According to the AFR, AGL Energy faces “a huge daily challenge” just to keep its “geriatric” Liddell coal-fired power station running and will need to spend up to $150 million just to “keep our noses above water” until 2022. It will cost $900 million to keep it open for another 10 years, as Malcolm Turnbull and Josh Frydenberg would have it.

“It’s exceptionally challenging,” AGL Macquarie general manager Kate Coates told the group of press representatives and other interested persons on the tour on Tuesday.

As she spoke, one of the four turbines was down for its three-yearly maintenance, another out of action due to an unexpected “complex” failure. The other two are running below capacity to minimise the chance of them also breaking down. So out of a nominal capacity of 2000 MW only 840 MW was being supplied.

They were dealing with age-related issues such as corrosion, erosion, wear-and-tear, and vibration-induced fatigue. There are:

-

about 12 failures a year, incurring costly expenditure to replace burst pipework.

The coal conveyor system and the ash disposal system are also “highly compromised”, requiring significant work, while the insulation systems are degrading with water starting to leak into the electrical system, Ms Coates said.

Even with the reduced output, they were still finding it difficult to keep up the supply of coal.

Apart from a segment on ABC RN’s The World Today, I can’t find much in the mainstream media. RenewEconomy has a piece, which links to a podcast with ITK analyst David Leitch (link near the bottom). It doesn’t spend a lot of time on Liddell, but among the points made:

- Liddell was simply the worst case he’d seen and he’s seen more than a few.

- A coal plant can wind up and down about 100 MW in an hour.

- He thinks AGL will use OC gas to ‘firm’ renewables they build to replace Liddell.

- Liddell north of Newcastle has no access to gas, but it is cheaper to build a gas pipeline than to build high voltage transmission>

- The coal they are using has more ash in it than would be acceptable to the Koreans.

- In the future the cost of coal alone is likely to be up to $70 per MWh, making existing coal-fired plants problematic in terms of cost.

The Australia Institute commissioned a ReachTEL poll which showed locals have a clear preference for renewables over coal, and more support AGL’s plan to close Liddell that Turnbull’s plan to keep it open.

Seems AGL has a chief economist, Dr Tim Nelson, who addressed the group on Tuesday (report in the AFR).

His big point is that “baseload” is old hat, and we need to get over it in favour of “flexible” power. In Germany, he said, the concept of “baseload” is passé among energy policy planners:

- “In Germany it’s pretty clear – and in Australia as well – the future is in renewables,” Markus Steigenberger at Berlin-based energy think-tank Agora Energiewende told Drilling Down last year.

“Weather-dependent renewables will be the basis of the future system, so baseload is what we don’t need any more.”

That was in November 2016. Also:

- Bloomberg New Energy Finance’s Kobad Bhavnagri says baseload coal will become “a liability” in Australia, unable to cope with rising demand for more flexible power supply.

He says:

- 76 per cent of the $US88 billion ($110 billion) of investment expected in Australia’s power generation infrastructure by 2040 will go on renewables, with much smaller amounts on gas power and extending the life of coal power.

That was last month. Not everyone agrees. Trevor St Baker, whose Delta Electricity owns the Vales Point coal generator on NSW’s Central Coast, is a fan of new ‘clean’ coal. However, Bhavnagri says that anyone of that view lives in a different world and probably hasn’t spoken to his banker.

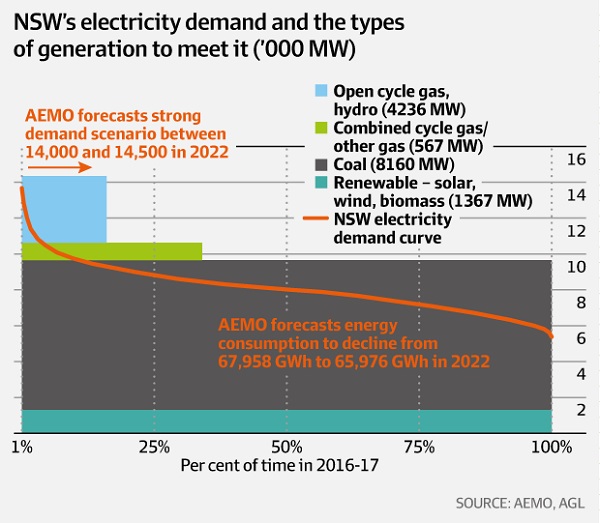

Australian Energy Market Operator forecasts that by 2022, when Liddell is due to close, NSW’s peak demand will have increased towards 14,500 MW, from about 14,000 MW now. However, at the same time, total energy consumption will continue to fall, to about 65,976 GWh in 2022 from about 67,958 GWh last financial year.

AGL showed this slide:

Remember, with solar, daily minimums will move to midday, followed by the daily peak a few hours later.

Overall, Turnbull and Frydenberg are no doubt playing politics rather than fixing the electricity system. They certainly did not do any due diligence on Liddell. Giles Parkinson says St Baker has also gone cold on his enthusiasm for taking over the plant.

Meanwhile Katherine Murphy finds Abbott’s stance purely political and unconscionable.

We deserve better.

Should be $70/MWh which translates to 7 cents/kWh.?

So what do we have?

-A clapped out power station that:

— Is struggling to produce even half its nominal capacity and certainly cannot be relied upon to produce power during peak demand periods.

–Will need a lot of money spent on it to even keeping it going to 2022, let alone an extra 5 yrs.

–getting near the end of its supply of low cost coal and may struggle to get coal supplies from anywhere given the uncertainty re how much demand the will be for the power produced. (Mines prefer customers with predictable demand.)

–Is owned by a company that would like to avoid providing providing opportunities competitors.

-There is no obvious reason why Liddell power needs to be replaced by power produced near the Liddell power station.

-There is no obvious reason the replacement power cannot be split between a number of very separate sites. (Why pipe gas to Liddell for peaking power generation? Or why use OCGT instead of on of the many alternative technologies and energy sources? )

– Spontaneous combustion of coal can be a risk when demand is unpredictable.

-Piping gas, spontaneous combustion and the uncertain cost of both coal and gas are good reasons to stop stuffing around and go straight to renewable energy.

The feds or NSW government (Or possibly other state or territory governments) should cut through the bullshit and set up a renewable energy auction or similar for the power that will really will be needed when Liddell shuts down. This auction may include a certain amount of energy storage for renewable alternatives other than solar tower.

John, yes I think it’s $70/MWh which would translate to 7 cents/kWh. I don’t know whether that’s expensive, but they were suggesting it is.

As to building gas on that site, they are obliged to remediate the site and may see some advantage in employing some of the same people. There may even be some loyalty to their workforce!

Brian, you’ve just achieved more thorough research than entire LNP have achieved in the whole month that they have been flying this ballon. The Australian will now have to bodge together a cluster of confusing words to refute your assessment.

7 cents per kWh for fuel is expensive and may well make Liddell generator of the last resort for coal fired power. It may also make solar towers a cheaper option for producing 24/7 power.

BilB, the Oz just put rubbish on the front page, like this one about renewables subsidies to Saudi billionaires .