As people most likely know, from 1 January 2017 some 327,000 pensioners have had their pensions adversely affected by changes in the assets test with around 100,000 losing their pensions entirely. Around 50,000 more will have their pensions increased to receive the full pension. The government is doing this to save $2.4 billion over four years, and, they say, to make the pension system more fair and sustainable.

As people most likely know, from 1 January 2017 some 327,000 pensioners have had their pensions adversely affected by changes in the assets test with around 100,000 losing their pensions entirely. Around 50,000 more will have their pensions increased to receive the full pension. The government is doing this to save $2.4 billion over four years, and, they say, to make the pension system more fair and sustainable.

Unfortunately proponents of the changes are framing this as about wealth, whereas it is actually about income. They are also saying that the changes are progressive, whereas the wealthy go completely free and the ones hit are actually hovering close to poverty, when you consider their income.

To refresh, from my June 2015 post Greens sell out on aged pensions, here are the main changes:

- From 2017, the assets test threshold for home-owning couples will be lowered from $1.15 million to $823,000. For single home-owners it will drop from $775,000 to $547,000. In addition, the current taper rate will double from $1.50 to $3.

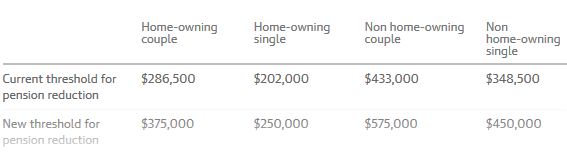

There are similar drops for non home-owners. This table shows the reductions:

Remember that the assets test includes household contents and personal effects such as furniture, jewellery and heirlooms, plus cars and retirement projects like boats, caravans or collections.

Moreover, pensioners also receive state concessions on rates, utilities and registrations, plus cheap prescriptions at the pharmacy.

A rough calculation indicates that non home-owning couples get around $125 a week extra to pay rent, which is manifestly inadequate in most parts of the country, but that is another story.

Here’s the table showing pension increases:

The income changes are small.

The main issue is about the negative effects of chages to the assets test. At the deeming rate of 3.25%, couples owning their own home, for example, would receive an income from $823,000 of $26,747, provided they didn’t own a car or other non income-earning assets. In June 2015, when the decision was made, the pension for a couple was $33,717. Previously cash assets of $1.15 million would be deemed to earn $37,375.

Formerly there was some incentive to save. Now there is an incentive to liquidate cash. This incentive is now even stronger with the taper rate doubling from $1.50 to $3. This means that for every $1000 of capital you liquidate you get an additional $3 per fortnight in the pension. Per annum you get $78 rather than $39.

That’s equivalent to an interest rate of 7.8%, better by far than you could get elsewhere.

Michael Janda reports the comments of Professor Susan Thorp from the University of Sydney Business School specialises in life cycle finance and individual financial decision-making. She says the pension changes will likely change behaviour in the affected bracket. There will be a temptation to spend the money, or indulge in riskier investments.

Warren McKeown of the University of Melbourne agrees, and says people wanting to maintain their lifestyle could then reverse mortgage their homes, and even get a loan from Centrelink, leaving a debt to their heirs!

Since oldies can’t buy cars or caravans, or indeed give the money away, travel would be one of the favourites. They can also improve their homes.

One factor, already at work, is that oldies are likely to hang onto a larger family home rather than move to a smaller one.

There has been a debate at The Guardian between Ben Eltham and Osman Faruqi on the topic, where I was disappointed to see the issue being framed as about ‘wealth’. The incomes I have been talking about in this post are from around $27,000 to $37,000 for a couple. Average incomes for singles are around $83,000 for men and $70,000 for women. I could not find the median income, the point at which 50% are above and below, but I believe it to be around $55,000. So we are talking about incomes for a couple that are well below the median income for individuals.

We started the year last year with a story One-third of Australian pensioners live in poverty? In September The Conversation ran a fact check on a statement made by Jacqui Lambie to that effect. Their finding was:

-

Jacqui Lambie was broadly correct to say that one-third of Australian age pensioners are living below the poverty line.

However:

- There is insufficient evidence to suggest the poverty rate for age pensioners will double in the near future. – Rafal Chomik

Ben Phillips in reviewing the finding said that the changes in the assets test could increase the number in poverty by a small number.

The point here is that the whole thing is being worked out in the zone around poverty. To frame it as being about wealth and to label it as progressive, is, I think, a bit obscene. The government is effectively stripping the assets of anyone who gets a dollar of pension.

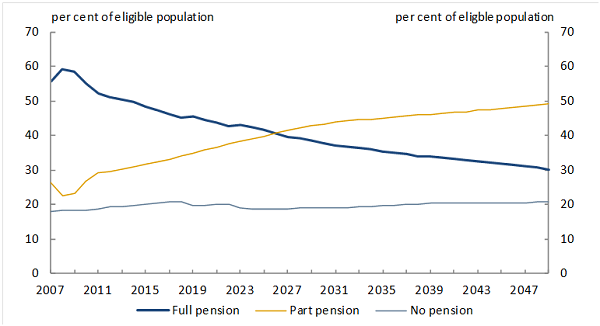

Roughly 20% of the population are wealthy enough not to receive the pension:

These include the people making the decisions. I believe the average non-home holdings of the top asset-owning quintile is $1.3 million.

The elephant in the room is what happens if you need to buy your way into institutional aged care. Here the family home comes into play. Particularly vulnerable are the non home-owners and the couple where one needs institutional care and one needs to maintain a home. Somehow this never comes up in the context of pensions and retirement incomes.

The CSIRO did a study that found old people tend to live frugally, maintaining their assets and are chided for not running them down.

Treasurer Scott Morrison thinks it is terrible if they leave an inheritance for their kids.

Thing is, you don’t know how long you are going to live, and when you might need a new hip or a new roof. You don’t know whether you will die with your boots on or have a long drawn-out demise under palliative care.

And what, pray, is wrong with helping you kids into the housing market?

Retirement incomes need a comprehensive review, but one that takes realistically into account end of life risks and needs. The current changes are piece-meal and wrong-headed.

The whole aged care welfare system is a dogs breakfast that sends old people into fibrillation every time yet another difficult to understand cut is proposed. Governments simply don’t understand that the elderly have problems with complex bureaucratic decisions This one is particularly difficult because of the difficulty of assessing the value of a whole range of assets.

The other problem with this one is that many of the assets will be difficult to convert to income in a hurry .

This Gratton report has some useful information of the tax breaks and other benefits for the elderly.

A key graph in this report shows that when pensions and superannuation tax breaks are combined that the people who gain the most are the top 30%. The government could save money by removing all the superannuation tax breaks and paying the full pension to all those who are old enough to be eligible for the old age pension.

Thanks, John. That’s a telling graph and shows clearly who is getting the most help.

There was an update in the AFR this morning.

First, around 170,000 pensioners are getting the increase which averages $30 extra per fortnight. Good luck to them, but in the scheme of things, it’s cosmetic.

Secondly, according to DSS modelling a home-owning couple with $823,000 of assets will receive $14,467 less per year. That is not trivial, but is excused by saying that couples can cover the loss by drawing down 1.76 per cent of their assets.

That sounds all fine and good, but do it 25 times as inflation depreciates the value of the assets and more is required to keep pace with increased prices.

Third, apparently the scheme was invented by ACOSS, the Australian Council of Social Service. Essentially it appears that the government was threatening worse. Also the Council on the Ageing said the arrangements were reasonable in current circumstances.

Both are angry with the ACTU which has been conducting a robo-call campaign. The AFR gets on its high horse and blames labor for getting its union paymasters to do the dirty work.

So we have a bit of routine union bashing. I don’t think Ged Kearney and her troops are hanging about awaiting instructions from Labor.

The fact that ACOSS and the Council on the Ageing support the changes does not mean they are right. It’s just another case of more privileged people deciding what is good for everyone, that is everyone except those actually being dudded.

Apart from saving money by paying everyone of pension age the pension there are a number of ways that the cost of welfare and tax concessions to the elderly could be reduced. These include:

1. Converting some welfare into loans that are repaid by the estate or by using a HECS type repayment system if the income of an old person gets high enough.

2. Using death duties to recover some of the money spent on the elderly.

Either of these approaches avoid the income crisis being faced by those affected by changes to the asset rules and may also allow for a more generous pensions/loans.

Wont make children that want to maximize their inheritance happy.

For the record, the only chance of the Davidson’s getting a pension is for all the elderly to get the pension. (So yes, I am not completely disinterested in this one.)

We had a bit of a family new year get together last night and ended up talking about this. We concluded the the policy indicated a failure of empathy.

I won’t go into my own situation completely, but I’m probably close to where the actuaries would have told me at retirement age I would die, on average. Having lasted so long, they would now give me extra time, but I could still exceed their calculations by, say, five years.

The big worry is if one of us have to go into a nursing home and the other has to stay in dwelling in the suburbs.

When i cleaned the solar panels recently I noticed quite a lot of rust appearing on our iron roof. We are hoping it can be neutralised and painted over. I just heard on the radio a case where a new roof cost $40,000.

If we need to buy our way into institutional care, assets will have to be sold, and in fact capital gains paid. Capital gains tax isn’t fair and is tipped in favour of the ATO, but that’s another story.

However, the bottom line is that if I’d followed the strategy recommended by ScoMo and all the others who know best and ran down our assets, we’d have no money for a potential new roof and would have to sell up, downsize and probably move to a country town.

Brian, I see this a little differently. I might have marginally/almost qualified for a bit of pension under old rules, though I’ve never bothered to check and it would depend on property valuations anyway, but certainly won’t under new rules.

I agree with you that this is not because I am particularly “wealthy” by Australian standards (though certainly I am by global standards) but because of the way I have my assets arranged. If instead of having a modest flat and an inexpensive regeneration/holiday property, I put the price of both places plus a chunk of my super into one median priced house in Melbourne, I’d definitely qualify, even under the new rules, and my kids would still inherit the house. So I think a lot of the injustice, such as it is, is in the way the family home is treated – particularly that people can have million dollar (or multi-million dollar) homes and still qualify.

However I’m not particularly concerned about the changes in general. I understand your concerns, and accept that deeming rate is as you say, but empirically the rate of return on assets has been much higher for the last ten years (particularly in Melbourne and Sydney) than the deeming rate. My industry super pension scheme has returned about average 6% for ten years, notwithstanding the GFC.

Maybe you’ll say I’m living in a fools’ paradise, and I can see that, because I think some kind of financial crisis is very likely, with climate change, political disasters like Trump, etc, but what the impacts will be is hard to say. However I agree with John’s general points as I understand them – the big problem is the benefits going to the very wealthy, and also that we should have a universal pension/income scheme plus much more progressive tax and transfer arrangements (well actually I am of a more socialist bent and think everyone should get much the same level of income, but in the short term I support that suggestion).

Val, individual circunstances, and how people see them, will vary. I guess it comes down to a few points, which still stand.

Firstly, this is an issue of income rather than wealth.

Secondly, what the policy does in the main is to take from those who in terms of income are just above the poverty zone, and use it for budget repair, leaving the top quintile in the community pretty much free.

Third, the policy is based on the notion of running down assets in retirement according to actuarial averages, which I think is bad policy, and leaves people who are unfortunate enough to survive at risk.

A 6% return is, I think, not impressive, unless it incorporates the period of the GFC, which from what you say, I think it does. Most of my investments were in direct shares, and during the GFC I lost 46% of my assets by value, and 46% of my investment income stream.

That’s why I say you can get a sustainable 4.5 to 5% yield from shares, which will normally rise with inflation, but there is risk, so it is only sustainable if capitalism keeps ticking over without a glitch.

Gains from real estate have been faster than inflation, but we have been creating a world-class real estate bubble and we can’t expect that to go on.

My wife and I have adopted a policy of maintaining assets and living off the income they generate. I cashed in my super about five years ago to pay off some debt, which was costing me over 7% interest at the time. My wife has super, in a balanced fund, which is doing OK, and taking the minimum of 5% as a pension, which at her age she is obliged to do. So far it’s working OK and the balance is improving, about in line with inflation, which is what we want.

We can dream that another world is possible in how economic and social arrangements are structured, and we should.

If the Davidson’s got the pension it would have little effect on our spending rate unless we made a conscious decision to donate it to charity or some other perhaps more selfish enterprise. The pension could quite easily end up simply doing nothing more than increasing what we leave to our children.

Once you start talking about welfare to the relatively well off this welfare can, in reality, be welfare to the heirs rather than something that actually makes a difference to the lives of the elderly. This concern about “welfare to the heirs” is one of the reasons I suggest things like “welfare as a loan” and the return of death duties for inter-generational inheritance.

Some forms of welfare for the elderly that actually encourage desirable change will be less likely to contribute to welfare for the heirs. For example, free public transport and or some taxi subsidy may help the elderly to get round and about more and reduce the time they spend driving.

The above doesn’t mean that I have changed my mind about UBI and all oldies getting the same pension. I see UBI being paid for by reducing the lurks available to the rich and increasing their taxes. Part of the reason for supporting UBI is that it reduces the risk of the oldies being scared by government proposals they don’t understand and removing the disincentives for people on part pensions to go out and do some paid work or try and start a micro-business.

In my opinion, if you can sustain yourself in retirement, you should.

Welfare should be a safety net should that not be possible at some point, not to maintain an above average lifestyle.

If liquidating assets is needed, so be it.

If there are assets left after that then sure, pass them on.

The ” I payed taxes all my life, I deserve some back ” argument doesn’t wash. The year you payed that tax was the year it was spent ( and then some ! ), it’s gone.

Jumpy: Take a look at the graphs in the first comment. The message is that the government could save money by simply paying all the oldies the pension and cutting out the super tax breaks that mainly benefit the rich end of the scale.

The other thing to keep in mind is that the current system discourages people on the pension from working or starting a micro business. Many of the part pensioners I know have just given up because they find dealing with Centrelink just so onerous.

I can support the UBI and death duties, although I think we are along way from getting public and political support for such measures. The UBI, and in the interim the pension, should be sufficient to live with dignity. The fact that around a third of pensioners are living in poverty indicates that the pension is too low.

The problem at present is that the right-wing political class have a concept of the ‘undeserving’ poor, so the pension is ‘welfare’ and a concession.

Interesting debate on a UBI.

I know you keep saying we can afford it, John, but my idea of a UBI is that it would replace pensions and the dole. On the information provided it doesn’t look affordable.

During most of my working life I assumed that the Government, having the people of Australia’s best interests at heart, and knowing I was on the leading edge of a demographic bubble (the baby boom), was investing a portion of my taxes to prepare for the coming expense of my cohort’s pensions.

Turns out I was very naive.

John

I agree, so such of the welfare system discourages engagement in the legit workforce.

Black economy grows with every tweak in legislation.

zoot

Ahh, the Gillard Defence.

Turns out they used it, and then some, to porkbarrel the ” I Want IT Now ” voters.

Jumpy: It is the complexity of the rules that discourage people from working or starting micro businesses. Pensions or unemployment benefits are nowhere near large enough to discourage people from seeking more income.

John

Yes, regulatory compliance is a pain in the arse, you don’t need to tell me that. I also discourages potential enterprise.

For some, most have enough to live a simple life, the go-getters sell stuff at weekend markets, ironing or sell drugs untaxed on the black market.

But thats just my cul-de-sac, others may differ slightly.

Brian, I like your comment:

“We can dream that another world is possible in how economic and social arrangements are structured, and we should.”

Thanks for that.

Defence?

What am I charged with?