Barrie Cassidy has called it a breathtaking shift in economic management.

Laura Tingle took the gloves off in an article Being governed by fools is not funny:

A bit like the old story of the frog that gets boiled alive because the temperature of the water in which it sits rises only gradually, we don’t seem to quite be able to take in the growing realisation that we actually are being governed by idiots and fools, or that this actually has real-world consequences.

We finish the week with a Prime Minister who has lost his bundle and is making policy and political calls that go beyond reckless in an increasingly panicked and desperate attempt to save himself; a government that has not just utterly lost its way but its authority; and important policy debates left either as smouldering wrecks or unprosecuted.

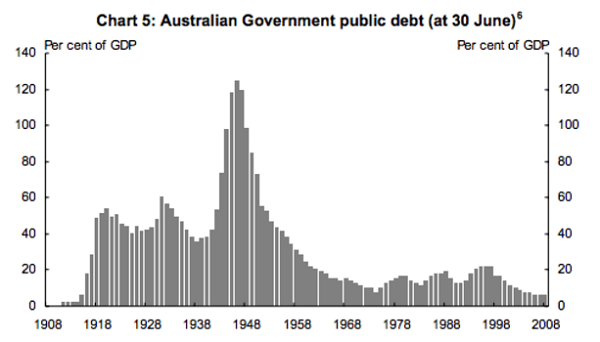

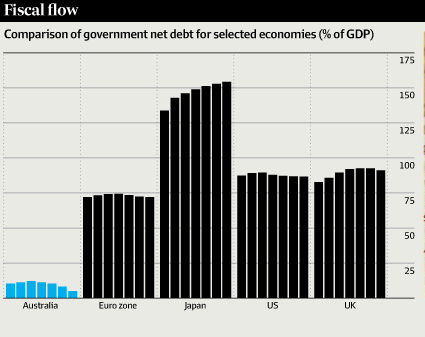

When debt under Labor reached 13% of GDP Abbott characterised it as a “disaster”, likely to send the economy down the Greek path. Suddenly, with 20% of his 2014 budget savings stalled in the senate, we have “done the heavy lifting” and the prospect of debt 50 to 60 per cent of GDP “is a pretty good result looking around the world”.

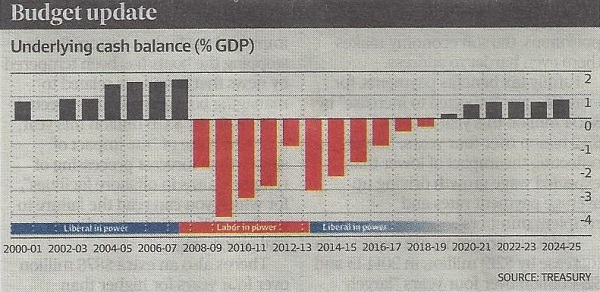

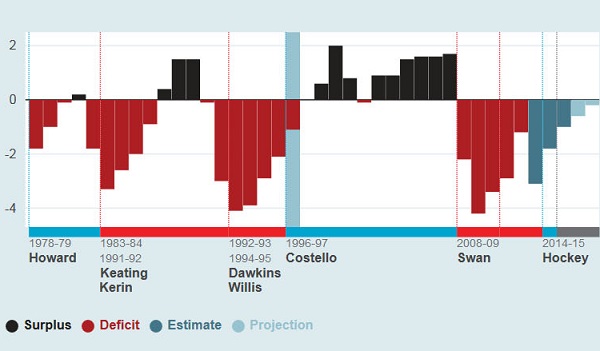

Here’s the graph of the forecast underlying budget cash balance from the Intergenerational Report:

It shows the “currently legislated” path reaching a deficit of 6% of GDP in 40 in years.

Here’s Abbott, pointing to the wrong line, showing us that we’ve done the heavy lifting:

Standard and Poor have warned that if debt, federal and state, goes beyond $30 billion we can expect to lose our prized AAA credit rating.

Laura Tingle and Phillip Coorey say that the federal budget’s forecast bottom line has gone backwards by at least $80 billion since the Coalition came to office.

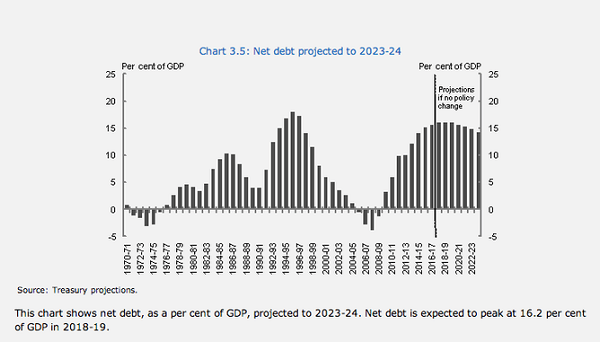

Abbott and Hockey would have us believe that the bottom line on that graph represents the legacy from Labor. In fact the following set of graphs from Tingle’s article shows the deterioration in the hands of Abbott and Hockey. The first set on the left represent Labor’s legacy:

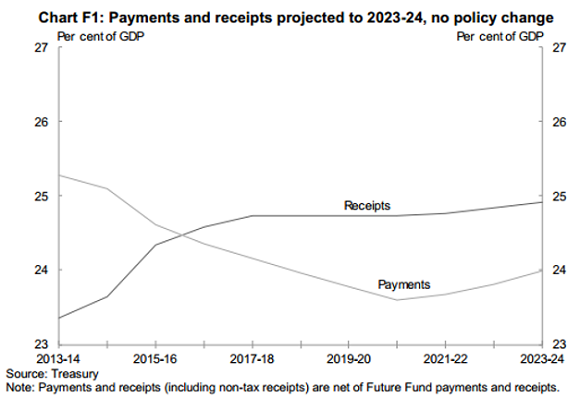

To emphasise the point about Labor’s legacy, this is the 10-year projection from the Pre-Election Fiscal Outlook (PEFO) prepared independently by Treasury and Finance and published under the charter of budget honesty in August 2013 before the last election is shown:

That’s from this post.

Laura Tingle says that Labor’s focus groups keep throwing up the word “idiot” in relation to Tony Abbott. Swinging voters in Western Sydney in polling commissioned by Fairfax described the Prime Minister as “incompetent, an international embarrassment and a fool”. She thinks that there are “signs that our political system really is in deep trouble – not as a polemic point, but in a very real sense.”

Peter Martin tells us that:

In Labor’s last financial year in office, spending exceeded revenue by 5.4 per cent. This year it will exceed it by 13 per cent.

The budget does have to be fixed. The Reserve Bank Governor, Glenn Stevens, recently warned that in a recession a deficit of 3% of GDP will quickly balloon out to 6 to 7%. That allows no space for government stimulus of the economy.

Apparently Hockey has been sitting on a tax white paper for several months which is to be released next Monday, after the NSW election. Peter Martin looks to the savings available from super:

Treasury’s most conservative estimate has the concession for contributions to super funds costing $15.5 billion this financial year, climbing to $18 billion over three years. The tax concession for the earnings of funds costs $12 billion and is set to almost double to $22 billion. By way of comparison, Medicare costs $20 billion.

Peter Lloyd, Professor of Economics at University of Melbourne, puts forward some ideas, including:

- Eliminating negative gearing for housing investments

- Restricting the allowable deductions for depreciation and other business expenses

- Revising rules relating to income from trusts

- Tightening the rules for fringe benefit taxation

- Reforming the taxation of super contributions and income

- Reducing tax concessions for not-for-profit organisations

As he says, each one of these will meet objections from tax payers. But then the art of taxation was always plucking the goose without too much squawking.

A prime minister fighting for political survival appears to have thrown in the towel.

Update: I meant to mention that Labor had the budget remaining in surplus over the remaining part of a 10-year projection in order to show how Gonski and NDIS would be paid for, whereas Abbott/Hockey planned to slash schools and Hospital funding by $80 billion dollars.

Abbott is now saying that a surplus will be achieved within 5 years, whereas Mathias Cormann is saying “as soon as possible”.