- One energy company executive, who asked not to be named, said the industry was beside itself.

“One of the most concerning developments in politics is that the quality of an argument no longer matters,” he said.

He went on to say that they all knew we needed to head for zero emissions. They just wanted to know what the rules would be on the way.

That was from the AFR article Labor backs the NEG as political mess sends power prices up. The print edition carried it as a front page headline story:

Political power price hit

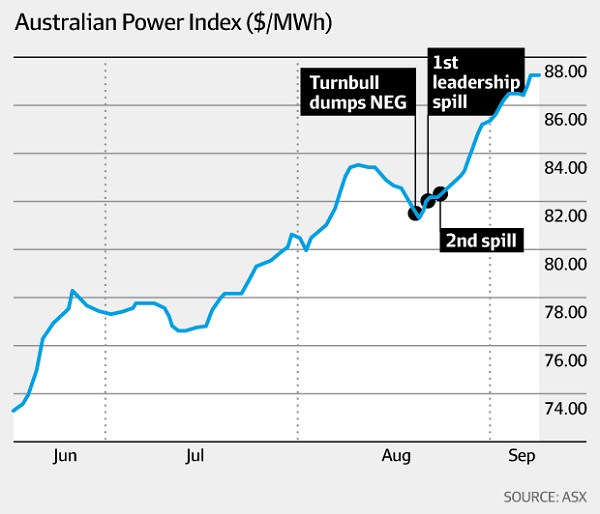

Here’s what has happened on prices:

Opposition energy spokesman Mark Butler pointed to the Energy Security Board modelling which showed an annual saving of around $150 a year for the NEG which would be due largely to investor certainty. That is quite apart from the cost of energy production and I think can be attributed to sentiment and cheaper money because of reduced risk.

The modelling also showed that having no policy would add another $300 to bills over a decade.

The article goes on to say:

“I can’t see how the death of the NEG will have helped suppress future prices. Future contracts represent the market’s consensus view of where electricity prices are headed,” Energy industry expert Paul McArdle, who is the chief executive of energy software company Global-Roam, said.

Future prices in most states started heading north from mid-August in most of the 36 contracts as investors saw the Coalition’s signature NEG slowly being dismantled, according to Global-Roam.

Future prices for 2019 have jumped to $86.77 per megawatt hour in NSW, $92.93/MWh in Victoria, $72.42/MWh in Queensland and $96.71/MWh in South Australia, according to ASX Energy.

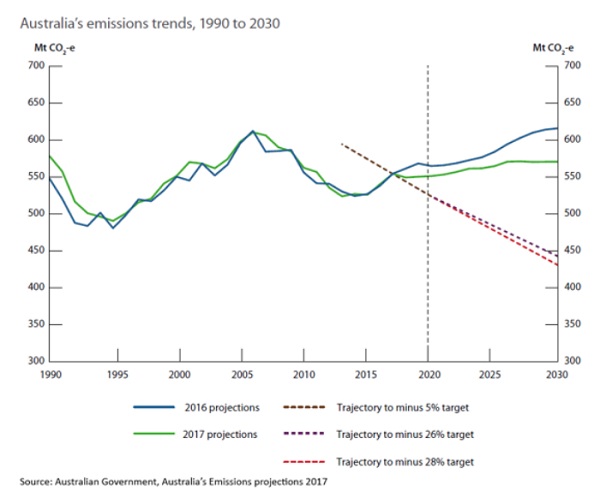

PM Scott Morrison has separated responsibility for energy and climate. Senior cabinet members simply assert that we will meet our Paris commitments of a 26% reduction in emissions “in a canter” (it was actually 26-28% across the board), from the cherry-picked starting point of 2005, as against the more usual starting point of 1990 used by serious countries. For a good example of how they handle this question, see Stephen Long’s There’s a certain Trump-like quality to Australia’s discourse on emissions reductions:

-

The PM reckons we’ll meet the targets “in a canter”.

“We’re on track to achieve them,” the new Environment Minister, ex-mining industry lawyer and mining executive Melissa Price, also reassured radio listeners, adding that she supports the construction of new coal-fired power stations.

Foreign Minister Marise Payne — back from meeting Pacific Islands leaders whose nations literally face an existential threat from climate change — joined the chorus, as did Energy Minister Angus Taylor.

Australia is on track to “meet and exceed” the Paris commitments, according to Trade Minister Simon Birmingham.

“We are already more than meeting the 26 per cent that was set down in the Paris agreement,” National Party leader Michael McCormack confidently told David Spears on Sky News, though when pressed, he was a bit unsure about what information that claim was based on.

“Well it’s er, based on, er, the figures that er, the data that is, er, produced by those people who measure emissions, as far as I’m aware,” he said.

Unfortunately:

-

these reassurances are at completely at odds with the Government’s own official advice.

Australia’s commitment to the global community is to cut greenhouse gas emissions by 26 to 28 per cent below 2005 levels by 2030.

Just before Christmas last year, the Australian Government published a report which suggests that — without significant policy change — Australia will miss that commitment by a long way.

Emissions in 2020 will be just 5 per cent below 2005 levels, according to the official projections and — without further measures to cut them — emissions will grow by 3.5 per cent on 2020 levels in the 10 years to 2030.

In other words, we’ll go backwards in the coming decade.

As seen on this graph, when reality is inconvenient you just draw a dotted line to where you want people to think you are going:

In truth climate minister Melissa Price has been tasked with coming up with the necessary plans, but it looks like mission impossible with the energy sector policies in shambles.

Problem is, we don’t just have inaction, we have an erratic government that seems capable of just about anything. The AFR article says:

-

The Australian Competition and Consumer Commission’s 56 recommendations on the electricity market were predicted to bring electricity prices down by an average of $409 by 2020-21, but the Coalition cherry-picked a handful of market interventions, including setting a default contract price and the federal government helping underwrite new generation, rather than all, the recommendations.

There is much hand waving and threats of using a “big stick”, meaning breaking up companies and compulsory divestment. Tony Wood from Grattan:

“People will still invest in things, but there are big questions about whether the government is going to start bashing up AGL again about keeping Liddell open, will the new government stick with the ex-prime minister’s nation building project Snowy 2.0. There are so many moving parts and we don’t know what’s going to happen.”

We have full-scale sovereign risk.

Killing the NEG has set Labor free. It had been inclined to support the NEG for the sake of achieving bipartisanship. Now Mark Butler says:

- Labor was talking to stakeholders “about a policy that will pull through the investment we need to renew a system that is getting old and increasingly unreliable, will cut pollution, drive jobs, and particularly put downward pressure on power prices once and for all”.

He all but ruled out carbon price schemes such as an emissions intensity scheme because they “require a level of bipartisanship”.

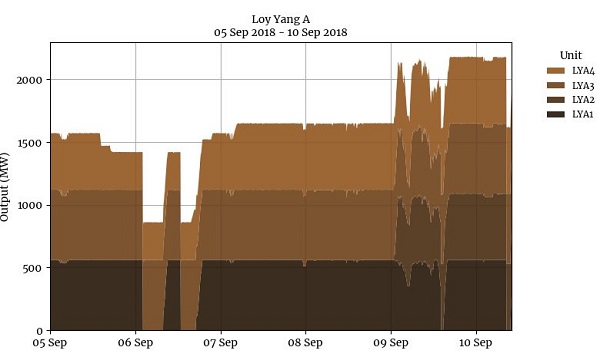

Meanwhile Giles Parkinson points out in his piece in the price hikes that the large coal burner Loy Yang A has just tripped four times in five days:

Old coal is neither dispatchable nor reliable.

This week’s Essential Report (whole report here) shows that voters want action on reducing carbon emissions to the tune of 69-23. Even Lib/Nat voters favour action 62/32.

Meanwhile Morrison has pulled a number from somewhere (there is a rude explanation for this which seems the most likely) by claiming that:

-

“Labor will legislate a 45 per cent emissions reduction target that will push power prices up by $1400 a year.”

I searched and all I could find was this – Coalition’s national energy guarantee predicted to drive up power prices:

-

New modelling forecasts Labor’s 45% target will force down Australian prices but government’s 26% will not.

On Friday 20 July Reputex modelling showed;

-

Over the life of the Turnbull government’s scheme, wholesale electricity prices are forecast to fall initially, reflecting the entry of already committed renewable capacity, then rise above $70 per MWh after the Liddell coal plant in New South Wales closes, then climb to $80 per MWh after the expected retirement of Yallourn in Victoria 2028.

But RepuTex says if the emissions reduction target was higher, at 45%, the policy would impose a constraint on emissions from coal-fired generators, and drive more new investment in large-scale renewables, adding more than 22GW of solar and wind capacity.

“Similar to the price decline under the 26% scenario prior to 2020, the competitive pressure from higher solar and wind energy is modelled to push wholesale prices lower, eventually resulting in the closure of excess coal capacity,” the analysis says.

The modelling assumes the AGL-owned Liddell plant closes in 2022, with other coal plants retiring closer to 2030. It then assumes renewables will displace some dispatch of gas generation during the day, which increases the opportunity for energy storage of excess renewable energy.

“As a result wholesale electricity prices oscillate around $60 per MWh through to 2030, rather than rise above $80 per MWh as seen under the low investment scenario under a 26% Neg,” the analysis says.

Stephen Long is right, there is a Trump-like character to this government.

In yesterday’s AFR is an article by Mark Ludlow headlined Clive Palmer says he is serious about building new coal-fired power station in Galilee Basin. The article includes:

The Conversation June 27 article headlined New coal doesn’t stack up – just look at Queensland’s renewable energy numbers by Matthew Stocks and Professor Andrew Blakers, includes:

And the South Australian concentrated solar thermal (CST) 150MW with 8 hours storage Aurora project is capped at $78/MWh. But that’s a one-off generator unit – larger (say 200 – 220 MW capacity per generator units) with more energy storage (say 16 to 17 hours energy storage each at max power output) to increase capacity factor (to say 65 to 70%) and multiple concurrent-built (say five) generator units, delivering electricity over a 20-year supply contract period, would likely be significantly cheaper. The question is: Could this strategy push CST (dispatchable solar) energy supply costs below $70/MWh or lower (even low $60s/MWh)?

The interesting thing to see is whether Queensland electorate constituents will be duped by Clive’s promises for a coal-fired power station. I suspect wily Clive has his eye on the Commonwealth Northern Australia Investment Facility (NAIF) to fund it at tax-payers’ expense. Will the Queensland Government veto NAIF funding? We’ll see.

Today’s SMH article headlined More Australians fear climate change as Morrison government dumps emissions legislation, by Nicole Hasham, begins with:

The article refers to new research by The Australia Institute published today.

Yes, TAI have taken over Climate of the Nation from the Climate Institute, which went defunct last year.

I’ve promised myself to do three posts I’ve been wanting to do for some time, then I might get back to looking at it.

On September 3, BZE Community Radio Show produced a podcast titled Rise Up For Climate, link here. It includes interviews with:

Ian Dunlop, Member of the Club of Rome, from time interval 02:24 through to 20:04;

Louise Fraser, Member of 350.org, from time interval 20:23 through to 26:15;

Sarah & Tim, Members of Frontline Action on Coal, from 26:15 through to 34:15; and

Giles Parkinson, Editor of RenewEconomy, from time interval 34:45 through to 53:10.

Ian Dunlop says (from time interval 14:31, bold text my emphasis):

From BP Statistical Review of World Energy – 67th Edition, published June 13:

On page 28: Production of natural gas in year-2017 in descending rank order: #1, USA (20.0% global share, 734.5 Gm3); #2, Russian Federation (17.3%, 635.6 Gm3); #3, Iran (6.1%, 223.9 Gm3); #4, Canada (4.8%, 176.3 Gm3); #5, Qatar (4.8%, 175.7 Gm3); #6, China (4.1%, 149.2 Gm3); #7, Norway (3.3%, 123.2 Gm3); #8, Australia (3.1%, 113.5 Gm3)

On page 38: Production of coal in year-2017 in descending rank order: #1, China (46.4% global share, 1747 Mtoe); #2, USA (9.9%, 371.3 Mtoe); #3, Australia (7.9%, 297.4 Mtoe); #4, India (7.8%, 294.2 Mtoe); #5, Indonesia (7.2%, 271.6 Mtoe); #6, Russian Federation (5.5%, 206.3 Mtoe); #7, South Africa (3.8%, 143.0 Mtoe); #8, Colombia (1.6%, 61.4 Mtoe)

On page 11: Global coal consumption in 2017 fell to 27.6% primary energy share, and natural gas accounted for 23.4% of global primary energy consumption. Renewable energy hit a new high of 3.6%.

Giles Parkinson laments the lack of knowledge most journalists display when reporting on energy technologies, and suggests most of them allow mistruths/lies to remain unchallenged.

I recommend you listen to interviews with Ian Dunlop and Giles Parkinson in full.

Late yesterday in the SMH is an article headlined Industry calls for NEG resurrection to end ‘cycle of hope and despair’ by Nichole Hasham. It includes:

I can’t see why Labor is spending effort on resurrecting the NEG. It certainly needs to be extensively reworked to encourage more renewables into the NEM.

As Professor Andrew Blakers testified under oath earlier this year (on page 53, bold text my emphasis):

Climate and energy policies are inextricably linked.

Yesterday, posted at crudeoilpeak.info is an article headlined What happened to crude oil production after the first peak in 2005? by Matt.

Fig 13: Cumulative crude production changes since 2005 shows only Iraq and the US provide for global growth in oil production.

Matt’s conclusion:

The sooner Australia transitions away from petroleum oil dependency the better.

Today in the SMH is an article by Cole Latimer headlined High petrol prices fuelling interest in electric cars. The article includes:

And yet on Monday (Sep 24) ScoMo turned the first sod at the Western Sydney Airport site. ScoMo is reported to have said:

I can’t see how the Western Sydney Airport project can accelerate job creation in its operational phase if “the world is headed for a potential oil shortage with prices to rise above $US100 a barrel.“

Also in today’s SMH is another article by Cole Latimer headlined AGL says it remains committed to closing Liddell power plant in 2022. The article included:

Giles Parkinson at RenewEconomy also has his post on the same subject headlined AGL promises no change in strategic direction, coal closures not “ideological”.

The Renew Economy article referred to by GM went on to say:

While I have been a long time advocate of moving to to contracts with a large available capacity component (rather than simply paying for power supplied, for coal fired power in particular we need to to recognize that there are different levels of “availability” depending on how long it would take to get the generator up to full capacity.

We also need to recognize that, in the case of generation systems that require fuels, there will often be problems setting up fuel supply contracts for unpredictable demand or demand that only occurs over a small part of the year. Keep in mind here that coal stockpiles will deteriorate over time and may catch fire.

For new capacity, the capacity contract should be long enough to justify the investment.

For existing capacity the capacity contract should be long enough to justify major maintenance but not much longer. (The contracts should not be about guaranteeing that a generator will still be needed in 20 yrs time.)

John, I’ll just mention once again the potential of demand response, which, from memory, has been used in Queensland since 2006.

Not only commercial and industrial users, both Energex and Ergon have Peaksmart available to turn down home aircon.

I imagine the whole demand response thing works better if you have state-owned distributors which carry out the retail function.

Brian: Agree that demand management has a lot of scope for reducing peak demand or as a response for power system failures. Most manufacturers and miners cannot sell everything they could produce if they ran 24/7. In some cases they would need a warning to allow controlled shutdowns or have to limit power off times to prevent potline freezing or other problems. Even then it may be practical to run a potline on reduced power without causing problems.

Think your way through your house. Most of the power consumed in a house doesn’t have to be on demand. Lots of stuff can be shut down for at least some time most of the time and things like clothes dryers could have starts delayed. Much the same could be said about other public and business consumption.

Brian (Re: SEPTEMBER 27, 2018 AT 9:55 AM):

The aircon must be a DRED (Demand Response Enabled Device). See here for the Department of Climate Change and Energy Efficiency – Appliance Energy Efficiency Branch Submission for the Australian Energy Market Commission in response to the Issues Paper: Power of choice – giving consumers options in the way they use electricity, dated August 2011.

Brands including Daikin, Fujitsu, Mitsubishi Electric and LG, have in recent years offered DRED capability on at least some of their aircon models, usually as an add-on option.

That’s a good idea, Geoff.

Suppose retailers offered bonus (higher) feed-in tariffs during peak load periods on domestic (or commetcial) solar pv? Every little bit can help.

Suggested marketing slogan:

Shed loads of Load Shedding!!

Ambigulous (Re: SEPTEMBER 28, 2018 AT 11:30 AM):

Provided your meter is “smart” AND configured to read solar-PV exports at discrete (i.e. 30 minute) time intervals, AND your energy retailer offers that option.

Victoria introduced mandatory “smart” meters a few years ago. NSW is a much slower to implement “smart” meters – it’s still only voluntary.

My electricity network import and solar-PV export meters are “basic” and measure only accumulated energy in kWh – i.e. flat rate – so they cannot measure time of day import or export.

Yes, we’re as smart as paint over here in Victoria. There was a bit of householder resistance,

averaging 700 ohms, 🙂

to the new “smart meters”. Seems to have vanished now.

Mr A

I’m not sure solar PV is working too well during peak load periods.

Do you have any graphs time of day load demand in Victoria that you see as accurate and credible ?

Both summer and winter would be great.

Mr J

Do you have any graphs time of day load demand in Victoria that you see as accurate and credible ? If you did it would support your hypothesis.

Zoot: The growth of solar has moved the daily all except solar peak demand from about midday to late afternoon early evening. A logical slot for solar towers, batteries or pumped hydro.

There is certainly a case for organizing tariffs so that someone with spare energy storage can buy cheap solar during the middle of the day and either do some of the things that they used to do outside the old midday peak demand during the peak solar supply time and/or use energy storage to gobble up this cheap power for later usage or selling back to the system when solar power production has dropped off

Yes, John.

In the Guardian online, a report that Australia’s quarterly emissions data were released without fanfare on Friday afternoon.

An estimated 1.3% overall rise in the year to the March quarter.

A drop in emissions from electricity generation.

A claim that agriculture continues to provide reduced emissions.

Bill Hare says we are not on track to meet our Paris commitments.

***

How can that be? Minister Freydenberg and PM Turnbull and PM Morrison have been assuring the public that we will meet them in a canter. No problems. She’ll be apples, mate. Not a worry.

Is someone being more economical with the truth than the nation is being with emissions output??

Not economical with the truth, Ambi, rather living in an alternative reality where what you say comes to be without doing anything at all.

Problem is some day they will wake up in fright.

Jumpy (Re: SEPTEMBER 28, 2018 AT 4:21 PM):

See RenewEconomy article headlined Solar takes centre stage in South Australia, becoming No 1 energy source in middle of day, dated Sep 18. The article includes:

Solar-PV needs energy storage to support high demand in the early morning, late afternoon and early evening.

Adequate concentrated solar thermal (CST) with storage generator capacity can bridge that deficiency. Per SolarReserve’s Submission (#246):

But solar-PV Levelised Cost of Energy (LCOE) is of the order of AU$30-50/MWh, and wind LCOE is of the order of about AU$50-55/MWh, then add costs for storage (i.e. pumped-hydro and some battery storage) and interconnectors (up to AU$25/MWh, per Professor Blakers). There’s currently much more installed solar-PV and wind capacity (compared with CST).

South Australia’s project Aurora CST is capped at AU$78/MWh. There’s much less installed CST capacity – it’s still regarded by some as an emerging technology – but hopefully that attitude will change with Aurora (and other large-scale CST projects in other parts of the world) becoming operational and demonstrating their capability. I think there’s scope to reduce CST LCOE significantly further, but that requires “fair dinkum” competitive tender processes.

More energy storage (and stronger interconnectors) are required to make renewables reliable and resilient above about 50% supply contribution. (Per Professor Blakers)

Solar-PV and wind can complement CST.

Brian (Re: SEPTEMBER 29, 2018 AT 10:04 AM):

The problem with that is “some day” may be too late.

Ian Dunlop spoke of the influence of vested interests at the Australian Senate Foreign Affairs, Defence and Trade References Committee inquiry into the Implications of climate change for Australia’s national security at the public hearing on 8 Dec 2017.

On page 52 of the hearing transcript, Ian Dunlop says (bold text my emphasis):

Ambigulous (Re: SEPTEMBER 29, 2018 AT 6:55 AM):

Similarly, in the SMH online yesterday afternoon is an article by Peter Hannam headlined ‘Terrible’: Rising gas output lifts Australia’s greenhouse gas emissions, and begins with:

I think it’s not surprising, given Ian Dunlop’s comments here, and reiterated:

Also in the SMH today is an article by Cole Latimer headlined ‘Don’t fill up, top up’: Cheap petrol is over but not everyone is hurting. It includes:

I refer back to my comments here and here, and reiterate:

GM:

The average car goes about 15.000km p.a which would require 750 litres of fuel for a small car consuming 5 litres/100km. At $1.74/litre the weekly cost works out at $25/week including recreational car driving. The financial case for using public transport instead of an already owned car is weak.

So, if “already owned”, it’s fair to exclude the registration fee and insurance premium from the calculation?

To attend a big sporting or musical event in a capital city, public transport might be preferred. No parking fees or road congestion to deal with….

Extra trains/trams laid on.

The AFL and Victorian govt push public transport very hard for the football Finals, Melbourne Show, Aust Tennis Open, etc.

Eventually we all come to Love Big Nanny.

(apologies to the artist formerly known as Eric Blair)

Ambi:

Fixed costs such as registration should only be included if the alternative being considered is selling the car and depending on public and active transport.

Cost comparisons should only include the things that will change.

Yes John,

And my example of travel to big events represents only a tiny fraction of annual metropolitan kms travelled.

GM re Peaksmart:

Outside SEQ in Qld Ergon is the retailer as well as the distributor.

In SEQ the distributor Energex does the metre-reading for the retailers. Not sure how the money works.

John Davidson (Re: SEPTEMBER 29, 2018 AT 12:18 PM):

Are you sure about that, John? You may have a road vehicle (that you may own outright) that is relatively new that has a very good fuel efficiency with you driving it in a frugal/efficient manner, but I think you are assuming everyone else is doing the same thing – my point is: don’t count on it without doing the analysis using credible data – don’t assume.

Per ABS statistics, the average age of Australian cars is 10.1 years, unchanged since 2015. What was the average fuel efficiency of cars 10 years ago and older? Are these older cars being maintained adequately to ensure they are continuing to achieve their near new fuel efficiency, or are they worsening with age? And what terrain are these vehicles being driven over (i.e. hilly or flat?) and how are they driven (i.e. efficiently/sedately or like a race car)?

John, is your fuel bill circa $25/week per vehicle, lower or higher? Do you align with your own assumptions and calculations? You may, but don’t assume everyone else does.

Where I live I see many SUVs and light trucks (i.e dual cab utes) that are not so fuel efficient, so I doubt the weekly fuel bill would be as low as $25/week unless the vehicles are travelling very little distance, I think unlikely for this area.

I think it depends on where you live, and how adequate public transport is to provide alternative, viable options. In rural and regional areas there are very few or no public transport options, but in large cities, you may find a different story.

Owning and operating a car isn’t just about fuel costs. Other consumables include tyres, oil filters, engine oil, brake pads, etc. Tyres and lubricants generally have at least some raw materials derived from petroleum – these consumables aren’t getting any cheaper either.

Brian (Re: SEPTEMBER 30, 2018 AT 10:41 PM):

PeakSmart:

4kW to less than 10kW cooling capacity provides a reward of $200.

10kW or more cooling capacity provides a reward of $400.

If you have an aircon with less than 4kW cooling capacity then you presumably get no reward for your effort.

The signal receiver in ‘PeakSmart’ enabled aircon units (I suspect) uses a Ripple Current Device (RCD) receiver – the same technology that enables off-peak hot water systems to operate. RCD switching can operate with or without “smart” meters. “Smart” meter units usually have available at least one metered circuit with RCD switching built-in for off-peak water heater system network control.

Availability of “smart” meters are a separate issue from the “PeakSmart” programme. I think/suspect you don’t need to have a “smart” meter to take advantage of the “PeakSmart” programme in Queensland.

I note that per the Ergon website:

So, it seems to me it will take a considerable amount of time for Queensland (and NSW) to transition from “basic” metering to “smart” metering.

Geoff M, I think the main idea with the digital meters is that they can be read remotely, so no-one need physically read the meter box. The added advantage is that the grid peple can turn down your appliances such as aircon, which would also need to be smart.

Yes,

Our smart meter is certainly read remotely, Brian.

– from the Victorian era.

Brian (Re: OCTOBER 3, 2018 AT 12:21 PM):

That’s the idea, but as the replacements of “basic” meters with “smart” meters in Queensland is not mandatory unless there’s a requirement to replace existing faulty or add a new unit (because perhaps you are adding solar-PV or adding additional phase) then I don’t see the transition from “basic” to “smart” as being rapid. Victoria had a mandatory replacement of “basic” with “smart” meters. And in NSW it’s voluntary.

“Smart” meters will do away with jobs – the meter readers.

You don’t need a “smart” meter to control aircon – it’s the “smarts” (or RCD receiver) in the aircon that’s needed. That was my point in the last comment: