1. Australia’s vast kelp forests devastated by marine heatwave, study reveals

-

A hundred kilometres of kelp forests off the western coast of Australia were wiped out by a marine heatwave between 2010 and 2013, a new study has revealed.

About 90% of the forests that make up the north-western tip of the Great Southern Reef disappeared over the period, replaced by seaweed turfs, corals, and coral fish usually found in tropical and subtropical waters.

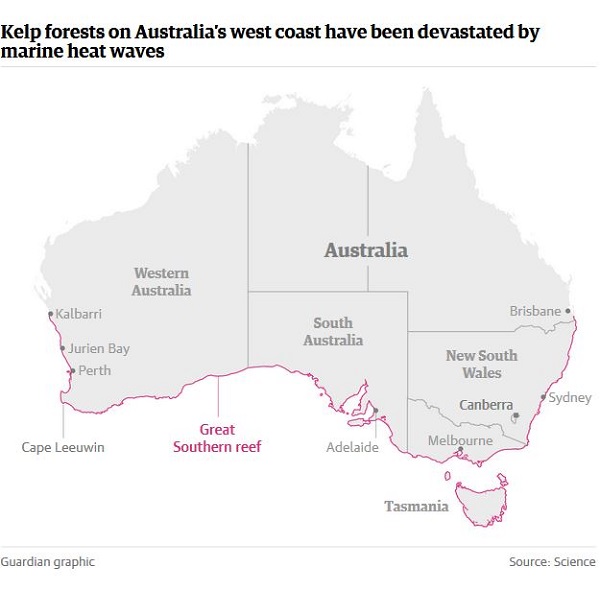

The Great Southern Reef is a system of rocky reefs covered by kelp forests that runs for 2,300km along the south coast of Australia, extending past Sydney on the east coast, down to Tasmania and, previously, back up to Kalbarri on the west coast.

It supports most of the nation’s fisheries, including the lucrative rock lobster and abalone fisheries, and is worth about $10bn to the Australian economy. It is also a global biodiversity hotspot, with up to 30% of species endemic.

There has been a functional extinction of 370sq km of rocky cool-climate reefs, extending down the coast from Kalbarri. See map below:

If the trend continues the kelp forests could retract to the southern tip of the state, with environmental and economic consequences as grave as the loss of the Great Barrier Reef.

- …the number of endemic species was “orders of magnitude more on the Great Southern Reef than the Great Barrier Reef”.

2. China is methodically building the world’s most ambitious carbon market

- To make a long story short: Yes, a comprehensive carbon trading system covering the world’s largest emitter will, eventually, be a Very Big Deal. But Tuesday’s announcement was neither the beginning nor the completion of that effort, only a signpost on a path that the country is navigating with great care.

Gradually, is the word. They started building up carbon market in the Five-Year Plan covering 2011-15, trialling the concept.

- Even trading in the power sector will not begin immediately, however. A few years will be spent gathering and verifying data on plant-level emissions, establishing rules and baselines, engaging in “dummy” trades as a stress test, and generally setting the table. Actual trading, with money changing hands, will begin in 2020. The system will expand to cover other sectors like steel, concrete, and aviation at some unspecified post-2020 date.

If it works it will affect us all.

3. Carbon farming could be worth $8 billion to Queensland by 2030

Just before the election was called the Queensland Government put out a media statement about a possible $8 billion carbon farming market under certain conditions. A report Unlocking value for the Queensland economy with land and agriculture offsets published in September identifies the more likely estimated value of carbon farming in Queensland under current settings as $1.4 to $4.7 billion.

Queensland certainly aims to get a share of whatever comes out of the Australian Government Emissions Reduction Fund, but the strategy aims at having longer term environmental, agricultural and social benefits. There’s more at the Queensland Government departmental site.

4. Turnbull has politicked himself into irrelevance on energy and climate in 2018

That’s the view of Alan Pears, Senior Industry Fellow, RMIT University at John Menadue’s Pearls and Irritations:

As we approach the end of the year, it’s useful to look back and forward. Now is an auspicious time, as two major energy-related reports have been released this week: the federal government’s review of their climate change policies, and a discussion paper from the Australian Energy Market Operator (AEMO) on future energy paths.

The difference between the two is striking. The AEMO paper is practical, direct and realistic. On the other hand, the climate policy review relies essentially on Australia buying lots of international carbon permits to meet our Paris target (and, implicitly, on state governments taking up the challenge their Canberra colleagues have largely abandoned).

It’s amusing to read a document that plays with numbers in such creative ways. But it is a fairy story, and it’s no way to drive national climate policy.

AEMO’s report is a discussion document calling for input to formulate an integrated grid plan to facilitate the efficient development and connection of renewable energy zones across the National Electricity Market (NEM) as recommended by the Finkel Review.

Of the Turnbull Government Pears says:

-

The federal government is almost irrelevant; the public statements and policies it presents are simply aimed at getting “something” through the Coalition party room, or trying to throw blame on others. It’s very sad.

The real heavy lifters are the Chief Scientist Alan Finkel, AEMO chief executive Audrey Zibelman, and South Australian Premier Jay Weatherill.

5. The criminal dimension of climate change

Andrew Glikson writes about a new book

-

Unprecedented Crime: Climate Science Denial and Game Changers for Survival, by Dr Peter Carter and Dr Elizabeth Woodworth, with a foreword by the leading climate scientist Professor James Hansen (https://www.amazon.com/Unprecedented-Crime-Climate-Changers-Survival/dp/0998694738/), outlines the criminality of those who actively promote the continuing emission of carbon gases into the atmosphere despite the scientific evidence, including the intensification of extreme weather events such as hurricanes, floods and fires around the world.

The book highlights the collusion of large part of the media with climate change denial and cover up…

There’s a synopsis, table of contents and excerpt here.

Professor Joachim Schellnhuber, Director of the Potsdam Institute of Climate Impacts, is quoted as saying “We’re simply talking about the very life support system of this planet” and there is a foreword by James Hansen, who I’m sure does not hold back. We are on course for the sixth mass extinction of species.

Apart from technical actions the authors accuse politicians and the media of wilful neglect and explore avenues of recourse including charging them with crimes against humanity under international law.

Yes, yes, yes…

“ including charging them with crimes against humanity under international law“

Brian: China may be positioning itself to take advantage/control of a world carbon market. Howeeer, my take on the basis or Aus experience is that it may provide profit opportunities for a whole raft of spivs but is hardly necessary.

In Aus the inflated power prices are a defacto carbon tax. Not sure that bringing power prices down to a level that can compete with rooftop solar will make much difference

Here is the real tipping point horror show getting under way in the Arctic. This is the politically driven crime against humanity that will be 100% on the heads of all denialists

http://arctic-news.blogspot.com.au/2018/01/unfolding-arctic-catastrophe.html

Its time to start making that list and checking it twice.

That looks serious, BilB.

Off-topic but you might be interested in this item on hot new houses:

http://www.abc.net.au/news/2018-01-04/australian-houses-losing-in-heat-management-design/9287188

Myles Allen (New Scientist pp 38, 7 Oct 2017) is the chief climate modeller for the University of Oxford. He is advocating a far more aggressive approach to big oil and other producers and sellers of products that start with fossil carbon. “He wants to to join the dots and show the world – and particularly the courts – where the culpability lies for global warming.”

Among other things he says that “The uncertainties of climate science should be acknowledged but, amidst the caution people miss the fact that our best estimate of human contribution to global warming is all of it.”

He points out, for example, that aid budgets rather than big oil profits are being used to restore infrastructure in the Caribbean after Hurricane Irma.

Insurers to pay out record $135 billion for 2017 after hurricanes

Re insurance is where the bucks stop. It is worthwhile to read their report Climate change and its consequences: What do we know? What do we assume? compiled by Dr. Eberhard Faust, their leading expert on natural hazards and Peter Höppe,

head of Geo Risks Research/Corporate Climate Centre, Munich Re. They report that normalised losses from severe thunderstorms in North America are rising, while in Europe, the trend in losses from floods has fallen, because of massive investment in flood protection.

Meanwhile in the finance industry, investors increasingly assess risk not just in terms of financial risk anymore , but also social, environmental and governance (ESG) issues that may be critical to financial returns. Investors are demanding that investment firms start to factor in ESG components. Thus green bonds become more popular and change slowly the financial sector. Also, several countries are now issuing green economy road maps. Read about the impact on global finance and regulations here.

This is alarming.

Jebus, zoot!