Bruce Mountain in an opinion piece in the AFR (pay-walled) said the NEG was “shambolic” policy which “snatches defeat from the jaws of victory”. Bloomberg New Energy Finance, according to Laura Tingle (also pay-walled) says “the concept is innovative and elegant, and could well prove ingenious”.

They are predicting it could achieve the same level of renewable energy in the system as the proposals set out by the Finkel review.

- “If effective and efficient, it would be a template for policy makers worldwide”, they said.

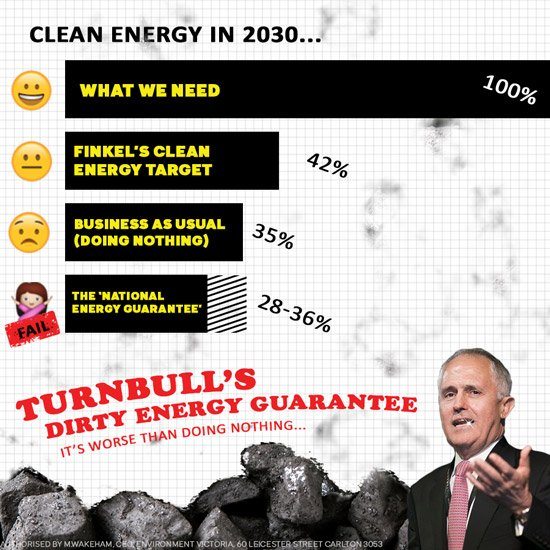

However, if you read Giles Parkinson’s account, BNEF find all manner of problems with the NEG. And if you look at this graph of the day, it could be worse than doing nothing:

So let’s have a look at the scheme.

The brief

From the Energy Security Board (ESB) advice to Turnbull:

- Specifically you requested advice on the changes needed to the NEM and legislative framework to ensure that the system provides

reliable, secure and affordable electricity, and in particular, ensure that:

-

• The reliability of the system is maintained;

• The emissions reduction required to meet Australia’s international commitments are achieved;

• The above objectives are met at the lowest overall costs.

You also requested advice on AEMO’s recommendation for the development of a strategic reserve. AEMO advises that it is presently developing a design for a strategic reserve. The ESB recommends that this work continue and that its advice on a strategic reserve proceed after AEMO completes its analysis later this spring. We see the Strategic Reserve as a separate policy issue from the mechanisms outlined below and compatible with what follows.

I can’t help noting that spring had sprung when they sent this missive, and AEMO’s bad read of the weather was a large part of the problem in SA both in September 2016 and this February.

At this point I have my first query. I’d suggest that the strategic reserve should be integral to the system. What is a strategic reserve for if you don’t call on it to meet ‘load management events’? Without some idea of what a strategic reserve is and how it would be used I’d suggest the picture is incomplete.

How the National Electricity Market (NEM) operates to supply electricity

The main way the market operates is through longer term contracts between retailers who buy electricity from generators to supply their customers.

These contracts are usually insufficient to meet fluctuating demand, which is supplied through the spot market, where bids from generators are matched with demand by AEMO in half-hour then five-minute blocks, to keep the voltage constant.

Together they are termed the ‘wholesale market’.

This is where I have to say that up until now I have misunderstood how the market works. I thought all the power was handled in the AEMO half-hour transaction, and the spot market consisted of the five-minute adjustments to that half-hour bid to keep supply and consumption in synch. I’d always wondered about the ‘wholesale market’ and suspected it had to do with supply to business not signed up to longer term contracts.

My bad, we live and learn, as they say.

I’ve excoriated the retailers for doing nothing of substance except send out the bill. Seems they actually do shop around for the bulk of the electricity to meet their customers’ needs. I’m still not convinced they add value greater than the profit they extract. Prices have gone up since they entered the system, and the regional Queensland market still gets along perfectly well without them.

What now changes?

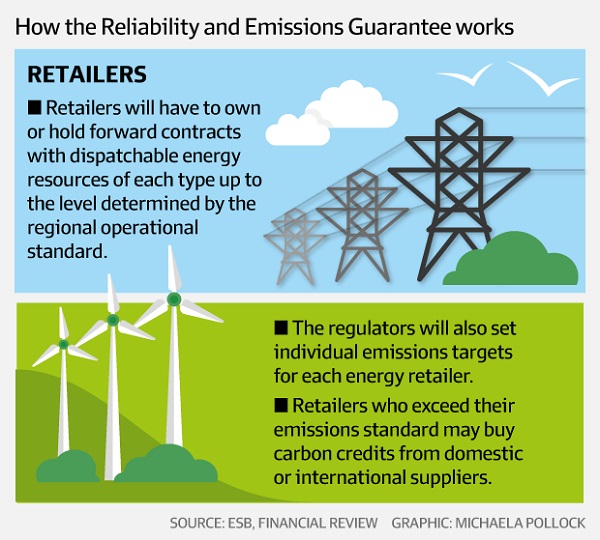

Retailers will now have dual obligations. They will now have to source a proportion of their electricity determined by the regulator from ‘dispatchable’ sources. They will not be able to substitute cheap intermittent power, even if it is available and has nowhere else to go.

At the same time regulators will set individual emissions targets for each retailer. A specified percentage of the electricity each retailer provides must be clean. If the retailer has trouble meeting this standard they can purchase credits domestically or internationally to an as yet unspecified degree.

Failure to meet the regulated standards could result in deregistration.

The new regime has been encapsulated in this infographic at the AFR:

A different standard for each region

The ESB derives its national standard from the government’s specified commitment to the Paris agreement, namely a 26% reduction in emissions to be achieved by 2030. There is a separate argument over how pathetically inadequate this target is, but don’t blame the ESB. They are merely helping the government to reach its goal.

However, the ESB is aware that progress varies between the states, so they are going to strike different levels in each state to progress the transfer to cleaner energy over the whole nation. The existence of Emissions-intensive trade-exposed industries (EITE) will be taken into account, as will commitments undertaken in the RET schemes before 2020, which have a life through to 2030.

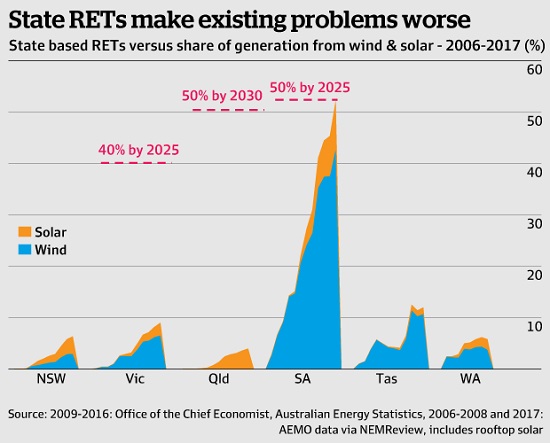

This graph, also from the AFR displays the progress to date in each state, though I don’t agree with the heading:

The infrographic also shows the state targets, which the ESB says can still be pursued, provided their regulations are not breached. There is no reason why firmed renewables cannot replace dirty existing electricity, provided their standards of dispatchability, as yet unquantified, are met. However, it is expected that concentrated solar towers (CST) with molten salt or other storage would qualify.

Similarly, intermittent power firmed by a contract with a gas generator could qualify, provided both standards were met.

Prices to fall?

The ESB say this:

- It is expected that following the guarantee could lead to a reduction in residential bills in the order of $100-115 per annum over the 2020-2030 period. Wholesale prices are expected to decline by 20-25% per annum over the same period.

That’s 8-10% better than Finkel’s CET.

There is extreme doubt over this claim. David Leitch says that NEG will favour the gen-tailers, the retailers who are also generators, will reduce competition and is likely to increase prices. State-run reverse auctions are still the lowest cost, most effective way to procure new supply, as they introduce new players into the market. He links to an article on Building a 1GW dispatchable, largely renewable generator in NSW. But he says forecasting is a mugs game.

The Courier Mail has an article (pay-walled, it opened on Facebook) where Queensland Premier Annastacia Palaszczuk warns electricity retailers to cut bills or she’ll set up a government-owned retailer to steal their customers. There must be fat in the system if Alinta can offer 25% discounts over two years, which it is in Queensland.

The article, from memory now, quotes a ReachTEL survey of three blue-ribbon seats which disbelieved the price fall and were still willing to pay a premium to encourage renewables.

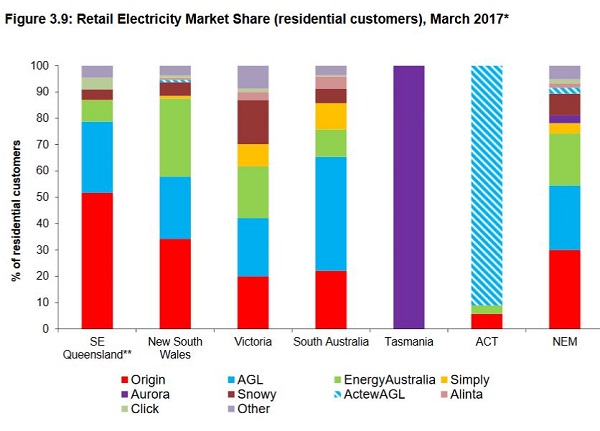

The ACCC in its interim report on the Electricity supply & prices inquiry has this table of retail market share:

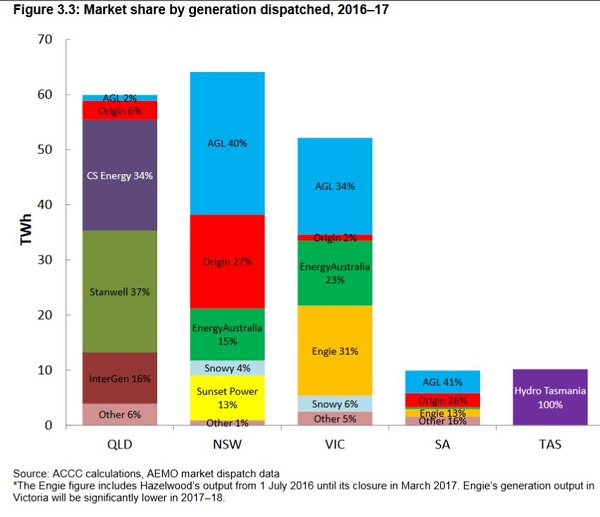

Then here is the electricity actually dispatched in the NEM:

Of interest here is that SA produces about the same amount of electricity as Tasmania, although its population is 1,721,000 as against Tasmania’s 520,100. Queensland, production is high. The populations are NSW 7,837,700, Victoria 6,290,700 and Qld 4,907,600.

Clearly the ACCC is already worried about industry consolidation.

My broker says in a report on AGL that retailers such as AGL will now have to work in 18 markets on the NEM. I’d suggest that deep pockets and sophisticated players able to cope with risk and complexity would be required.

I’d have to say I’m with Annastacia. I can’t see the retailers doing anything a government agency could not do, and state government reverse auctions rather than choices made by consumers would produce more competition in generation.

Other implications

Generally speaking, for the first time the ESB plan will bring climate planning into the operating frame of the NEM. This is good, but Finkel would have done that also. However, there are at least three other implications we should think about.

First, there is a hidden subsidy to coal and gas. Very simply burning coal and gas and dumping the waste gases into the atmosphere will cost future generations dearly – economically, ecologically, in health and will also bring mass people movements, conflict and death. I’m in favour of some price penalty on this as well as direct action by states, municipalities, businesses and consumers for a cleaner planet.

Second, while no-one, myself included, really knows how the NEG would play out, there seems to be an indication that intermittent energy generation will be sidelined to the spot market. AEMO seems a bit paranoiac about the lack of ‘firm’ energy. South Australia has operated many times with more than 50% wind and solar generation, and the power system worked. Audrey Zibelman has complained about AEMO having to intervene more to get the gas turned on. I thought that was their job.

I would like to ask someone with the appropriate technical knowledge whether the lights would have gone out in SA when a dirty big storm blew down 22 transmission pylons, and the Heywood interconnector from Victoria was being run at 95% capacity. When the interconnector tripped and 600 MW fell out of the system, would the lights have stayed on if SA was running on gas and coal rather than renewables?

I suspect the difference would have been measured in seconds at best.

Third, the NEG seems to encourage an aggregated rather than decentralised grid, but I could be wrong.

The question of John Pierce

Finally, serious questions have been raised about the role of John Pierce. At RenewEconomy Giles Parkinson rips in. Pierce, it seems, has a track record of favouring established interest, of disliking the RET, of dragging the chain on necessary rule changes, which is his core job apart from the design of the whole NEM. And he’s suspected of being a friend of coal.

There is no doubt he was the brains behind the NEG.

Nevertheless, bad people can do good things, so we should judge the scheme on its merits. Still, this is a worry:

- A couple of sources have told RenewEconomy of the first meeting between Finkel’s review panel and the AEMC, at which point Finkel asked, ‘is anyone here an electrical engineer’.

Upon being told no – the AEMC is largely made up of lawyers and economists – Finkel then said: ‘Then why are we here’. Finkel and Pierce are said to have had fierce disagreements over the role of markets and market design.

Someone on Insiders today suggested Finkel should get an award for diplomacy. I’m sure he does not want to be sent to Coventry.

See also previous post: Turnbull does energy policy on the back of an envelope.

Turnbull’s NEG (ative) fails on the basis that, as the top graphic indicates, this is the outcome of a long process of ideological subjective policy over riding clearly defined and essential objective policy requirements. The LNP have used the committee approach to demolish climate action down to a token gesture, and in a way that they will claim to have solved the Climate Change threat.

The 100% in the top graphic is in fact the minimum responsible sufficiently effective action to mitigate climate change which offers no compensation for Australian’s per capita back contribution to atmospheric CO2 content and hence Global Warming.

Sadly Laura Tingle has been successfully schmoozed by Turnbull into believing that he has achieved something significant with his NEG, rather than what it is….. “Global Warming mitigation action” death by a thousand cuts.

The committee approach: The objective, to decide if a bolt should be used to join two plates together to balance the loads and hold the building together.

A committee is formed called together by a government body of lawyers and literary luminaries. The committee consists of 1 engineer, 1 architect, 1 town planner, 1 artist, and 1 accountant.

The engineers says it is definitely required, should be this size and should go here. The architect says he would prefer it to go here so it does not affect the aesthetic flow of the building and can it be smaller. The town planner is in a huff because the whole project is contrary to his design. The artist says that bolts are out of vogue it should be achieved by binding the parts together with rope for a better vibe. The accountant is concerned about the cost of the larger bolt and argues for the rope approach as there is a surplus of rope in the government stores.

The discuss it and vote. What sort of outcome can come from such an approach?

Nothing Ever Good.

Brian,

My background is as a mechanical engineer, with most of my professional life designing industrial equipment in the materials handling area.

As I understand the performance of coal-fired power stations, they don’t have the nimbleness to respond in seconds to ramp-up power output to compensate for such a large supply dropout of 600 MW. I think if SA’s 520 MW capacity Northern (closed at about 9:30am 9 May 2016) and 240 MW capacity Playford B (closed 9 May 2016) had still been operational, but only operating at light load prior to the interconnector dropping out, “spinning reserve” would not have made any difference.

SA’s Torrens Island’s oldest gas-thermal 4 x 120 MW generators (completed in 1967) were to be mothballed indefinitely from the 3Q of 2014, but this decision was reviewed when Northern & Playford B were announced to close. Torrens Island’s newer gas-thermal 4 x 200 MW generators (completed in 1976) are also approaching their use-by date. Again, even if Torrens Island was running at or less than half its rated capacity prior to the interconnector dropping out, I doubt whether it would have managed to make up 600 MW supply in a matter of seconds.

SA’s Pelican Point power station is a gas-fired combined cycle comprising 2 x 160 MW gas turbines and 1 x 165 MW steam turbine, generating up to 485 MW of electricity. Pelican Point is SA’s largest combined cycle gas-fired power station, and certainly would not have the capacity to handle the sudden large increase in demand.

I think if Northern, Playford B, Torrens Island, and Pelican Point had all been operational on the day of the “system black” event the outcome would have been the same IMHO. But I wonder what the costs to consumers and to the health of people nearby would have been to keep Northern and Playford B open burning poorer quality sub-bituminous coal from Leigh Creek?

But let’s not let facts get in the way of ideologues trying to demonise renewable energy!

I’ve heard some commentators say that renewable energy is unaffordable and will never provide “baseload” power. So what happens when finite oil, gas, coal, uranium & thorium become scarce and unaffordable? But that’s a too inconvenient question for some!

The old paradigm is no longer safe for our long-term future – we need to transition to a sustainable one.

Brian,

In a comment 2 days ago, I was lamenting the lack of STEM backgrounds for our parliamentarians. It seems to me Dr Finkel’s reported questioning of the competency/relevancy of the backgrounds of the AEMC people appears coincident with my thinking.

And perhaps that’s why we appear to be in one hell of a mess. I think “tribalism”, for want of a better word, seems to be devaluing the input of scientists and engineers on technical issues. “Incumbency mindset” and “groupthink” are other words that come to mind.

Geoff M, it is clearly possible for people with power to be ‘captured’ by a particular source of expertise. There could be a bit of that, but in Pierce’s case he clearly has ideas of his own, and for now, against Finkel, he has won.

I appreciate your detailed comments on SA blackout, and the reality is much as I had thought.

Anna Krien says Port Augusta was being poisoned by Leigh Creek coal and still was after the power stations closed.

The break in the network from the storm was mid-north, which left the north without power for a considerable time.

Elsewhere it was only three hours, which is garden variety in Queensland.

After the shut-down I believe wind was the first to come on board in the black start. If the same happened in the future there would be the battery and when it is finished, probably the government gas-fired generator, which would be started and put in standby on the basis of the weather report.

A lack of understanding of stormy weather was part of the problem, especially the capacity for supercells to develop in a storm front.

That’s routine hereabouts.

Have to go out now, Mark coming tonight, working tomorrow.

GM: The SA crisis you were talking about would have been helped if:

1. Generators and power storers were either government owned or largely contracted to provide “available capacity” over the longer term (with some additional payments for generated power and being at higher levels of standby.)

2. The power supply systems were run by operating organizations whose performance was the responsibility of states instead of the false god of the magic market. (These

organizations may be statewide but larger or smaller areas might be appropriate.)

3. The operating organizations had the power to set up the capacity contracts and then decide what needs to be running or in the process of moving to a higher standby level at any one time.

4. There was enough quick response energy storage to provide the power needed to keep the system going until the slower response generators could start producing power.

5. More power was supplied as controlled power that can be turned off quickly in a crisis without causing problems. (There is plenty of scope to increase the % of controlled power.)

Is there a tote on when SA will export electricity interstate ?

Are there monetary gains if/when they do ?

John Davidson (Re: October 23, 2017 at 5:26 pm):

According to the AEMO’s Electricity Forecasting Insights for the NEM, published June 2017, in Table 2 showing the forecast maximum operational demand (10% probability of exceedance) for SA region in 2016-17 in summer is 3116 MW for neutral scenario.

So, a dropout of supply of 600 MW over a time-scale of seconds for a demand of 3116 MW represents around 19.3%. That’s a big, rapid dropout as a proportion of demand in my estimation.

1. I don’t think being government owned would have made any difference – the event was just too large and too quick.

2. “Market forces” can be regulated to provide the necessary performance requirements in the state’s interest (if governments have the will and intelligence), and more importantly enforced rigidly. But again, I think the event was just too large and too quick to react to effectively.

3. More reserve capacity means more cost. SA’s electricity prices are reportedly the highest in the world. Who’s going to pay for it, particularly if it’s for an event that only happens once in a while? As Brian commented above, a significant part of SA was back to normal in about 3 hours, while the north remained without supply for very much longer. It’s a question of the risk of the event happening compounded by the consequences of the event versus the cost required to avoid that event.

4. Enough quick response would have helped, but that costs money. Who pays?

5. Controlled devices, like off-peak hot water systems, use ripple-current signalling over the electricity grid. The signal is slow to transmit so it would not have been sufficiently quick to respond. If the signal is to be transmitted over the internet, that opens up a whole can of worms concerning security/hacking, and it needs a stable connection. Another alternative is to use an RF control signal, but that needs long-term planning and implementation. I agree that there needs to be more devices that are subject to demand management controls – better to have some non-essential devices shutdown temporarily to reduce the load than to have a complete blackout.

6. Putting major power lines underground would help, but that costs money. Correct me if I’m wrong; I believe Sweden does it.

It’s good to have hindsight – let’s learn from this event. But it requires judicious decision-making to maximise benefits vs costs.

GM: I accept that power systems can become unstable and shut down when there is a big drop in supply but would make the general comment that the risk of a major disruption would be reduced if you have some very fast response sources of power like batteries and more of the demand being supplied by controlled power feeding things that can handle crash stops.

Batteries in the home would would help too since what the public hates about blackouts is the lights going out and having to “sit around in the dark”.

What i am really saying is that the nature of the market is what counts. On the down side a power spot market that is supposed to deal with peak demand provides little certainty for those that supply the peak power needed for a few hrs at the hottest time of the year and low certainty means that very high prices are charged and systems gamed when the opportunity arises.

On the other hand a market for long term contracts for capacity would attract some very competitive bidding because the tenderers would have a good idea of what providing capacity is going to cost.

I’ve added a note in the text really drawing attention to the low generation in SA and the high generation in Queensland. Here’s what I said:

Of interest here is that SA produces about the same amount of electricity as Tasmania, although its population is 1,721,000 as against Tasmania’s 520,100. Queensland, production is high. The populations are NSW 7,837,700, Victoria 6,290,700 and Qld 4,907,600.

Brian (Re: October 23, 2017 at 11:59 pm):

Thanks for adding the information. I think it highlights the relationship between generating capacity and population (or electricity demand). Although Tasmania and SA both dispatched roughly 10 TWh in 2016-17 each, SA’s population is 3.3 times that of Tasmania.

John Davidson (Re: October 23, 2017 at 11:16 pm):

South Australia is currently having installed the world’s largest battery storage system delivering a maximum power output of 100 MW with energy storage capacity of 129 MWh, and due to become operational next month (or it’s free). This system should help make SA’s power supply be more resilient, but if it had been available last year during the “system black” event, it would probably not have been sufficient to prevent it.

SA is also planning to build and become operational by 2020 the world’s largest (150 MW) concentrated solar-thermal with storage (8 hours) generator. I applaud them for doing so – it’s about time Australia started utilising this technology. These all help make SA’s electricity supply more resilient, but they cost money.

Agreed – but only if you own (outright or mortgaged) your own home and can afford to do so. What about renters, or people who can’t afford to do so? And you also need to be thinking about a battery recycling scheme when these batteries require replacing in roughly 10 years time.

Agreed – “gaming” the system should be penalised. But I think this is part of what governments should be doing: regulating and enforcing the rules of the market for a lowest cost, reliable, long-term sustainable, reducing to zero net carbon emissions system. In my view, governments have abrogated their responsibilities to some extent, but I think there are some indications (some states more than others) that there are some serious re-evaluations to steer a better path. I’m less confident about the current Fed regime re energy policy.

I’ll qualify this statement by adding “on a much larger scale”.

Some solar thermal technologies are currently being utilised in Australia, but they are only small scale. eg. the NSW Jemalong proposal is 30 MW with 4 hours storage.

Geoff M, I think the Qld state government policies do something to help renters, but I’d have to check it out.

More generally, there were two bits of information I left out of the post, because we can’t be 100% sure, and I didn’t have the links to hand.

Giles Parkinson claims that the price reduction forecast was plucked from the air and thrown in the sell the deal. It’s alarming, but no doubt true in this regard, that Frydenberg airily said that modelling will give you any answer you want.

Secondly, Parkinson says that Turnbull and Frydenberg accepted the ESB advice instantly, not after a day or an hour, took it straight to cabinet and the party room and had a deal basically within 24 hours.

The only way this could have happened would be if the Government was in on crafting the advice.

The ESB does not come out of it looking like independent experts.

Over at The Guardian, First Dog seems unimpressed…..

Another thought about battery storage in the home: – Existing strata properties retro-fitting battery storage could be problematic. New strata developments could incorporate battery storage more easily if included in the design process, but it’s likely incentives would be needed to encourage this.

Over at REneweconomy this article shows 4 charts that illustrate just how quickly the transformation of the global energy market is moving in the opposite direction to Australia’s energy policy.

Geoff, good link.

I’ve done a new post NEG will probably win.

Ambi: First dog over the moon provides the clearest explanation of the government’s energy policy ”i have seen so far.

Last night at Senate Estimates representatives for the Northern Australia Infrastructure Facility (NAIF) were being questioned. It began at 20:33:06 and finished at 23:03:25, although some of that time concerned other non-NAIF issues. A video of the proceedings can be seen at this URL, then search through for the event : Senate – 26/10/2017 – 20:00 – Economics (Part 3) – 03:03:25.

The CEO of the NAIF in her opening statement (from time interval 20:33:27) announced that the NAIF board had made its first investment decision (on 29 Sep 2017) for the Onslow Marine Support Base Pty Ltd to offer a loan of up to $16.8 million. Note that the NAIF is required to make public a board investment decision within 30 days, so I suspect this announcement was timed for the benefit of last night’s Senate Estimates. Note that the NAIF Act was established on 3 May 2016 and the NAIF office was established on 1 July 2016, with $5 billion of funds available for loans for investing over 5 years. It seems to me the NAIF is not in a hurry to invest its $5 billion treasure.

The NAIF CEO stated there are currently 140 inquiries, of which 63 are “active”, and 10 projects are at “due diligence” or “execution” stage.

Beginning at time interval 20:53:00 Senator Peter Whish-Wilson (for Tasmania; Greens) asked about the definitions of “due diligence” and “execution”, and then asked whether the Adani (rail) proposal was still at “due diligence” stage since confirmation at the Senate inquiry hearing into the NAIF on 11 August 2017. The NAIF CEO last night confirmed the Adani rail proposal is still at “due diligence” stage, despite serious allegations concerning Adani aired on ABC’s Four Corners programme on 2 October 2017.

I thought Senator Ian Macdonald (for Queensland; LNP) did a terrific job of interrupting/delaying Senators that were asking inconvenient questions, with spurious points of order. I get the impression that, come hell or high water, the COALition is still determined to push the Adani project through.

Watching these proceedings reminded me of having a tooth pulled, with the phrase “commercial-in-confidence” being used often to deflect questions. Here’s an example of our tax money hard at work.

Over at The Conversation posted today, is a politics podcast with Michelle Grattan interviewing Energy Security Board chair Kerry Schott.