Rob Burgess had an interesting post in the May 2 Business Spectator on the commision of audit. He discusses the competing, and very different ideological positions dividing the political right as well as pointing out that “Australia has more to lose from radical change than just about any country in the world.”

The competing ideological divisions within the right wing of Australian politics might be described as:

- The revolutionary neo-liberal position that says that “the system is fundamentally flawed and needs fixing.” Their preferred fix are the radical steps required to remove the the restraints on our economy caused by the “dead hand of government.” Vs

- The conservative liberal position that says we are actually doing quite well and we should limit our efforts to incremental change. They might say something like: “In this situation it doesn’t make sense to be risking our gains by making unnecessarily dramatic changes. If you like: “If it aint broke why fix it?””

There is a similar division on the left of politics between those who want radical change (Think the end of capitalism) and those who favour incremental improvements.

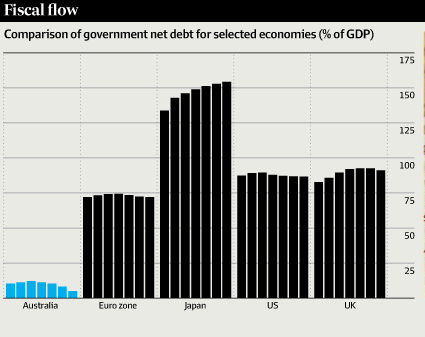

The key question here is whether the current state of the Australian economy really justifies the sort of radical fix advocated by the Audit Commission. A comparison between Australia and other developed countries might be a good start:

- According to The Conversation, Commonwealth net debt “is about 11% of GDP, the third lowest in the OECD (the average is 50%), and low by historical standards” Not a crisis.

- Rob Burgess provided the following:

- Combined federal, state and local tax rates ran at a bit over 30 per cent during the Howard years, dropping to about 27 per cent during the Rudd/Gillard years. (State taxes account for around 4 per cent of GDP, and local taxes (rates) hover around 1 per cent of GDP.) By comparison, Singapore’s total tax-to-GDP ratio is around 14 per cent, the US 27 per cent, Switzerland 29 per cent, and Canada 32 per cent. Not a crisis but it would be interesting to know the reasons behind the low Singaporean rate. It is worth noting that people may actually be better off in a “high taxing” country if the high taxes mean that the state pays for services that other, lower taxing countries make people pay for themselves.

-

In terms of GDP corrected for purchasing power parity (PPP) we rank 10th on the World Bank and IMF scales. We could do better. A key factor here is how expensive it is to rent/buy a house in Australia compared with places like the US or Spain where house prices were really hit by the GFC. In our case, the problem really took off when Peter Costello offered negative gearing to people who could afford to borrow money to buy investment properties. His first home buyer schemes also tended to push up the price of houses rather than help first home buyers. However, fixing home prices is no win territory. It is a bit challenging to please existing homeowners and new home buyers at the same time when it comes to prices.

-

Australia does much better when we use the ‘human development index’, which factors in longevity (as a proxy for good health), educational attainment, gross national income and, in recent years, measures of inequality. On that scale we jostle for the number one spot with Norway. Not 6th or 10th. Number one. Definitely not a crisis.

- Best news of all is that last year’s Credit Suisse survey showed Australia having the highest median wealth per adult citizen of any nation. Definitely not a crisis although inflated home prices may have helped a bit here.

Conclusion: Australia’s alleged budget crisis is either the product of a fevered imagination or a deliberate attempt by neo-liberals to justify the imposition of their questionable ideas.

None of this mean that there aren’t many things in Australia that would benefit from radical change. However, the case for these radical changes should be justified by fact based, logical conversations about the specific issues. Definitely not based on ideological assertions about the dead hand of governments or private is best.

Terry at Saturday Salon

Terry at Saturday Salon