First up there are all kinds of figures going around. The big one – $9 billion dollars – is over 10 years. So the annual figure of less than a billion is a mere rounding error in a Commonwealth budget of around half a trillion. Nevertheless all dollars are accounted for, so Annastacia Palaszczuk is right to ask where the money is coming from.

First up there are all kinds of figures going around. The big one – $9 billion dollars – is over 10 years. So the annual figure of less than a billion is a mere rounding error in a Commonwealth budget of around half a trillion. Nevertheless all dollars are accounted for, so Annastacia Palaszczuk is right to ask where the money is coming from.

As to GST and the states, according to this article by John Freebairn, state and territory governments get about half their funds from the Commonwealth government. Half of the Commonwealth funding is in the form of special purpose grants, such as education, health, housing and infrastructure. The other half is the GST, which states are free to spend as they desire.

However, the purpose of the GST is to allow citizens, wherever they live, to receive similar levels of state government services. So some states get more back than the GST collected in their domain, some get less. The Northern Territory, I heard, gets back more than four times what is collected there. Western Australia has received as little as 30%. That is because their access to mining royalties boosts their state revenue stream far ahead of the rest in per capita terms.

It’s a fact that Western Australia comprises about a third of Australia’s land mass, but has only around 10% of its population.

At present Freebairn says that NSW, Victoria and Western Australia are net contributors. South Australia, Tasmania and the Northern Territory are net recipients. He does not mention Queensland. I don’t think that is an oversight, they probably get back what they contribute.

Three issues are behind the current changes.

First, the Commonwealth Grants Commission in deciding state capacity looks at their average revenue over the previous three years. WA has been caught short by a dip in mining revenues, which is not immediately fully reflected in the formula.

Secondly, there is a danger that Western Australians would be sufficiently aggrieved to vote against a party that did not give them a better deal. So there is politics to think about.

Thirdly, a notion has crept in that it is unfair for the fortunate not to profit at least to some extent from their fortune. So they look for ‘reforms’ to allow the better off to keep their wealth.

If you go back to Saul Eslake in May last year, he said we were world champions at ‘equalising’ across a federation. So in an article WA’s economic mismanagement is not a reason to review how the GST is carved up he says:

- Australia has long gone much further than other federations in seeking to “equalise” the way state and territory governments provide public services to their citizens. That’s one of the principal reasons why the disparity in living standards between Tasmania (Australia’s poorest state) and WA (our richest), is a lot less than that between, say, Mississippi and Massachusetts in the United States or even Mecklenburg-Vorpommern and Bavaria in Germany.

This seems to be offensive to Chris Richardson from Deloitte Access Economics. If you look at this video, he says that rich states supporting small states is dumb because it is not smart. He also says that an unequal Australia is a stronger Australia, so ultimately a fairer Australia.

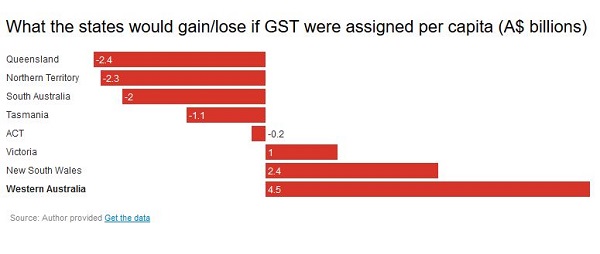

Saul Eslake did the sums of what would happen if you threw all the GST gathered into a big pile and then doled it out to states on a per capita basis:

The graph shows how many billions would be lost or gained by each state against what happens now.

Eslake points out that WA worker productivity averaged almost 50% above that of Australia as a whole, a margin without precedent in Australia’s history. Not because they work harder or are more clever. Those big machines and ore trains do the work.

In fact, Eslake says the WA (Liberal) government has been profligate and has mismanaged the state’s finances. He concludes:

- There is room, to be sure, to make the Grants Commission’s procedures less complex and more transparent. But the principle which has underpinned the Grants Commission’s recommendations for more than 80 years has served Australia well, and shouldn’t be tossed aside merely to salve the self-inflicted wounds of Australia’s richest state.

An inquiry five years earlier chaired by Nick Greiner had found the system OK and the criticisms over-stated. However, Scott Morrison simply declared the present system broken and set up a Productivity Commission inquiry to find a fix.

There is detail in Michelle Grattan’s article, but the simple version is that the Government did not like the Productivity Commission’s suggestions, so they varied them to come up with a magic pudding to satisfy everyone, while outlaying less money than the PC recommended. The PC version would have cost the Feds $3-4 billion each year.

All states and territories are to get “at least the equal of NSW or Victoria, whichever is higher”. That would form the benchmark.

Transition arrangements would be instituted so that a:

- “floor” would also be set, below which no state could fall. From 2022-23, this would be 70 cents per person per dollar of the GST, rising to 75 cents from 2024-25.

The Commonwealth Government would chuck in extra funds, so that “no state will be worse off and indeed every state will be better off”.

Dennis Atkins in the Courier Mail, who has access to calculations by KPMG, says that WA will get just under 70% of the $9 billion, Tasmania, SA and the Territories get 11%, leaving the three most populous states to pick up the scraps.

Apparently the Productivity Commission was keen to use the scheme to incentivise ‘reforms’, which, according to PriceWaterhouse via Dennis Atkins, include:

- “asset privatisation, private-public partnerships, trading hours liberalisation and stamp duty reforms, to ensure these (smaller) states are as productive as possible.”

Under the scheme the government has chosen, these incentives are not included.

Chris Richardson regrets that the toxic nature of our politics makes these reforms impossible, so he reckons the “smaller bribe, smaller reform” route is the best on offer.

Grattan says the Commonwealth would like the states to agree, but since it’s all theirs to dispose, they don’t actually need agreement.

So they all lived happily ever after. I’ve not seen what Saul Eslake thinks now.

Getting 70% of a relatively small amount sounds like a reasonable political compromise. … the Westerners can crow about the huge 70% and everyone else can quietly note the accuracy of your arithmetic.

🙂

The argument for equalising seems strong in a Federation that strives for unity of purpose. We do strive for that, don’t we?

The “fair go” isn’t a huge lie, is it??

Ambi, Stephen Bell and Michael Keating were talking today about their book Fair Share: Competing Claims and Australia’s Economic Future with Amanda Vanstone.

I think they are saying that in most advanced economies since about 1980 everyone except the top quarter has been dudded. Not as much here as elsewhere, but we are catching the disease.

We need more money spent on education, health the dole etc and need to bump up revenue by about 3% of GDP.

They reckon that when the GST was introduced the compensation paid by government to make it palatable was greater than the revenue gain.

A per capita division might make more sense if things like mining royalties were added to the GST pile.

On the other hand Qld has to support all the golden oldies who migrate to Qld when they cease being productive workers and……..arrgh! To make matters worse it is Qld that people from Northern NSW go to for serious hospital service etc.

Me, I think it is ridiculous for the capital of qld being closer to Launceston .

My plan dejeur is to locate state boundaries on lines that are halfway between the closest capital cities. Definitely cut NSW down to size if the cockroaches aren’t smart enough to change their capital city.

Good idea, John.

Not sure what medical facilities are like in Hobart, but I suspect you need an Adelaide-sized population to make some of the more expert and expensive services available.

That would put the kybosh on bits of Qld wanting to go it alone.

John

Essentially they are.

Here are the 12-13 numbers. The bottom table puts it best.

Essentially the Fed wants all the revenue to redistribute, holding back the best performing States to prop up the worst, financially.

I wouldn’t be too concerned about boundaries or State Capitals, there both as irrelevant here nowadays as borders and National Capitals are in the EU or were in the USSR.

I don’t know how the GST carve up gets around Section 99 of our Constitution.

Not to mention Regional and local grant pork barreling.

Tasmania, pop 515m, is about half the size of Adelaide. That seems big enough to support a reasonable hospital. Travel distances to a Hobart hospital for Tasmanians are a lot lot shorter than the trip to a reasonable sized hospital for most parts of Aus.

I had my appendix out at the Newman hospital (population about 6000.) Groote Eyandt had 2 hospitals. (Population 2500)

I think Qld should be split into at least 2 so that Queenslanders who live further away from Bribane than Launceston might feel that they have more influence. Keep in mind that one of the big problems at the moment is that it is very hard to decentralize because a capital city acts as a job magnet. We need more capital cities to drive decentralization.

Yeah.

I think Rocky use to be the center of all the diocese back in the day but Townsville seem to have the commercial capital tag now.

Pity both are shitholes compared to Mackay. 🙂

Jump: Mackay a logical location for capital, 800km to B’bane, 1352 to to Bamaga

I think if you are going to split Qld up you should go the whole way and go for two levels of government, with the states to go.

Hospitals could be run as a national system. John, I have rellies that use the hospitals in Toowoomba and Rockhampton. Most services are available there, but not all, whereas the services available in Brisbane a pretty much world class. Too expensive to replicate in the smaller cities.

Not sure what is available in Townsville.

Brian: I agree we would be better off getting rid of the states and replacing states and local government with Brisbane city council size local/regional councils.

Some services such as hospitals should become a federal responsibility,

John D,:

Welcome aboard.

Why the blue blazes are we still stuck with what bureaucrats in London’s jolly old Colonial Office drew up? Those pipe-dreams made very little geographic or economic sense at the time – and they make even less sense at all now. Mind you, the back-of-an-envelope forced amalgamations of local government entities during the Beattie Era in Queensland made little sense either but at least it was step in the right direction.

If we did get rid of the States (formerly Colonies) and replaced them with Cities and city-equivalent Provinces, all of us would be much better off.

I doubt it.

The State borders have been made irrelevant in anything other than nostalgic tribalism.

The electoral boundaries that have been made to determine who gets what are changing constantly.

The council jurisdiction boundaries are unrelated to State representative boundaries and different again are Federal representative boundaries.

We’ve got that many representatives fighting the good fight on our behalf but they cancel each other out.

Me, I’ve got a Lib Mayor, a Lab State Rep and a Nat M.P.

None of which know what’s best for me, pretend they do and couldn’t care less.

How about having the most prized boundary around individual sovereignty?

Jump, are you going to do your own brain surgery if you need it?

Or will you form yourself with others into a common market, so you can access the necessary services and have a common currency to pay for it.

If you keep extending that in a rational manner you’ll maybe end up reinventing the state.

Jump:

I do share some (but not all) of your frustration. The way electorates were set up was supposed to ensure that everyone’s vote had equal value, that gerrymanders were prevented, that rotten boroughs could never happen here. What a joke. We, in 2018, mightn’t have gerrymanders and rotten boroughs as such; we have worse then either.

We can’t get fair and effective representation until we have electorates that make social and geographical sense as well as having stable, tamper-proof boundaries – and that can’t happen until we allow up to thirty or so percent difference in population from one electorate to another. The Homes-For-Homeless-Homing-Pigeons-Alliance will scream like banshees at the suggestion, of course, (on orders from their financial backers and beneficiaries of the status quo, of course) – but how else can we elect a government that actually works for us for a change and is responsible to us?

Brian:

I’m too busy to do my own brain surgery so I’ll give up a few of my many liberties so that someone with a bit more time – and maybe skill too – can do the job.

GB: If you want a better electoral system you might like to look at my proposal for 3 member electorates.

KEY FEATURES OF THE PROPOSED SYSTEM

1. All electorates will have three members.

2. The party (or registered coalition) that wins the 2PP vote becomes the government. (No matter where boundaries are located – Boundaries could be arranged to give geographically sensible electorates.)

3. All electorates will have one government MP and two non-government MP’s.

4. MP’s will not all have the same number of votes in parliament.

5. The parliament will not be able to prevent the government getting the money it needs to do its job.

6. The government would be able to put blocked legislation to a referendum (or some other mechanism for consulting the people.)

An early election in response to a successful no confidence vote can only be called if the governor is convinced that this action is justified.