In a one newspaper town, the Courier Mail will never miss an opportunity to slam the Palaszczuk Labor government, even if they have to distort or mislead, while generally neglecting good news.

So we’ve had another front page headline:

In a one newspaper town, the Courier Mail will never miss an opportunity to slam the Palaszczuk Labor government, even if they have to distort or mislead, while generally neglecting good news.

So we’ve had another front page headline:

Last week began with a front page article in the AFR Victoria prone to blackouts this summer as grid wilts and ended with an AFR editorial How can Australia have third-world power blackouts?

The answer to that question is easy – we don’t have to avoid third-world blackouts because we don’t have them. The more important question is, why is Michael Stutchbury’s head in such a muddle? Stutchbury is editor in chief of the AFR and appeared on ABC Insiders this morning. Other panelists asked whether he had read “the report”. Continue reading Keeping the lights on

A myth has been vigorously stoked by Malcolm Turnbull and Josh Frydenberg that an irrational frolic with renewables has made the electricity grid unreliable, as demonstrated conclusively by the state blackout in South Australia in 2016. This is now being taken into actual policy by Angus Taylor and Scott Morrison with “big stick” penalties and government intervention to produce “fair dinkum 24/7” power.

This myth has now been thoroughly debunked by a Grattan Institute report Keep calm and carry on: Managing electricity reliability. Blaming renewables for reliability issues is “wrong and dangerous”. Continue reading Blackouts are not increasing, keep calm and carry on!

When I logged on Tuesday there was an alert from John Davidson of a lead article at RenewEconomy Coalition energy plan “unworkable”, as Taylor charges into coal. It sent shivers up my spine.

There is PM Scott Morrison, shallow, ignorant and complacent, when first asked about climate change he admitted he’d never really thought about it.

There is Angus Taylor, bull-headed, supremely confident, and just plain wrong.

While Taylor’s “big stick” Treasury Laws Amendment (Prohibiting Energy Market Misconduct) Bill 2018 is the subject of Senate Standing Committee on Economics hearings (see submissions here) he is pressing on with establishing tenders for “24/7” reliable power in what appears to be a mad rush to lock in contracts before the expected “caretaker” period begins in mid April, ahead of the anticipated mid-May poll. Continue reading Angus Taylor is trying to steal the electricity system

Today’s AFR carries an article Investors warn of consequences of cutting electricity retailer margins (the print version was “‘Crazy’ to target energy retail margins, warn big investors”):

Big investors have slammed the Morrison government’s “big stick” approach to the electricity sector, saying any move to force companies to cut prices will have a major impact on profits, future investment and result in less competition in the long term. Continue reading Big investors slam ‘big stick’ approach

Scott Morrison put in a fine effort to stop the votes that would have retained Wentworth for the Liberals. And he succeeded. Now he seems intent on stopping the $200 billion worth of investment that will be needed to transform the electricity sector.

Craig Emerson in his weekly column for the AFR on Monday drew attention the Venezuelan comparison. On 22 November 2017 they passed a law:

The Liberal party has changed leader, in part because of climate change, and are now proceeding with pretty much the final policy landed upon by Malcolm Turnbull, with a couple of significant twists. We now have a very explicit instruction that energy prices along with keeping the lights on are the main game, while emissions reductions can be safely put off to the never-never.

The Coalition government under Scott Morrison is now almost completely isolated on energy and climate change. Compared to adult countries we look completely foolish, The question remains whether the main actors, the states and the corporates investing in the system, can move forward regardless. Continue reading Reconnecting climate change politics with reality

Here are the last four feature articles from Giles Parkinson at RenewEconomy (as of last weekend):

It’s quite likely that politicians don’t read RenewEconomy. Here’s Ben Potter in the last Weekend AFR:

The Turnbull government has effectively vacated the field on climate change mitigation. Until it shows that it is serious on the matter, there can be no certainty, no end to the climate wars.

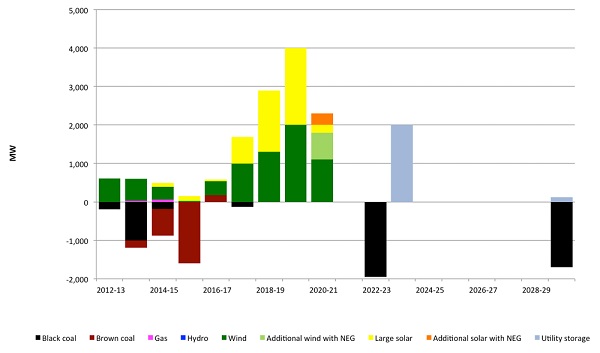

The Energy Security Board working for the Turnbull government has come up with a National Energy Guarantee which does no work on emissions reduction, because the target of 26% will be met almost as soon as the policy becomes operational. From the post NEG becomes a farce, this is what is forecast to happen:

Continue reading 26 per cent emissions target means no certainty

Continue reading 26 per cent emissions target means no certainty

Malcolm Turnbull specialises in scapegoating and threatening, while Josh Frydenberg sits there looking vacant, as well he might, until it’s his turn.

Danny Price in an article well worth reading, says Politicians have destroyed the trust needed to make the NEG work.

Kane Thornton CEO of the Clean Energy Council says NEG car is worth buying, even if tyres need pumping up, the flat tyre to him being the 26% emissions reduction target, which will be met by work under way before the NEG starts. If you want to use that analogy, the NEG is like a car without an engine, because it does no work.

David Leitch has two compelling articles – Energy (In)security Board and its modelling spreadsheet and Know your NEM: The ESB is becoming a laughing stock. If, however, you want to read just one article, read Simon Holmes à Court’s NEG promises death of wind and solar, and even battery storage. Continue reading NEG becomes a farce

On the weekend Energy Minister Josh Frydenberg gently reminded the Coalsheviks in the LNP Coalition that they should not be flirting with the idea of coal-fired power, because

On the weekend Energy Minister Josh Frydenberg gently reminded the Coalsheviks in the LNP Coalition that they should not be flirting with the idea of coal-fired power, because

He warns that they may be investing in what will become ‘stranded assets’ before they wear out.

Why doesn’t he tell them like it really is? Tell them to look out the window.

The heatwave in Europe this year has been assessed as ‘five times’ more likely because of climate change. The northern summer’s heat is being recognised as the strongest climate signal yet. Wildfires have raced through neighborhoods in the western United States, Greece and as far north as the Arctic Circle. Drought is threatening food supplies: Continue reading NEG policy disaster won’t fly

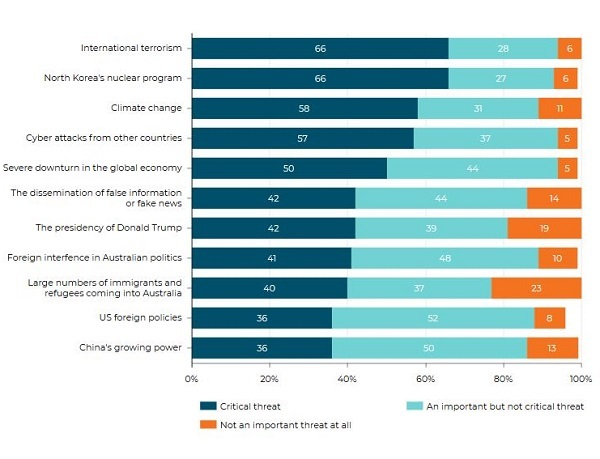

In the Lowy Institute Poll 2018 (interactive version here) respondents were asked to rate 11 threats to Australia’s vital interests as (1) a critical threat, (2) an important but not critical threat, or (3) not an important threat at all. Here’s the result:

At 58% climate change came third. However, a stubborn 11% thought climate change not a threat at all. Continue reading Australians speak: what does the government hear?