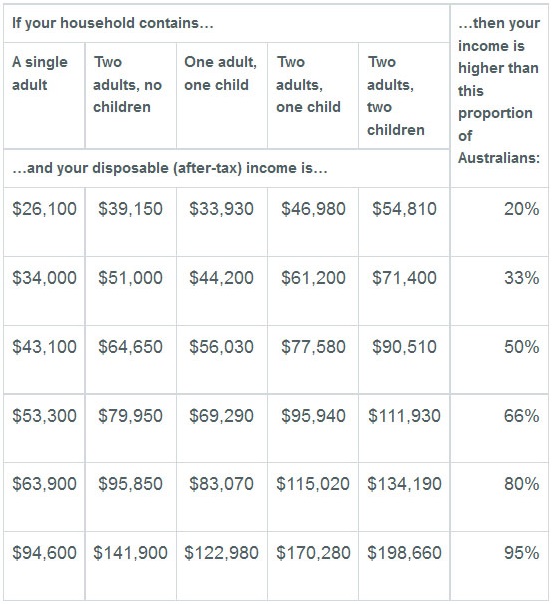

Cowgill leads us through the complexities of analysing wage and income distribution. Of most interest was this table which takes into account household circumstances:

In terms of straight taxable income the top 10% cut in at about $105,000. If we are to do similar research to the Princeton study in Australia, I’d suggest targeting senior executives, I’m guessing in the range of $200,000 plus. They are likely to sit in the top 5% of incomes. They are also likely to reflect the views of the top 2% whose views Gilens found to be unknowable.

If government is to be accountable to the electors, then the Princeton research suggests that universal franchise is a necessary but not a sufficient condition for democracy. We need to think carefully about how democracy works, lest we be left with the form rather than the substance.

Hockey’s morality play

Joe Hockey has mightily offended Bernard Keane by making his austerity a moral issue, evoking a trenchant critique. The shorter Keane is that if you turn budgeting into a moral issue you are held to a higher standard. On this basis Hockey comes out as a prize hypocrite.

More of Keane later, first let’s wrangle some numbers.

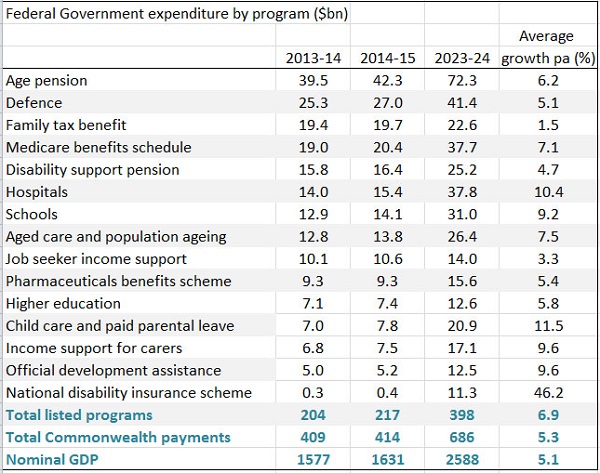

I’ve made a table of the 15 major expenditure items identified by the National Commission of Audit as causing concern over the long term, omitting the eight years of 2015-16 to 2013-24 for convenience. The intervening data does tell some stories. For example, after growth spurts both Schools and the NDIS settle to much flatter growth in the out-years. The table was reprinted in the AFR.

To me the most important numbers are the two in the bottom right. When all is said and done total Commonwealth payments would grow by 0.2% of GDP over 10 years. In today’s dollars that’s about $3 billion dollars. Sounds a lot, but in a $400 billion budget it’s a rounding error.

Hockey is trying to achieve two main goals. (Here I’m drawing mainly from Phillip Coorey, but also Laura Tingle in the AFR.)

First, he is aiming at a small surplus in 2019-20 and a surplus of one per cent of GDP by 2023-24. Economists and others can argue about timing and quantum but this aim seems to me fair enough.

Secondly, Hockey wants to shrink expenditure as a proportion of GDP. This is ideological, not moral.

Hockey claims that if he takes his hands off the wheel expenditure will grow by 3.75% per annum, reaching 26.5% of GDP by 2023-4. From memory, I think that’s roughly where it was under Howard and Costello.

The CIA’s world Factbook has a country comparison of tax and other revenues as a proportion of GDP. Obviously they use a particular definition (probably includes GST) since Australia comes in at 33.2%. By contrast we have Canada at 37.7%, New Zealand at 38.5%, the UK at 40.4%, then follow the Europeans up to the Scandinavians at above 50%. If Australia’s share was lifted to Canada’s the government would have an extra $55 billion available.

All I’m saying here is that lifting the share by a few percentage points is not self-evidently a crime against the people, immoral or even economically foolish.

The audit commission has assumed that tax receipts must remain limited to 24% of GDP, for reasons unknown.

Before the election Hockey was saying that he would take 1% off tax receipts as a proportion of GDP. He hasn’t nominated a percentage now that I know of, but he has deemed that growth in expenditure will be limited to 1.75% per annum. That’s harsh. Tingle says Labor’s aim, not always achieved, was for a 2% limit, also austere.

Again we are told this 1.75% limit is right, responsible and moral, without any supporting argument.

Labor’s plans

Wayne Swan, I understand, reduced outlays by a couple of percentage points of GDP. His problem was that revenues were a couple of percentage points shy of outlays. Still, Labor had a long-term plan back to the black. The following graph is from the Pre-Election Fiscal Outlook (PEFO) published under the charter of budget honesty before the last election. I displayed it in my ‘liars and clunkheads’ post back then.

I understand it involved allowing bracket creep. One has to ask why Hockey’s self-imposed austerity path is supposed to be superior.

Hewson on tax concessions

One way of fixing the budget would be to allow bracket creep, ruled out by the audit commission and Hockey.

Another way, suggested by John Hewson, would be to take a look at tax concessions, especially in superannuation.

A startling fact is that the percentage of retired folk receiving at least a part pension is projected to remain at 80%. Hewson says that superannuation policy robs the poor in favour of the rich, and in amounts that matter. He calculates super tax concessions at around $44 billion, roughly the same as the aged pension but growing faster.

Tax concessions overall are around $120 billion rising to $150 billion by 2016/17. Today’s AFR identifies some of the budget sacred cows, leading with $15 billion in protecting the family home from capital gains, $13 billion in not broadening the GST. Tightening the age pension means test to include the family home would save $7 billion.

By contrast the mooted ‘deficit levy’ would only yield hundreds of millions even if implemented widely. It’s small change. Such a move must be regarded a political rather than economic.

Keane’s critique

Keane asked Hockey what he was going to tell his granchildren about what he did to prevent global warming. They will pay.

Why were Labor’s efforts to reign in middle class welfare either not commented on or termed “class warfare” or “the politics of envy”?

Why did the LNP fight tooth an nail cutting back the private healthcare rebate to high-income earners?

In November, Hockey abandoned Labor’s plan to reduce the extravagant tax concessions enjoyed by superannuants earning over $100,000 a year, costing billions. He also restored a fringe benefits tax rort, an actual rort, for novated leases, again worth billions.

Hockey wants to cut carbon pricing and the mining tax.

Hockey is talking to us about the “moral imperative” of fiscal discipline while handing billions to large companies, wealthy retirees and tax rorters.

One minute Hockey is complaining about

a “massive increase” in defence spending beyond forward estimates and that it was a budget boobytrap, a fiscal “tsunami coming across the water” created by Labor.

The next minute he’s committing billions to F-35s which “wouldn’t cost anything” because it’s already in the budget.

Then of course there is the rolled gold parental leave scheme.

Keane reckons Hockey has cut revenue by about $15 billion. He would have increased spending by a similar amount. Then he complains about a budget mess and dresses up his austerity program as a moral crusade.

By the way here’s Labor’s Budget debt in context:

I think we’ve been short of revenue since Rudd matched Howard’s tax cuts in the 2007 election campaign. There’s nothing broken about the budget that a steady hand, a mature review of priorities and a gradual return to revenue levels prevailing under the Howard government would not fix, together with a modernisation of the whole tax regime. Time to look seriously at Ken Henry’s review.

Elsewhere, Peter Martin has some tips.

Update:

In the Weekend AFR Phillip Coorey in an article The budget crunch is John Howard’s baby too reckons the budget problems date back that far. Apart from generous handouts to middle Australia in the previous years, Howard/Costello promised a $31.5 billion tax cuts in the May 2007 budget. One day into the election campaign he added a promise of $34 billions worth of further tax cuts (we’re talking four-year budget cycles). Rudd matched him, in addition to his own spending plans. The half-year budget update did find an extra $59 billion worth of revenue.

No-one foresaw the GFC and the end of the salad days.

Also Chris Bowen has an article pointing out that scrapping the low income superannuation contribution (LISC) and deferring the increase in the superannuation guarantee will take $55 billion out of our national savings pool over the next 7 years. These policies, he says, were designed to reduce the numbers of middle and low income earners requiring pension support in the future. Do this rather than lift the retirement age, he says.

Bowen’s comment received specific support from Tony Shepherd, chair of the audit commission.

See also John Davidson’s post, plus Richard Holden on why Australia does not have a debt crisis.

Update – posts on Budget 2014:

On a mission to upset everyone

Poll anger or a shift in the tectonic plates?

Lower living standards

On the most recent comparable data from the final three months of last year, living standards have gone backward.

While consumer prices increased by 0.7 of 1 per cent during that quarter, household incomes only went up 0.1 of 1 per cent.

That’s what we were told on Radio National yesterday.

Ben Phillips from Canberra University’s National Institute for Social and Economic Modelling says there’s a shift under way in our standard of living. Export prices are lower than they have been, the cost of services such as school education, electricity, and gas are going up. Incomes are not keeping pace.

Household debt is an issue.

Professor David Peetz of Griffith University says that the Bureau of Statistics’ wage price index, a key measure of household income, fell to its lowest level on record in the December quarter. He points out that the labour market is largely non-unionised and hence vulnerable with unemployment increasing.

The question is whether this is a temporary blip or the beginning of a longer trend. Given the commentary from the experts it’s looking like the latter.

In this context it looks as though interest rates will be on hold, given also that the CPI came in lower than expected. That was courtesy of falls in the price of furniture, clothing, footwear and car repairs, not big on my shopping list.

Given that the age of entitlement has ended, Treasurer Hockey is now looking at the Audit Commission big picture.

Fiscal stimulation seems very far from his mind. Hockey says “nothing is free” and warns that spending people have come to take for granted will be wound back. Co-payments and means tests are on the agenda.

I’m in favour of means tests, in moderation, but I fear Hockey’s ‘vision’ is to shrink Australia.