Some of each, I think.

In one sense the MYEFO (Mid-year Economic and Fiscal outlook) statement was not so bad. The bottom line is $10 billion worse and the budget will reach a surplus a year later, in 2019 instead of 2018. Ross Gittens gives Hockey a tick for not panicking.

Yet the MYEFO assumes that the Senate will co-operate in the new year and pass all those lovely cuts to higher education and welfare benefits along with other measures like the GP visits co-payment scheme.

Laura Tingle finds little to show that the Government has a clue on what to do about the collapse in revenue from the terms of trade and long-term fiscal consolidation. It’s blindingly obvious that we need to pay more tax, but the Government has taken the soft option of soaking the unseen poor by taking $3.7 billion from foreign aid.

Ben Eltham in an excellent budget review finds the Coalition’s economic policy “hopelessly confused”.

Last week Ian McAuley took a look at the Government’s economic strategies, which he finds based on three planks:

The first plank, revealed in the 2014 Budget, is an attempt to tilt income distribution towards the already well-off. The idea is that, given enough breaks, the rich will save and invest, providing employment for everyone else.

It’s a policy based on heroic assumptions about how the rich behave, most notably an assumption that rich people are rich because they are clever and industrious. Suffice to say that this was the disastrous approach known as “supply side economics” or “Reaganonomics” in America in the 1980s. If it stimulates any employment it is likely to be among workers in BMW car plants in Bavaria and real-estate agents in Sydney’s north shore.

The Australia Institute’s report The budget’s hidden gender agenda points out that this also favours men over women.

The second plank is about sustaining material living standards as long as possible on the back of the resource boom.

The benefits of the resources boom have been distributed in tax cuts and middle class welfare. Wayne Swan in his book The Good Fight points out that Peter Costello received a total of $334 billion in revenue upgrades and managed to spend $314 billion of it. A once in a century chance to upgrade our infrastructure was missed.

The Coalition’s third plank is pursuit of “small government”, even though Australia has one of the smallest public sectors of all developed countries, and we have pushed privatization to the extent that we are paying far more for poorer services than we would be had we retained public ownership of assets such as roads, airports and energy and water utilities.

Yet Eltham tells us:

With spending at 25.9 per cent of GDP, the Abbott government is indeed spending more than Julia Gillard’s government – more, in fact, than every year of the Rudd-Gillard era, except the stimulus year of 2009-10.

I’ve always thought there was an ideological dimension to Howard-Costello’s distribution of goodies. We are expected to take more responsibility for ourselves. But why does Labor follow suit? Purely for political reasons, I think. To avoid the ‘big spender’ tag and demonstrate economic management.

Labor might do better to take a different and more honest approach. Australia could become a better, fairer and more decent place to live if we taxed and spent to, say, 30% of GDP. We’d still be near the bottom of the league tables.

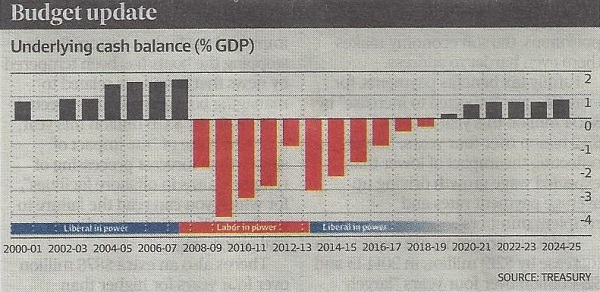

I’ll leave you with this graph of the underlying cash balance as a percentage of GDP from MYEFO via the AFR:

You’ll notice that Swan had the balance down almost to minus one percent before Hockey came and created a mess. I agree with Chris Bowen, Hockey is simply not up to the job.

Greg Gamut says little has been done to bolster economic growth other than say it will be bolstered.

He gives masses of graphs on the performance of the economy.

From the Fin Review: