This is a guest post by blog commenter Geoff Henderson. It is particularly strong on the structure and standing of Adani as a company, and on the truly pathetic contribution the project would make to both jobs and the coffers of the state government in royalties. I’ve added some links of other recent material at the end. Enjoy!

———————————————————————————–

A Four Corners program[1a] made serious claims about the Adani Conglomerate corporate profile in India. Credible allegations of bribery, corruption, money laundering, environmental destruction, tax/royalty avoidance and more were leveled at Adani.[1b]

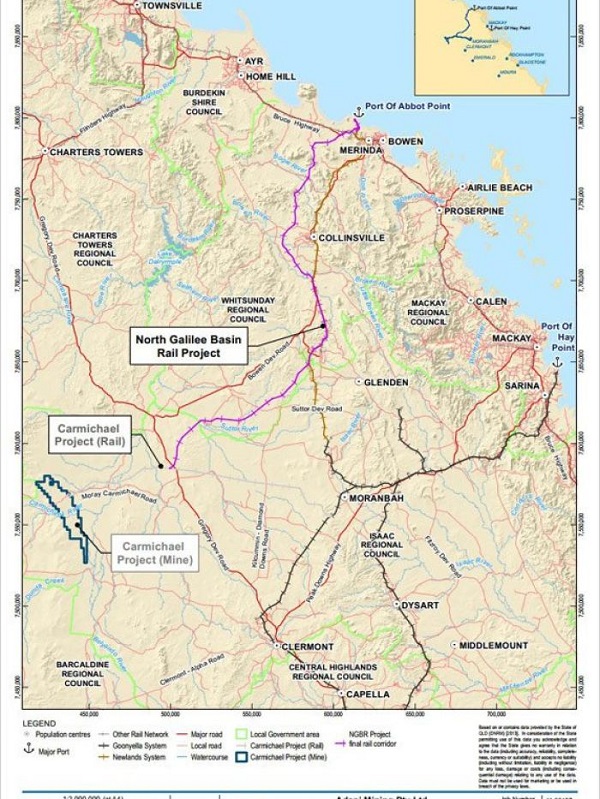

Adani’s Australian project is huge. The project comprises of several parts: one, the mine itself, two, a rail line to haul the coal and, three, the Abbot Point export port. Adani is seeking a $1 billion loan from Australian taxpayers to fund the rail line. Abbot Point will be expanded by dredging up to 1.1 million tons of material.

Four Corners exposed Adani’s shocking corporate citizen record in India. What might we expect from Adani Australia?

The Mine, (Carmichael) is set in the Galilee Basin. It is likely the first of up to nine mines proposed for the Basin. To mine up to 60 million tons per year, open pits 40 km long and 10 km wide are intended.[2] Adani is authorized to draw unlimited groundwater for 60 years. Massive environmental risks are apparent.

The Railway is approximately 400 km long reaching from the mine to Abbot Point port. Adani has requested a government loan of $1 billion to establish the railway. The rail line will be owned by separate Adani companies (four companies and two trusts[3][4]) owned ultimately in the Cayman Islands.[3] This obscures the profit guidance of the rail company, and brings uncertainty to the repayment of a $1 billion rail funding loan. Should other mines be developed in the ‘Basin, they will use the same rail, generating profits that accrue to Adani, Cayman Islands.

Abbot Point is the shipping port for Adani’s Carmichael coal. Adani has already “purchased” the port (99-year lease actually[3][4]) but the actual ownership entity remains unclear. There is an inconsistency between asset accounts of Indian and Australian reporting.[5] This leads to uncertainty about repayments, guarantees and who are the responsible entities. Government conditions upon the development become worthless if the responsible party is sheltered in a tax haven. Like the rail, it is the intention of Adani to obscure ownership of the Port; – five companies and two trusts, all controlled by companies in the Cayman Islands.[6]

The complex array of companies and trusts of the Adani family in the Cayman Islands provides an opaque view of the company and its dealings. Adani Australia is set up to avoid taxes, royalties and responsibilities.

The Environment. Activist group GetUp is very prominent with its opposing ‘Stop Adani’ campaign.[7] GetUp’s campaign targets the effects on the Great Barrier Reef (GBR) based on the contribution to world CO2 levels. The CO2-equivalent produced by the mine over its lifetime is in the order of 4.7 billion tonnes. It’s about 0.5% of the carbon budget needed to limit warming to 2 degrees.[8] Annualised, that is double the emissions of Tokyo and 20% more than New York city.[8] That level of CO2 emission will completely offset Australia’s carbon reduction goals, or 80% of Canada’s goals or over 50% of Japan’s goals.[8]

A more immediate threat is shipping through the reef – up to 500 ships per year risks groundings and spills. The introduction of exotic marine life to the GBR lagoon via the water ballast of arriving ships is another risk. Maritime rules require that Indian water is purged from the ships before arrival. However, compliance is in the hands of Adani, who show willful disdain for regulations.[1]

Will the mine go ahead? Carmichael may never operate. It has been shown to be unviable[9] in a July 2017 report by Prof. John Quiggin and the Australia Institute. Even under favourable conditions the mine would not generate sufficient funds to repay loans. Another paper[10] released by the Institute for Energy Economics and Financial Analysis (IFFEA) raises concerns about the fiscal position of Adani and especially the Abbot Point coal port. Adani’s global debt is approximately $15 billion. Abandoning the Carmichael mine would remove a $1.4 billion asset from its balance sheet. Adani’s Mundra power station is listed as for sale for the price of just one rupee[10] and a further write down of $1.2 billion off Adani’s balance sheet.

State and Federal politicians of the major parties still support the project, likewise opposition parties and regional local government. In June 2015 Queensland Treasury declared Carmichael as unbankable.[11] Why the support?

Anna Krien[12] cites Ross Gittins[13] saying the media has overinflated the importance of mining. Mining accounts for 7% of Australia’s GDP and 2% of the workforce, 230,000 in total. Adani’s 1460 would amount to 0.006%. Royalties for Queensland last year amounted to $1.63 billion, 3% of state revenue. Perhaps the political thought is that Adani will boost state revenues and satisfy some regional promises.

Job promises lured politicians. Adani’s strategic promise was 10,000 jobs. Under oath though Adani revised that back to 1460 jobs.[14]

Independent MP Rob Pyne[15] said politicians were protecting their jobs first – they seek re-election. The incumbent government wants re-election. Policy reflects that the pro-Carmichael coal belt (Gladstone – Townsville) is critical to re-election. Labor MP Craig Crawford[16] said little to suggest another rationale but was coy about his own re-election as motive. He was personally against Adani, but had to toe the party line.

Evidence is overwhelmingly against the Adani Project going ahead. Serious issues with environment, governance and high financial risk for Australia weigh convincingly against the project.

Endnotes:

1a. Four Corners, ABC, Oct 2 2017

1b. The Adani Files, https://adanifiles.com.au Accessed 28/9/17

http://www.abc.net.au/news/2017-06-06/questions-raised-by-adanis-green-light-on-carmichael-coal-mine/8594060 Accessed 22/9/17

https://adanifiles.com.au Accessed 28/9/17

ABC News 21/12/2016, Accessed 22/9/17 from: http://www.abc.net.au/news/2016-12-21/adani-corporate-web-spreads-to-tax-havens/8135700

1a. Four Corners, ABC, Oct 2 2017

1b.The Adani Files, https://adanifiles.com.au Accessed 28/9/17

2. http://www.abc.net.au/news/2017-06-06/questions-raised-by-adanis-green-light-on-carmichael-coal-mine/8594060 Accessed 22/9/17

3. https://adanifiles.com.au Accessed 28/9/17

4. ABC News 21/12/2016, Accessed 22/9/17 from: http://www.abc.net.au/news/2016-12-21/adani-corporate-web-spreads-to-tax-havens/8135700

5. https://envirojustice.org.au/sites/default/files/files/Submissions%20and%20reports/The_Adani_Brief_by_Environmental_Justice_Australia.pdf Accessed 7/9/17

6. http://www.abc.net.au/news/2016-12-21/adani-corporate-web-spreads-to-tax-havens/8135700 Accessed 28/9/17

7. https://www.getup.org.au/campaigns/great-barrier-reef–3/adani-video-report/help-stop-adani-from-destroying-the-great-barrier-reef Accessed 8/9/17

8. http://www.tai.org.au/sites/defualt/files/Amos%202015%20Carmichael%20in%20context%20-.pdf Accessed 28/9/17

9. http://www.tai.org.au/sites/defualt/files/The%20economic%20non%20viability%20of%20the%20Adani%20Galilee%20Basin%20Project.pdf Accessed 8/9/17

10. http://ieefa.org/wp-content/uploads/2017/10/Escalating-Financial-Risk-of-Adanis-Abbot-Point-Coal-Terminal.pdf Accessed 3/10/17

11. http://www.smh.com.au/comment/mine-games-why-adani-is-banking-on-the-unbankable-20170531-gwgzvb.html Accessed 25/9/2017

12. Anna Krien, Quarterly Essay 65, The Long Goodbye: Coal, Coral and Australia’s Climate Deadlock

13. http://www.canberratimes.com.au/business/comment-and-analysis/minings-economic-contribution-not-as-big-as-you-might-think-20170203-gu4r5l.html

14. http://adanijobs.com/ Accessed 25/9/2017

15. Cairns independent MP, face-to-face interview Sept 19 2017.

16. Labor MP, personal interview 24/9/2017

————————————————————————————————

Geoff prepared this originally as a university assignment. Part of the requirement was that the finished product should have a prospect of being published. I happily undertook to do so. Minor alterations have been made to the assignment as submitted.

It was prepared in a standard assignment format with references. Geoff changed that to endnotes. Obviously it would be preferable online to have live links, but the time to set that up is simply not available. Sorry.

One small observation of my own is that the railway line crosses an expansive flood plain devoted to grazing. The line will interrupt the natural movement of water across the plain and create significant inconvenience for landholders.

Other links

In breaking news:

- The ABC has learned that a Chinese state-owned enterprise, China Machinery Engineering Corporation (CMEC), is in negotiations with Adani and its principal engineering and procurement contractor, Downer EDI.

If the deal goes ahead, it would see CMEC awarded contracts to build key mining plant and equipment in return for China’s financial backing of the Carmichael mine.

Senate hearings confirmed that Australian government ministers had written to the Chinese Government in support of the Adani mine, confirming it had all necessary approvals, in a bid to help secure finance.

It means the carmichael mine could in fact go ahead with Chines government backing. What are they up to?

Julien Vincent at The Age:

CMEC is part of Chinese Government-owned Sinomach, one of the world’s biggest providers of machinery and equipment for infrastructure projects. It has been busily building coal-fired power stations in key strategic countries such as Pakistan, Bangladesh and others across South and South-East Asia as part of China’s One Belt One Road plan.

India pointedly ignored China’s Belt and Road initiative. Now the Chinese are enabling Gautam Adani, close mate of Indian President Narendra Modi, to supply Australian coal for their strategy of outflanking India.

Australia has decisively chosen China over India in a regional battle for influence.

Vincent also points out that the Northern Australia Infrastructure Facility (NAIF) would be a last-in-line creditor, effectively a quasi- equity holder. Another way of looking at this is the Australia taxpayer is subsidising the Chinese government in its regional power games.

Thankyou Barnaby Joyce and Steve Ciobo.

It makes China look distinctly hypocritical on climate change efforts, not that our bozos would care.

Michael West at The Conversation didn’t know this when he asked:

He says:

- the most compelling explanation is that neither of the major parties is prepared to be “wedged” on jobs, accused of being anti-business or anti-Queensland.

Alternatively, Adani does have a track record of corrupting officials and West points out that:

-

There are votes in Queensland’s north at stake. Furthermore, the fingerprints of Adani’s lobbyists are everywhere.

Adani lobbyist and Bill Shorten’s former chief of staff Cameron Milner helped run the re-election campaign of Premier Annastacia Palaszczuk. This support, according to The Australian, has been given free of charge…

Milner volunteers for the ALP while keeping his day job as director and registered lobbyist at Next Level Strategic Services, which works for Adani.

Also:

- “Next Level Strategic Services co-director David Moore — an LNP stalwart who was Mr Newman’s chief of staff during his successful 2012 election campaign — is also expected to volunteer with the LNP campaign.”

This is getting spooky! At one level it sounds as though our politicians are so cheap you don’t even have to buy them. West does rather think it is really about jobs, however.

West also points out that the Adani family will always extract cash even if one of these dodgy companies goes broke.

Alan Jones is outraged:

- “This is smelly no matter how it’s viewed.”

Jones thinks it’s about donations to political parties.

Van Badham is with him about the mine “but it sure feels awkward and strange agreeing with Alan Jones.”

That was on Q&A where we also had Kevin Rudd who said it was all wrong, in particular the Northern Australian Infrastructure Facility’s (NAIF) $1 billion funding was “wrong, wrong, wrong”. It’s about climate change, stupid, and we can’t keep burning coal. He says Indian, Chinese and South Korean companies represent 70 percent of the global investment in new coal mines across the world.

This makes me wonder whether Peter Garrett, working for Rudd, might have knocked the project on the head. Garrett famously nixed the Traveston Dam project in 2009 when his Queensland Labor mates had spent a half a million bucks on land reclamation.

The Jones article links to:

It says the only support comes from suburban conservative elites. The ReachTEL survey, done after the Four Corners program, shows One Nation oppose the mine 44.9% to 37.7%. Nationals oppose it 57.9% to 21.7%. Overall it’s 55.6% against to 26.1% in favour. The Australian Conservatives come out 57-31.7 in favour.

Overall nearly two-thirds of Australian want the Queensland government to veto the loan for the railway.

The Jones article also links to:

There are 10 electorates that either border the mine site, or are located in nearby areas where economic stimulus could be expected to flow on. Four – Mundingburra, Townsville, Thuringowa and Mirani – changed hands last election, swinging to Labor by about 10%. They could easily swing back, and you can be sure the parties have done their homework. So we had this:

That photo, I think, will remain as a classic.

Then, when the Queensland state election was called Premier Palaszczuk kept getting this:

The protesting came from the Stop Adani Alliance, which started with 13 members, and now has 31. There is also a #STOP ADANI site.

The Greens piggy-backed on the protests politically, making a coal mine supported by both major parties an election issue. Then came the bombshell:

Adani: Premier Annastacia Palaszczuk withdraws Government involvement in mine funding

Palaszczuk says her chief of staff David Barbagallo had become aware of a plan being hatched by Canberra LNP politicians to “smear” her because her partner Shaun Drabsch in his job at Price Waterhouse had done work on the Adani railway proposal to NAIF. Palaszczuk said they don’t talk about his work, and she did everything by the book in consultation with the parliamentary Integrity Commissioner. She now announced that the Queensland government would veto the NAIF loan deal, which she actually can’t in caretaker mode without the support of opposition leader Tim Nicholls, who said on TV that he would do business with anyone at all without any discrimination whatsoever. So he reckons it is a stunt, but if re-elected I can’t imagine Palaszczuk changing her stance.

Mind, she still supports the mine, just not the use of taxpayer funds. Of course, back in May there was this:

- The Queensland Government is offering Indian mining company Adani a “royalties holiday” worth hundreds of millions of dollars for its massive Carmichael coal mine in the state’s north.

Royalties start at $2 million in the first year, ramp up to be paid in full eventually, but numbers people reckon the state will end up short.

Around that time we also got this:

Earlier Adani said the loan was not critical. I think it has to be to fall within the NAIF charter, so that might explain its convenient change in status.

Adani doesn’t mind a bit of help here and there, so we had this:

Townsville and Rockhampton, the designated support cities, will fund an airstrip next to the mine.

That was just last week, I think. No-one was pleased outside Adani.

Nearly done here. A bunch of articles:

I could go on forever. I think the question asked by Geoff can be answered decisively in the negative. Ben Eltham, at his awesome best, concludes that:

- Vale an Australian political system that can approve a mining project so clearly against the national interest. Ben Eltham explains.

Let us assume for a moment that the Carmichael coal mine in Queensland does go ahead. Leaving aside the huge hurdle of finance, the mine has cleared all necessary approvals.

What does that say about the health of Australia’s democracy?

The answers to that question are worrying. Australia’s system of regulatory and environmental approvals has failed in the case of the Carmichael mine, letting a development through that no sane policy could justify.

Carmichael illustrates what is broken in Australian politics, like few other issues. The planned mine is so large, it will materially affect the future of global warming. It will help destroy the Great Barrier Reef. As climate campaigner Bill McKibben wrote in 2016, “you can’t have both the Paris climate agreement and Adani’s Carmichael coalmine. Full stop.”

Yet there is another question, we have not seriously begun to ask. What about the rest of the coal industry, numbered at around 100 mines, and more particularly its plans for expansion?

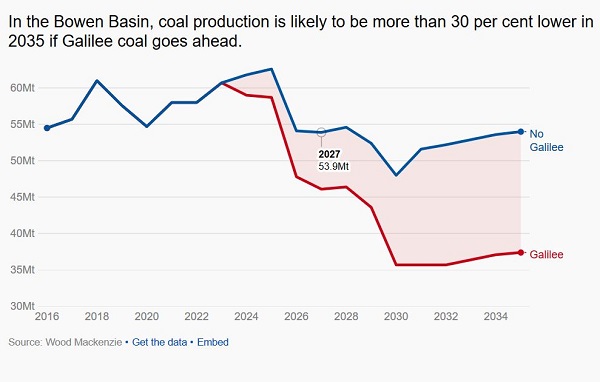

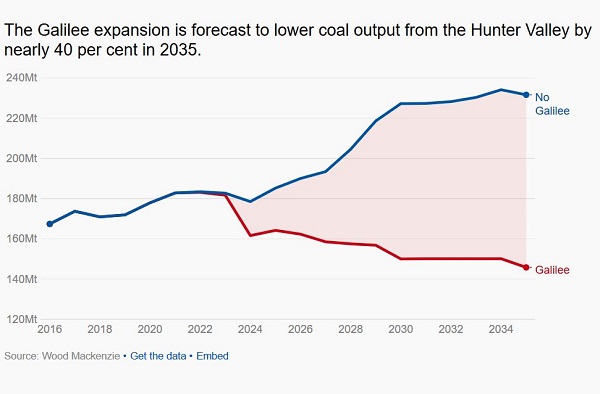

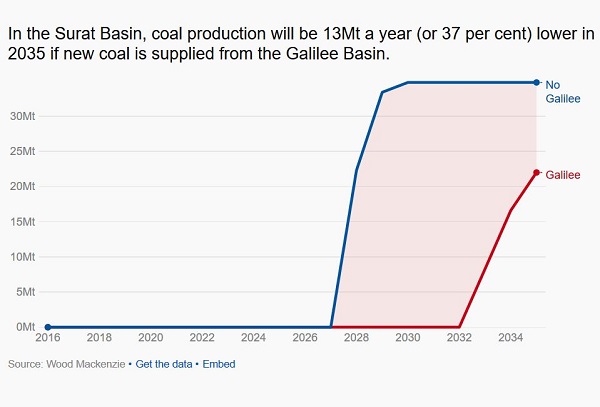

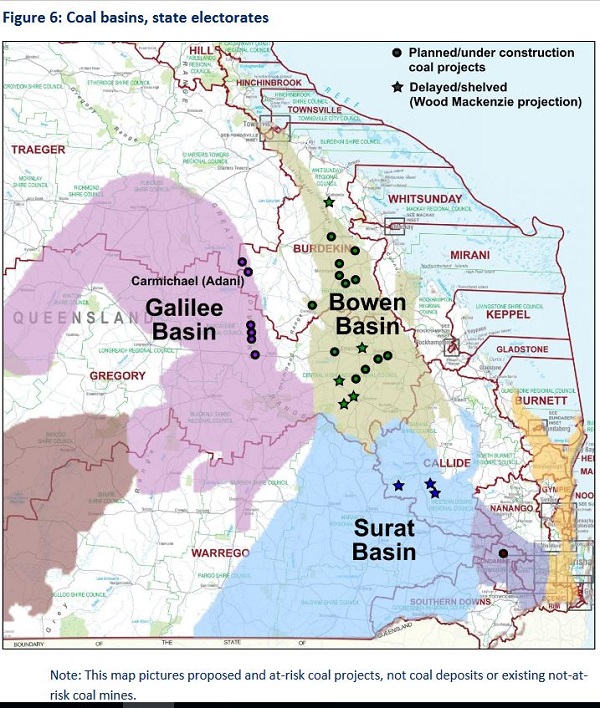

This article explains that the opening the Galilee basin will negatively impact on plans in the Bowen and Surat basins as well as the Hunter valley:

The study was commissioned by The Infrastructure Fund, which owns a 50 per cent stake in the privatised Port of Newcastle. It found:

- Ten new mining projects or mine expansions in the NSW Hunter Valley would be displaced by the Galilee Basin output and shelved or delayed

- Eight mining projects or expansions would be delayed or shelved in Queensland

- Hunter Valley thermal coal output would fall by some 86 million tonnes, or 37 per cent

- Bowen Basin output would decline by nearly a third, with 17 million fewer tonnes mined

- The Surat Basin in south-east Queensland, which is yet to be developed, would produce 37 per cent less coal than it otherwise would

Take a look at these truly gruesome graphs:

That was the Bowen Basin, but look at the Hunter Valley:

And here is the Surat, I think mainly the deferred large Wandoan mine, where a lot of the land resumption has already occurred:

The mining lease was granted on 7 August this year.

The town is near where I grew up. We used to go to the movies there. 32,000 hectares swallowed up. I believe the mine goes to within 2 km of the town centre:

Can’t help but being a bit emotional about that one.

However the general point is that we should not stop the Adani mine so that we can, in an orderly way, nix the Great Barrier Reef from business as usual.

There is a general point to be made about legal responsibility here. Fred Pearce has this article in the New Scientist (pay-walled):

Pearce looks at the work of Oxford University modeller Myles Allen:

- Allen’s most recent paper listed fossil-fuel companies in order of what he has calculated is their responsibility for CO2 emissions. Saudi Aramco tops the list, closely followed by Chevron, ExxonMobil, BP and Gazprom. His team’s meticulous modelling showed, for instance, that 30 per cent of the sea level rise since 1880 is down to just 90 carbon emitters. “Their products are warming the planet. They need to be held to account.”

Legally, where the stuff is burnt governments are held accountable. In the US where it has been tried, companies have escaped responsibility because the state, the gubblement is responsible for the policies that allow us to wreck the planet. This may change in the US now that the government has washed its hands of climate change policy.

If the law is to change, then attitudes need to change. The way the international law sits now it seems that nice people like Greg Combet, former environment minister while representing a coal mining electorate, could have it both ways and sleep well at nights. Ditto for premiers like Annastacia Palaszczuk.

Then there is politics, which operates within the realm of the possible. I think right now the only politician that we could expect to be elected on a ‘stop Adani’ ticket is Bill Shorten. Malcolm Turnbull could not while ever he has the strong fingers of his climate contrarian buddies around his you know whats.

Here’s my post of December 2013 Galilee Basin coal: a vision splendid or a kind of madness? and in June this year Adani – a mirage that will dissolve into mist?

Might have got that one wrong.

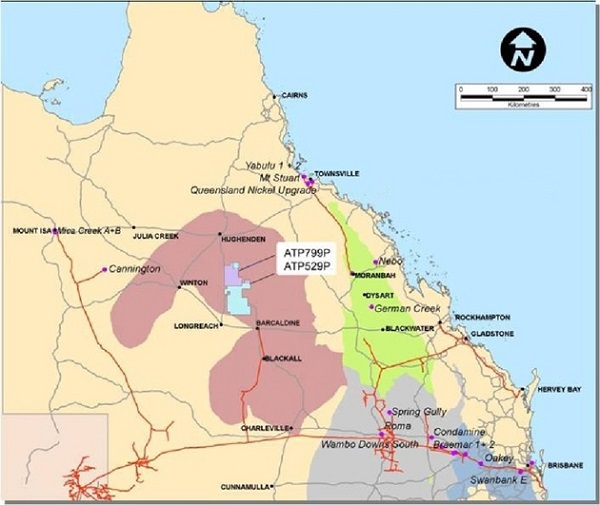

Here’s where the Galilee Basin is located in Queensland:

And this shows the mines in relation to some other towns:

It’s really in the middle of nowhere, and closer to Mackay as the crow flies rather than Townsville or Rockhampton, which is the best way of getting there.

Update: Map of proposed rail line:

Update 2:

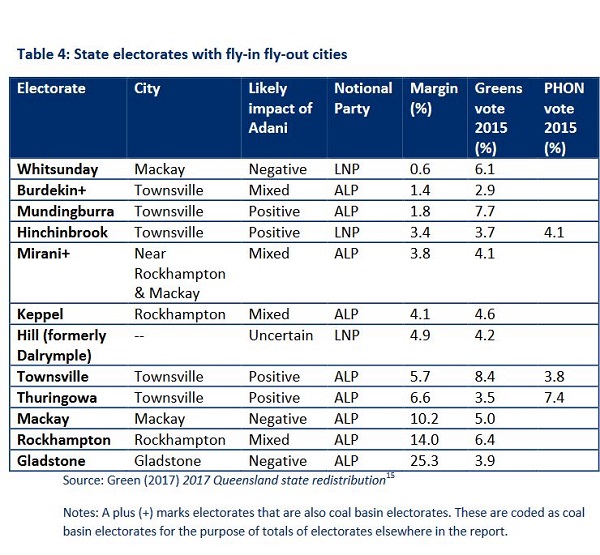

The Australia Institute has done a comprehensive analysis of the impact of employment of the Adani mine and the implications in terms of marginal seats in the election. They based their analysis on the Wood Mackenzie report on the impact on other coal mining activities commissioned by the Port of Newcastle.

The main story is that their are only four electorates where the effect will be positive, all in Townsville. For one electorate the effect is uncertain, four have mixed effects and three negative.

There is a lot of detail in the report. here’s the story of the main cities.

Townsville has only 2500 workers supporting coal mining. There are five seats in town, including the northern tip of Burdekin. Four will gain, but I would think that in a city of around 180,000, the effect will be marginal.

Mackay has 14,400 workers in 1559 businesses. Mackay, a city of 85,000, will lose. Mackay is a safe Labor seat.

Rockhampton and Gladstone together, known as the Fitzroy Region, have 9,000 workers. Gladstone, a city of some 49,000, will lose. For Rockhampton the outlook is mixed, but for a city of some 80,000, it looks negligible at best.

Here is the outlook for fly-in fly-out centres:

Here is the map of the coal basins and state electorates:

Update 3:

Following the importance of the Adani issue to the Queensland 2017 election, a few updates.

Kristen Lyons, Morgan Brigg & John Quiggin are embarking on a five-part series at New Matilda on:

- the ‘who, what, when, where and why’ of the proposed Adani Carmichael coal mine, it’s impact on Traditional Owners, the terrible economics that surround it, and our inexplicable march towards climate oblivion.

I suspect this series will reveal uncomfortable evidence of how active the Qld Labor government has been on behalf of Adani.

It promises to be an important offering.

See also Part 2 and Part 3. They’ve hidden them under More – Environment.

Also Phillip Adams interviewed Stephen Long, the investigative reporter who worked on the Four Corners story.

Long investigated how many times Adani had lobbied the Qld government, finding Adani responsible for more lobbying than all other lobbying combined. That does not indicate the success of the lobbying, however.

From the above and elsewhere, I think two points have been clarified. First, I understand that the Queensland government did send the NAIF railway proposal to its destination with a positive recommendation. My son Mark thinks it would have been decided by the mines minister, Curtis Pitt (for the mine) and Jackie Trad (against the mine) with Palaszczuk standing aside.

Indian company Adani has vowed to proceed with its controversial $16.5 billion Carmichael mine despite a likely funding shortfall from the return of the Palaszczuk Labor government.

With the Chinese government on board, I’d suggest they will.

Secondly, Stephen Long said the 1460 jobs quoted by Adani in court was a net number taking into account the negative effect on other coal mining ventures.

This is long but I hope worthwhile. There was an option of making it two posts, but I think the additional material flows on reasonably well. There are a few points near the end that shouldn’t be missed.

The main elements missing, I think, are the involvement of the First Nations Peoples and the legal cases.

Last I heard from Geoff he was on the road, but in touch with email. I hope he’s back on the interwebs by now, but I decided that the time to publish was ASAP.

Answering your question, “NO!“

I think it’s time for people such as Van Badham to broaden their outlook a bit, and not worry about “feeling awkward and strange agreeing with Alan Jones”.

Look at the facts, look at the policies; don’t be so squeamish.

Thanks Geoff and Brian for your excellent work.

Thanks, Ambi.

On the railway line, I believe NAIF expenditure is supposed to go to projects that have merit but will struggle to get finance on the market, and then the funding is to be no more than 50%.

Robbie Katter pointed out the other day that the railway line was one element of the Adani project that was bound to make money, as the other Galilee miners would also use it and Adani would make hay.

Makes it hard to believe that the railway would struggle for funding from the market.

Katter’s proposal was that the government should fund and own the railway. Couldn’t miss, says he.

Brian,

Tony Abbott was having a chat with Ray Hadley on Radio 2GB today, when he raised the subject of the Adani Mine, criticising Palaszczuk for her change in direction, and making this claim:

10,000 jobs? The Queensland Land Court was advised by Adani’s own expert that net jobs gain would be less than 1,500 nationwide.

Help people out in India? On the ABC’s Four Corners Digging into Adani programme, aired on October 2, according to India’s former most powerful energy bureaucrat, E.A.S. Sarma, he said:

Who will buy Adani’s coal? Apparently not India. Not likely China either – its thermal coal import demand is falling.

A win-win for everyone? Not for existing coal producers in the NSW coal basins, and southern Queensland if the Adani Carmichael Mine starts producing coal. I’m puzzled why the NSW Government doesn’t protest – they’ll likely lose NSW jobs & royalties.

It seems to me, lies just get repeated, and repeated, and some sections of the media won’t challenge these dangerous clowns.

1460 jobs was what Adani said under oath. Tim Nicholls was spruiking 10,000 today. He has no shame.

Geoff M, the post links to an article that says the Chinese government are building coal-fired power through SE Asia I gather in the more mendicant countries, and look like financing the mine.

Yes, the NSW government should be screaming blue murder.

I’ve heard from Hendo. He is in Port Macquarie, heading north. He says they were “chased by some of the most vicious rain, wind and hail I have ever seen from Sydney north”.

Welcome to thunderstorm country!

Geoff H likes the post, but I gather he has only email*. Says he’s now been working on the effects of climate change on the Pacific Islands.

Geoff wonders what Jumpy thinks, since notionally he’s in the coal belt.

My guess is that it doesn’t make one iota of difference to Mackay one way or the other. I think the coal is further inland and Mackay isn’t how you get to it. I’ve only been there once, in the 1970s, and remember sugar.

*He did read the post, so not sure how he’s placed.

Hi Brian – yes on the road but home on 12th. Keeping in touch through the marvels of emails and links and things…

About the NAIF loan to Adani: The Conversation looks at it this morning – https://theconversation.com/why-adani-may-still-get-its-government-loan-86926?utm_medium=email&utm_campaign=Latest%20from%20The%20Conversation%20for%20November%207%202017%20-%2087317273&utm_content=Latest%20from%20The%20Conversation%20for%20November%207%202017%20-%2087317273+CID_fa95429d355db33acc977d926d7a69f7&utm_source=campaign_monitor&utm_term=Why%20Adani%20may%20still%20get%20its%20government%20loan

As I understand the article it suggests that the loan could proceed without Queensland’s hand.

China’s (possible) role in the financing of the rail adds some complexity, especially if there is a condition that Chinese also actually carry out the construction of the rail, not say, Downer.

If that situation went beyond theoretical, I don’t think our current government has the intellectual or moral fabric to deal with it.

Geoff, glad you could get online and comment.

The Conversation link is convoluted lawyer stuff, and seems to come down to the fact that the facility for granting the loan has already been set up, so would require an overt act to renege. That can’t happen in caretaker mode. But there is this:

I’ve been assuming that Palaszczuk would act on her word if re-elected.

Today Margaret Strelow, Rockhampton mayor has announced that she is running as an independent. She had been supported by Palaszczuk, but was overturned by the local branch.

Strelow said that Adani coal would produce less emissions than the coal power station in Gladstone. It is Queensland’s biggest, a 1,680 megawatt power station accounts for approximately 13 per cent of Queensland’s installed electricity generation capacity.

That’s capacity, but I believe it has been operating at about half capacity over the last five years.

Strelow’s statement looks ridiculous, and I believe she should justify it with evidence before anyone takes it seriously.

Brian,

Where on the maps is the Abbot Point coal-loader?

Cheers Geoff M

Geoff and Brian

It appears the article in The Conversation suggests that the ‘facility’ to pass loan money to Adani via the Qld Treasury has already been set up, and if the loan were approved by NAIF, the cash could transit to Adani before a new Qld govt takes office. Effectively avoiding the caretaker Premier’s “veto”.

I may have misunderstood.

So then the question becomes: would a statutory Federal body act in such a way, during a State election campaign? Would Minister Canavan allow it so to act?

***

BTW, the effects that coal mines in one State can have on output from other States reminds me also of the competitive bidding by States, against other States, to attract foreign investors (especially in mining, processing and manufacturing) by offering concessions on royalty or tax payments.

…… to the detriment of the nation……

“Co-operative Federalism” sounds like a distant dream, sometimes.

The general environmental argument against Adani would apply to any Galilee coal mine. The rail is a risky investment and certainly cannot be justified in non-coal terms unless we are talking about a massive projects producing renewable, non-biological fuels. Even then there is no logical reason why these would be located so far fromthe coast.

Ambi, what you say may be correct. Canavan is pure and simple climate denialist, and I think quite ruthless.

Yesterday Emma Griffiths spoke to Mark Ludlow, AFR correspondent who lives in Brisbane. he was underwhelming in terms of his knowledge of the issue, and clearly regarded renewables as just another source of energy. However, he thought Palaszczuk pulling the plug may in fact jeopardise the project. It had blindsided Adani, and I think there was a mentiuon of a deadline for funding.

Today Griffiths interviewed Jo-Ann Miller, who had worked for a mining company.

She went straight to the Wood Mackenzie study and kept coming back to it. She reckoned that if Adani wanted coal the best and cheapest way was to buy it from existing Australian miners. She says that a number of mines are working under capacity.

BTW she’s taken all the ALP bits off her signage, and says she’s proud ALP but it makes LNPs and Greens comfortable voting for her. It’s her 8th campaign. Didn’t come down in the last shower.

Geoff M, map of proposed rail line:

Bowen is not a big place. It’s all happening, kind of nowhere much. Seems they are going NW to avoid mountains.

Bl**dy h*ll, Brian

We recently enjoyed a family holiday on a small island just off Airlie Beach, just down the road from Bowen.

Magic. Paradise. 🙂

Hadn’t seen the Whitsundays before.

Bl**dy h*ll.

Ambi, Bowen has about 10,400 people and Airlie Beach is about 78km down the road. Haven’t been there myself, unfortunately, but Whitsundays are about as good as it gets from reports. Smashed by Cyclone Debbie, but will recover.

Big danger, apart from the global warming thing is bilge water and high traffic through the reef, as mentioned by Geoff H.

Whitsundays are probably far enough away to not be affected much, but not sure which way the currents go.

Coal ports in Mackay and Gladstone area ship a lot more coal than Adanis ever will.

Thanks Brian,

The map showing the railway route puts it into better perspective.

John Davidson (Re: NOVEMBER 8, 2017 AT 11:21 AM):

Keep in mind if Adani goes ahead, exports from Mackay, Gladstone, Newcastle and Port Kembla are likely to drop. More competition with a shrinking number of global consumers.

GeoffM – possibly some effect on existing suppliers. But the Carmichael coal is not great stuff. Quiggins analysis explains that because of its low energy density and high ash content, it is discounted by about 30% against the higher grade coals. Running low grade coal through furnaces adds other costs to the generation so it may not be attractive even at a lower price.

Welcome Geoff H. I hope you avoided the 4 cm hail and cyclonic winds around Bundaberg. Good point about the quality of the coal, because it is over-spruiked by Adani proponents.

Geoff M, I think John D was saying that traffic through the Reef may not be as big a deal as is being made out. There’s a lot of it now and will be in the future.

Matt Canavan, that lovely man, said Palaszczuk cancelled the NAIF loan because of a ‘domestic with her boyfriend’.

Mark Ludlow in the AFR reports this from Greens candidate Amy MacMahon:

An exploration licence would have been given way back, and Greg Hunt cleared it for the environment in 2014. After that knocking it back would have needed substantial reasons to avoid compensation.

Palaszczuk says Queensland people do not want taxpayers’ money to be given to a billionaire. That’s the long and short of it.

Turns out she’s right. A ReachTEL survey found 70% of people statewide opposed the loan:

Brian,

What will these ships/boats be fueled with in a likely post- ‘peak oil’ world? It’s a question that I find is highly inconvenient to some people. It’s a question I’ve asked Ministers and government department officers, and there’s usually an uncomfortable silence. It was the same reaction at the NSW PAC public hearing re Bylong Coal Project – deathly silence.

I refer to various evidence and ask if they think this is wrong, and to provide credible counter-evidence, and no one is willing to do so. Australian governments won’t even consider the possibility of declining petroleum fuel supplies – clear denial.

Perhaps Palaszczuk has now been properly briefed on the Adani Mine and sees it’s a huge liability for the state?

Brian: Apart from potential compensation issues arising from late blocking of the Adani mine there are serious sovereign risk implications that could act as a disincentive to desirable investments in the future. Sovereign risk is about dramatically changing the rules after companies have spent money on exploration, research etc. that assume that rules are not going change.

My reading of the situation is that, if we ignore the Greenhouse gas issue, Adani probably should not have been blocked for environmental reasons and that the Qld government should have agreed to a 60yr water lease and the various land acquisitions required for the mine and railroad. In a sense the greenhouse gas issue is a furphy since Adani is most unlikely to add to world wide coal production.

In terms of sovereign risk the Qld government is under no obligation to support the use of taxpayer money to set up the mine and has been stating this position for some time. It is also under no obligation to provide royalty breaks, but, having said they will it is a bad look if this is withdrawn, particularly if it can be argued that Adani has gone ahead and done something on the basis of this royalty break.

I do think that the Qld government should block the use of ratepayers money on the Adani airport. This use is a scandal.

If we are concerned about emissions the thing that should be fought is the proposal to build a new coal fired power station anywhere in Aus.

GM: The cost of energy to drive a large coal carrier isn’t going to make a large difference in the competitiveness of Adani. There are plenty of alternative sources of this energy including biofuels, electro fuels, nuclear and coal fired that can’t compete with bunker fuel while it is available.

John, I do very much want to emphasise your statement about sovereign risk. I had thought the same but had not gotten around to saying. You have put the issue very well.

On Mark’s recommendation I listened to most of Michelle Grattan’s podcast about the Qld election. Jackie Trad made a couple of important points.

Firstly, she said that there had been a secret deal between Geoff Seeney, Nicholls and Newman on the one hand and Adani on the other, that the Qld government was going to put up $500 million for the rail line.

The second was that it was long-term policy for Qld Labor that no tax payer assistance be given to any part of the Adani coal mine, and, importantly, at no stage had the Queensland government had to address the issue of the rail line. The request goes to NAIF and then eventually via the feds back to Qld. That hadn’t happened yet. Palaszczuk decided to assert long-term policy, Trad says in the face of multiple sources chattering about dumping on Palaszczuk and her partner.

That is as I understood her.

There is a Brisbane Times article where Curtis Pitt says it was because the people of Queensland did not want to lend money to a billionaire, and Palaszczuk has said much the same, but Trad’s reading of the formalities is interesting, as it means there was no backflip.

Another point of interest on the podcast was that ON leader Steve Dickson said they will in no way support the NAIF loan. They say the rail line should be built by the taxpayers, and they will reap $600 million pa in return.

Dennis Atkins says ON will pick up more than the 11 seats they won in 1998, and Labor alone is no chance. Anne Tiernan from Griffiths Uni says she doesn’t know, too early, and probably always will be too hard to tell.

The LNP are preferencing the Greens last, which should help Trad.

‘Back home after a very enjoyable trip to see family who still think their home town is better than Cairns…

Thanks for the very worthwhile additions and comments about Adani, greatly appreciated because it broadened the somewhat narrow theme of my post.

A little update:

The Queensland government has said it won’t facilitate the NAIF loan if approved by the Federal government. There are different versions of this apparent change of policy. The Premier linked it to a perceived challenge to her integrity because her partner had a role in the assessment of the Adani project. Another view is that the Premier is responding to an increasingly noisy groundswell against the project making it necessary to distance herself (and government) from Adani without losing the coal belt votes (Rockhampton – Gladstone).

It does seem that the NAIF loan could still proceed without the support the Premier withdrew. It is possible that the Queensland government has already given all necessary permissions for the loan to happen. Legal argument continues. Queensland Labor may have taken a cunning position, seemingly distancing itself from the project but not actually stopping it.

Still on finance, news reports claim that the Chinese government is showing interest in developing the rail. They would do this via one of their development arms China Machinery Engineering Corporation (CMEC), that normally at least, carries out the construction phase as well as the finance, engineering etc. The Federal government is apparently supportive of this. Hard to believe…

https://www.ft.com/content/1391f9a0-bf95-11e7-b8a3-38a6e068f464

If true, our Federal government would pass the rail construction to non-Australian workers.

Another view is that Adani may see the threat of Chinese involvement hastening a favourable outcome for their loan application. The Federal government, for it’s part, may also see the political value in not providing the NAIF loan to Adani, yet see the project go ahead anyway.

Geoff H

It seems the rail line might be a goer even without any Adani mine export coal.

Ambigulous – I don’t know. Our Chinese friends are very smart and will see that their chances of being repaid are small. And they will be aware of the complexities of the Adani structure.

My best guess is that this is an attempt by Adani to stretch out the story and maintain his balance sheet. The possible compliance between Modi (a mate of Adani), Turnbull and the Chinese government (wants to see its sphere of influence develop in the Trump era) is not too far fetched.

Ambi, I don’t think there is enough at the other end of the rail line to justify $2 billion expenditure, and there are many better opportunities for spending that kind of money.

Here’s an update I’ve just done to the post. It’s sickening that so many are slavering over so little and for some they effect is negative.

The Australia Institute has done a comprehensive analysis of the impact of employment of the Adani mine and the implications in terms of marginal seats in the election. They based their analysis on the Wood Mackenzie report on the impact on other coal mining activities commissioned by the Port of Newcastle.

The main story is that their are only four electorates where the effect will be positive, all in Townsville. For one electorate the effect is uncertain, four have mixed effects and three negative.

There is a lot of detail in the report. here’s the story of the main cities.

Townsville has only 2500 workers supporting coal mining. There are five seats in town, including the northern tip of Burdekin. Four will gain, but I would think that in a city of around 180,000, the effect will be marginal.

Mackay has 14,400 workers in 1559 businesses. Mackay, a city of 85,000, will lose. Mackay is a safe Labor seat.

Rockhampton and Gladstone together, known as the Fitzroy Region, have 9,000 workers. Gladstone, a city of some 49,000, will lose. For Rockhampton the outlook is mixed, but for a city of some 80,000, it looks negligible at best.

Here is the outlook for fly-in fly-out centres:

Here is the map of the coal basins and state electorates:

John Davidson (Re: NOVEMBER 9, 2017 AT 1:36 PM):

Biofuels:- heavily dependent on petroleum to produce, and have poor EROI. Unless these issues are fixed, don’t count on biofuels as an affordable, large-scale replacement for bunker fuel.

Electro-fuels? – do you mean your post on US navy trial to produce aviation jet fuel out of seawater? I suggest you look at Nick’s comment here. I would ask how much energy is required to produce a litre of fuel, or what is the EROI for this process? If it is less than 5:1 forget it. Less than 10:1 – doubtful alternative.

Nuclear:– uranium is finite. Ships have to be built, but they will take time.

Coal:- ships have to be built, but we should be getting off coal.

I think you are being optimistic.

GM: Suggest you look at my replies to Nicks comments.

I do know that Iceland produces renewable methanol commercially, and that at one stage NZ was converting methanol to gasoline commercially as part of a process that converted natural gas to gasoline.

I tend to favour renewable liquid ammonia as a fuel because you don’t have to scrabble around extracting CO2 from the air or seawater. However, it is not particularly suitable for planes because it has to be stored under similar conditions to LPG and has about half the energy density of AVGAS.

I am a bit like Bilb. I have had enough innovative wins not to give in when someone like you says something cannot be done.

Keep in mind the move to renewables is about saving the planet, not necessarily about being cost competitive with fossil fuels.

“…the move to renewables is about saving the planet, not necessarily about being cost competitive with fossil fuels.”.

Exactly right JD. I have complained before that every time a new solution is mooted the first response is the economic one. And sadly that usually ends the discussion.

I’m still strongly in favour of pumped hydro storage but for some reason it does not seem to get much traction, despite its very considerable advantages.

I noticed the comments about bunker oil. The word “bunker” is a relic from coal and wood bunkers that held those fuels at the shipping ports. It time oil became bunker oil.

There are some 51,500 international ships burning bunker oils. The composition varies, some being mobile at atmospheric temperatures, other so gluggy they need to be heated before pumping. In any event, the lower quality (cheapest) oil is the left-over from oil after it has passed through the cracking process and the lighter volatiles have been extracted. It is not a clean burning fuel.

Citing Google: “…the 15 largest ships in the world emit as much nitrogen oxide and sulphur oxide as the world’s 760 million cars.(Jun 5, 2013)” Another cost of globalisation. Hate to even think it, but since the technology is already in place (e.g. the US Navy) maybe there is a case for nuclear powered shipping.

John D & Geoff Henderson,

I have this impression you are ignoring the EROI issue.

We need to consume energy to acquire usable energy to do work. Low EROI energy resources require more energy diverted to get energy, meaning there is less energy available to do other things. We have been spoilt with high EROI fossil fuels that have enabled a rapid population growth. Unless we find other high EROI (i.e. better than 15:1) energy sources, we cannot sustain our current sophisticated civilisation.

I urge you to see this YouTube video, from about 20 minutes time interval. Hopefully it can explain the issues.

https://www.youtube.com/watch?v=YwdwUStzxww

Geoff M: I do understand EROI, and I’m quite certain JD does as well. It is not a big mystery even after Hall’s rather clumsy explanation.

Speaking for myself, I’m not sure how I gave you the impression that I dd not understand that concept – unless you have surmised that pumped storage (my favourite solution) fails the EROI test.

I think it is already clear that we cannot sustain our present population let alone provide for an increase without changing our living standards. Same goes for energy provision. As you point out, we have taken the low-hanging oil options.

We need to find alternative energy sources, or better use the existing ones. And we need to change our consumptive use patterns. Economics is not the most important driver anymore: it’s about long term survival.

I read that using graphene technology that batteries will not only hold significantly more energy, but that charge time will come down to minutes, perhaps comparable to petrol refilling and the need for internal combustion engines almost totally disappears.

The next part of the equation is how “green” is the recharge power. If that power is renewable, I believe we can go all electric, but we will need storage of some sort, and that is where I see pumped storage as the best fit over time.

GM: I do understand Energy Return On Investment and that sometimes it turns out to be negative. I also understand that proposals for producing renewable energy that involve using fossil energy at some part of the process can do little or even less about emissions.

However, when you think about it fuel price does not have much effect on transport cost and relatively expensive renewable fuels may not be a real problem, particularly if we move away from the current heavy tank car design to something much lighter that depends on accident avoidance for survival. Consider for example:

Average car does about 15,000 km per yr=288 km per week.

Fuel consumption for 5 litres per 100km car=14.4 litres per week.

Weekly cost @ $1.50 per litre fuel=$22 per week.

You could pay a lot more before killing the budget.

Just to get some feel for what might be acheived with ultra light my new e-scooter is claimed to do the equivalent of 6000km per litre of fuel – or to put it another way, energy price would have to go above the equivalent of $450 per litre before my e-scooter energy cost goes above the cost per km of the car example quoted above.

There is plenty of scope for improving car transport without putting everyone on e-scooters.

JD – I would be impressed by 600 km – but 6,000?

GH: Whoops. Forgot to multiply by the 24V battery voltage to get power.

Rerun of the calc gives 100km per kWh that converts to a 300km per litre diesel equivalent compared to 20km per litre for a car that does 5 litres/kWh. Still 15 times the range per litre equivalent compaed to the car but not a near miracle .

Would now be a bad time to ask ” how much fossils did you use today ? ”

Anyone with zero please stand up.

Jumpy:

The quick answer is “big mobs.” In part it was because I didn’t take enough effort to avoid using products that use fossil fuels and materials in their manufacture or use.

In part because the cleaner alternatives are not available at the moment.

Jumpy I guess one could avoid fossils, but even doing so would require the use of some fossil fuel derivative.

More realistic would be a limit on the use of virgin fossil fuels and an emphasis on re-using materials derived from fossil processes/products.

Jumpy I was hoping you could give an account of how your region feels about the Adani project.

John, there are alternatives to petrochemical, I’m guessing we’re all wearing them right now. Used plastic. Ate food from a very long way away. Traveled useing it.

Personally divesting is the first step if someone is serious, otherwise it’s just wanting others to do what you yourself don’t.

Mr A, my gist of the vibe is most want it but there are serious reservations with water and Taxpayer subsidies.

Following the importance of the Adani issue to the Queensland 2017 election, a few updates.

Kristen Lyons, Morgan Brigg & John Quiggin are embarking on a five-part series at New Matilda on:

I suspect this series will reveal uncomfortable evidence of how active the Qld Labor government has been on behalf of Adani.

It promises to be an important offering.

See also Part 2 and Part 3. They’ve hidden them under More – Environment.

Also Phillip Adams interviewed Stephen Long, the investigative reporter who worked on the Four Corners story.

Long investigated how many times Adani had lobbied the Qld government, finding Adani responsible for more lobbying than all other lobbying combined. That does not indicate the success of the lobbying, however.

From the above and elsewhere, I think two points have been clarified. First, I understand that the Queensland government did send the NAIF railway proposal to its destination with a positive recommendation. My son Mark thinks it would have been decided by the mines minister, Curtis Pitt (for the mine) and Jackie Trad (against the mine) with Palaszczuk standing aside.

From the AFR:

With the Chinese government on board, I’d suggest they will.

Secondly, Stephen Long said the 1460 jobs quoted by Adani in court was a net number taking into account the negative effect on other coal mining ventures.

Geoff H has pointed out to me that Quiggin has virtually called the death knell of Adani.

Two Chinese banks have now said they won’t fund it.

However, there is still a potential mine in Galilee with a GVK-Gina Hancock interest, also Clive Palmer’s Waratah Coal, neither of them in robust financial condition. Apparently Aurizon, the privatised Qld rail company, has applied for a loan from NAIF, seeking funding for its own rail line connecting Abbot Point and the Galilee Basin.

So we still need to be alert and somewhat alarmed. The Chinese are planning to build coal-fired power stations in other countries around India.

From the SMH – Chinese money will not fund ‘dirty’ Adani mine, says embassy:

Bob Carr says he lobbied the relevant officials in China.

This, however, does not settle the Aurizon rail proposal.

Two more items of interest today.

First, Bob Carr, former NSW premier and more recently Minister for Foreign Affairs under Gillard, claims involvement in the refusal of funding to Adani by Chinese banks. That from the SMH today (6/12). It is the first I have heard that Carr was involved at all, but if he has been helpful that is good.

The second item is the story about Adani being sued for making false and misleading claims about the number of jobs Carmichael would create. Environmental Justice acting for an aggrieved Adani applicant has referred Adani to the ACCC over the claims. The story can be found here:

http://www.abc.net.au/news/2017-12-06/adani-jobs-accc-legal-case-chris-mccoomb/9226560

The overstatement of jobs has been known for over two years now but was not widely acknowledged at the political level. Just prior to the Queensland election Labor realised that Adani had unraveled as political capital, distancing Labor from the project. The ACCC action will do much to dispel the remaining belief that Adani jobs would be available in great numbers for the region.