Too many Australians are struggling to find secure, affordable accommodation in places where they need/want to live. This can be true for those seeking to own a house of their own as well as those seeking rental accommodation.

This post focuses on affordable home ownership. (It does not include apartments. I have negligible experience with apartments.)

Contributing factors include:

-

A shortage of affordable accommodation in the places where it is needed.

-

Unoccupied accommodation that is where accommodation is needed but owners choose not to sell, rent or consider splitting a house that is larger than the occupiers need.

-

The Covid experience demonstrated that working at home can actually work while reducing the time and emissions associated with commutes. Problem is that this allows people to move to regions where they would prefer to live. However:

-

-

Some of these regions haven’t got the capacity to accommodate all of these newcomers.

-

The losers will be low income people who will struggle to compete with well paid newcomers for accommodation.

-

Communities may also suffer because low income service workers such as teachers, health workers and police will no longer be able to afford to live there.

-

It was concluded that:

-

Home ownership is declining because more and more people cannot afford to buy a home of their own. This is particularly true for younger Australians.

-

The combination of unusually low Reserve Bank interest rates and lack of bank home loan regulation is causing housing price hyperinflation. Banks and sellers are better off while mug buyers are lumbered with bigger loans.

These low interest rates may also be setting the country up for a GFC type crash when home loan interest rates go back to normal.

-

Average house size has grown dramatically with average m2 per occupant tripling since 1950 to 87m2, the highest in the world. (Average block size has remained about the same. This suggests that gardens and back yards have shrunk or disappeared entirely.)

-

The mix of new housing seems to be driven by developers trying to maximise their profits by building large, prestige houses in prestige estates.

The quest for developer profits may not providing the mix of accommodation communities need

-

Housing has become a very attractive investment because current tax laws strongly favour investing in a “big family home.”

Suggested Action:

-

Federal government:

-

-

Slowly tighten up housing lending and loan repayment rules to slow housing inflation and protect borrowers from the effect of rising interest rates.

-

Cancel or wind back concessions that encourage investment in large, expensive homes.

-

Support innovation and changes to Australian housing standards.

-

-

Local/state governments:

-

-

Establish what accommodation mix communities need to handle current/projected population mix.

-

-

-

Do what is necessary to get the mix and quantity of accommodation required to meet these needs. This may involve councils:

-

-

-

-

-

-

Taking a direct role in filling shortages of lower cost housing. (Finance by a special tax on rezoning profits?) AND/OR

-

Insisting that developers have to put their resources into producing the required accommodation mix with priority going to meeting low cost housing needs. (This doesn’t mean that each development must have the same mix.)

-

-

-

-

Keep in mind that some of these needs may be met by splitting existing large houses, allowing temporary accommodation in some free spaces etc. Not just building new affordable accommodation.

-

-

Identify and change rules that make it hard or impossible for owners/developers to do things with land or buildings they own that could provide more affordable accommodation in the short or long term.

-

-

-

Consider changing and/or discarding the current developer centric strategies.

-

DETAILS: AFFORDABLE HOME OWNERSHIP:

(NOTE: NSW defines Affordable housing as: “Housing that is appropriate for the needs of a range of very low to moderate income households and priced so that these households are also able to meet other basic living costs such as food, clothing, transport, medical care and education. As a rule of thumb, housing is usually considered affordable if it costs less than 30% of gross household income”)

This post looks at affordable home ownership. A later post may look at secure, affordable rental accommodation:

Home ownership is attractive for a number of reasons:

-

It provides cheap accommodation once the loan is repaid. Particularly attractive for people who end up living on the pension.

-

It gives people a feeling of security. It is difficult to move people out of a house that they own.

-

The house can be modified by the owner.

-

Its value moves up and down with the market. Can be important if you need to move for some reason and want to have enough money to buy a house at the place you move to. (However, if you move a lot it may be a lot simpler to simply rent and maybe keep an owned house as a rental property to protect from market fluctuations.)

How things have changed:

When we built our first house in the 1960’s there was a realistic expectation that the vast majority of Australians would end up with the security of owning their own home. (It was also easy to find places with affordable renting.)

Fast forward to 2021 and the percentage of people for whom owning their own house was a realistic expectation had dropped significantly. For example, the parliamentary report: “Declining Home Ownership Rates in Australia” concluded that:

-

Based on current trends, an increasing number of Australians are unlikely to become home owners.

-

Declining home ownership rates are likely to exacerbate existing pressures on the private rental sector, with a disproportionate impact on lower income households.

-

Policy makers can choose to either:

-

-

Accept lower home ownership rates, and put in place the necessary legislative and policy changes to address the broader and social economic implications of such changes OR

-

Seek to slow the decline through a range of other strategies. Given that the declining home ownership situation has developed over many decades, and is embedded in Australia’s economic and social structures, reversing the decline would not be a straightforward exercise.”

-

The report also provided data on the decline in the percentage of houses that were fully owned: “Outright home ownership has declined from 42.8 per cent of households in 1995–96 to 30.4 per cent of households in 2015–16. For those households nearing or in retirement (household reference person aged 55 years and over), ownership without a mortgage has fallen from 77.0 per cent in 1995–96 to 62.0 per cent in 2015–16. This, and lower rates of home ownership amongst younger households, has implications for Australia’s retirement income system in the future.”

So what has changed since the 1960’s?

-

Housing size has increased dramatically: Over the past 60 years Australian homes have more than doubled in size, going from an average of around 100 square metres in 1950 to about 240 square metres today. At the same time, the average number of people living in each household has declined to 2.8. This means that the average floor area per person has tripled from 30 square metres to 87 square metres. (The largest in the world, even higher than Canada and the United States.)

(NOTE: At the same time, average housing block size has actually shrunk. We used to talk about houses being on “¼ acre blocks.” (1012 m2) Now, googling “standard house block size Australia” got: “The most common block size is 640-660 square metres, and 34.5% of blocks are between 520 and 740 square metres. The median is 540-560 square metres. 180-200 is the most common smaller block size, and there is a small spike in block sizes of 1000-1020 square metres, which includes the quarter-acre block.22 May 2016” )

To put these house sizes in context it is worth asking: “What is a reasonable minimum house size?” Rough calculations gave the following minimums for fully self contained, cramped, 3m wide units that are designed to suit wheelchairs:

-

-

Couple: 21m2=10.5m2 per person.

-

Family with 2 kids using single kid’s beds: 33m2=8.3m2 per person.

-

Family with 4 kids using double bunks for the kids=5.5m2 per person)

-

A lot of space could be added to these cramped units before they reached 87m2 per person.

(NOTE: I spent most of primary school living happily with my parents and sister in a garage that was divided into 2 rooms – Interestingly, my mother later described this period as the best time of her life. Not sure why but I suspect what she liked was having the family together at the evening instead of hiding in their caves in a larger house. Have also spent quite a bit of time living in mining/construction plant dongas ranging from 6m2 up.)

-

Borrowing has become a lot easier.

When we built our first house the Commonwealth Bank would only loan up to the amount that could be repaid by 25% of the male partners income. Couples can now borrow much more. Some of this may help buy a bigger better house. However, I suspect that, in many cases, all the bigger loan does is allow people to bid more for a house they would have got for less when loans were more limited. (Seller and banks win. Mug buyer ends up with a bigger loan to repay.)

Suggested Action: Federal Government to slowly tighten up lending rules.

-

Home loan interest rates have dropped dramatically: The result is that home buyers are borrowing more to buy higher priced houses. (The underlying problem is that the Reserve Bank has been setting very low interest rates in an attempt to stimulate the economy.)

Potential problem with this is that we could have a GFC style crisis when home loan interest rates rise again.

Suggested Action: Federal Government:

-

Understands that RB interest rate settings are a crude tool that can be OK for solving one problem while causing problems in other areas such as the housing market

-

Insists that the interest rate used in lending rule calculations takes account of long term interest rate expectations. (This will reduce the amount that can be borrowed and reduce the risk of a GFC.)

-

Reduces the risk of a GFC style crisis by limiting the rate at which loan repayments can rise. (Link to general inflation or minimum wage growth?)

-

Developers have become more influential: Over time it has become more and more common for developers to insert themselves between the original acreage landowner and the final house/housing block customer. As part of the deal councils now insist that developers become responsible for providing services and sealed roads before selling the land.

Perception is that developers can make more money selling prestigious large homes built in prestigious developments instead of building affordable housing. Can contribute to the shortage of affordable housing.

Suggested Action: Local/state Governments:

-

-

Establish what accommodation mix is needed to handle current/projected population mix and needs.

-

Do what is necessary to get the mix and quantity of accommodation required to meet these needs. This might involve councils:

-

-

-

-

-

-

-

Taking a direct role in filling shortages of lower cost housing. (Finance by a special tax on rezoning profits?) AND/OR

-

Insisting that developers have to put their resources into producing the required accommodation mix with priority going to meeting low cost housing needs. (This doesn’t mean that each development must have the same mix.)

-

-

-

-

-

Keep in mind that some of these needs may be met by splitting existing large houses, allowing temporary accommodation in some free spaces etc. Not just building new accommodation.

Other Action: Local/state Governments:

-

-

Review what rules there are that make it hard or impossible for owners to do things on land or buildings they own that could provide more affordable accommodation in the short or long term.

-

Make it easy to break a freehold block into smaller freehold blocks and/or move block boundaries.

-

Allow walls to be the boundary for freehold blocks. (We do it with fences so why not walls?)

(NOTE: Freehold boundary flexibility helps avoid the costs and irritations associated with strata titles.)

-

-

Housing has become a very attractive investment: Current Tax laws strongly favour investing in a big “family home” instead of a smaller family home plus other more productive investments such as rental properties. (No capital gains tax for the family home.)

There is no social justice logic in systems that tax the rental properties that house the poor more harshly than the mansions that house the rich.

Suggested Action: Local, State and Federal Governments:

-

-

Remove incentives for investing in more expensive than needed family homes.

-

Provide incentives for the splitting up of oversized family homes and selling/renting part of the house. (NOTE: Could be attractive to empty nesters and others who want the cash benefits of downsizing without having to move away from where they have lived for years.)

-

FURTHER READING:

COVID-19 has made a tree change more alluring – but that may not last

Housing again at forefront of Australia’s economic growth, making banks happy

Home prices are climbing alright, but not for the reason you might think

House prices in Australia are soaring, but not because there aren’t enough homes

Broadly, we have enough homes. The 2016 census found we had 12 per cent more dwellings than households, up from 10 per cent in 2001.

If there really weren’t enough homes for people who wanted them, it would be more than property prices soaring; it would be rents. Instead, overall rents have been barely moving – growing even more slowly than wages – for half a decade.

So you want to live in a tiny house?

Earthquake-resistant tiny prefab boasts voice-controlled technology

Singapore- and China-based design studio Nestron has revealed a 14.5 square meter tiny home dubbed Cube One. The prefabricated single room home is ready to move-in from delivery and boasts a series of smart and sustainable technologies for a relatively cheap price tag of $30,000 (without land.) (Included this as an example of a tiny home, not a recommendation. – Many tiny houses have small footprints by doing things like use loft beds. Won’t work for people needing wheel chairs or wheelie walkers.

Tiny homes are adorable and cool, but how does the reality of living in one compare with the image?

-

One tiny house devotee has said the lifestyle requires planning and organisation to avoid the homes becoming messy quickly.

-

Another said the lifestyle provided peace of mind as he can drive his home, which is built on a truck, away from a fire threat.

-

The Australian Tiny House Association says the homes offer an answer to the urgent homelessness issue that senior women are facing

What’s the big driver for Co-op housing? We ask…and find many answers

“The desire for people to be connected to their community and share resources is driving the “mainstreaming” of co-operative living around Australia, according to industry representatives.”

Cooperative housing: a key model for sustainable housing in Europe (Cooperative housing is more important in Europe than Australia.)

The following e-mail is a sample of some of the questions that might be asked about needs for affordable housing.

Email to a Northern Sydney beach Greens Branch:

“I am particularly interested in affordable housing but know little about the Northern Beaches area. A few dumb questions that might clarify our thinking.

- How many people who grew up in the NB area will be able to afford to live there as adults?

- How many people who work in the NB area have to commute long distances to find affordable accommodation? Does this make it harder to find good employees?

- Do older residents who want to downsize have to move outside the NB area because they cannot divide up the house they live in to allow partial sell-off or find affordable/more appropriate accommodation in the area if they sell.

- Lack of aged care services or accommodation in the NB area?

- To what extent do council regulations block potential solutions to the above problems? For example:

- Smaller buildings?

- The splitting up of larger buildings into smaller, more affordable accommodation?

- Adding granny flats or whatever that can be sold/rented to people who need affordable accommodation.

- Placing tiny houses or whatever in people’s yards?

- The number of unrelated people who can share a house?

To what extent do these problems affect nearby council areas?

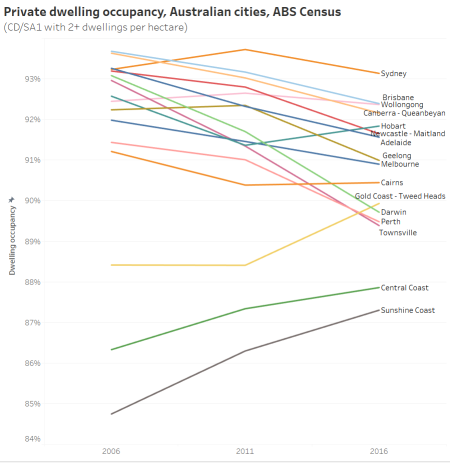

Where are the unoccupied dwellings in Australian cities?

N Netherlands unveils a 94-square-meter, two-bedroom home home 3D printed with concrete, and it wants to use the technology to house its growing population

Netherlands unveils a 94-square-meter, two-bedroom home home 3D printed with concrete, and it wants to use the technology to house its growing population

As part of a program exploring how the country can create the homes it needs. It was 3D printed at a nearby factory.

What role can local government play in delivering affordable housing?

Interesting one about the importance of retaining low income service workers. Advocates developer levy which is used to build affordable housing.

NOTE: What you need to keep teachers may need to be bigger/better than what you need to keep base restaurant workers.

Runaway land prices undermine housing utility

“Australia’s runaway land prices are akin to a national emergency. An increase of $4 trillion in just the next five years is highly likely.

Why isn’t housing affordability the most pressing policy issue?

Land price inflation of $600 billion this year will equate to 30 times the size of total banking profits. But our politicians barely raise a sweat over it. One could joke that the only time we hear of a land price crisis is when a wealthy campaign contributor wants their land rezoned.

Political intervention in the land and housing market via the use of first home buyers grants or stamp duty discounts have only seen first home buyer mortgages increase. Too much time has been spent on improving buyer deposits to “get into the game”, rather than confronting the land price spiral.

With every increase in mortgage or rental payments, there is less to spend into the local economy. This has a detrimental effect on small business resilience and jobs.”

A post on affordable rental accommodation will be written maybe some time

John, I was surprised by some of the information. It hadn’t occurred to me that we have 12% more houses than households, even though I work for two people who own empty houses ongoing.

Here’s another link, from one of your links:

When houses earn more than jobs: how we lost control of Australian house prices and how to get it back

He has suggested solutions which my poor brain can’t cope with right now.

The first graph shows the house prices have been rising quite steeply since 1950, apart from a couple of decade-long spells, the last of which was the 1990s.

Brian: “It hadn’t occurred to me that we have 12% more houses than households.”

The return on rental properties is quite low. The last time I looked the return on capital was about 2 – 3%. The real money is in the capital gains. As a result, people who have bought a house for capital gains can’t be bothered with the hassles of renting, particularly if renting looks like it may influence capital gains.

Numerous houses in our area are holiday homes that will be vacant some of the time even if the owners provide holiday rentals some of the time.

Then there are vacancies when houses are between rentals etc.

Brian: “We are often told the problem lies in supply — we don’t have enough homes in the places people want them. And while it’s true a reduction in the supply of housing relative to the population will reduce housing per person and increase housing rents, what we are seeing is something different — a growing divergence between rents and the price of housing as a financial asset that’s increasing much more quickly.”

Rental is a very separate market to house borrowing because you can’t borrow money to pay your rent. One of the graphs in my post shows rent increasing at a lower rate than wages.

I do an assessment of our share portfolio at the end of each financial year, so not quite there yet.

What I’m expecting is that what were solid income shares are probably paying about 3%.

Investment income is a bit hard to find without investing for capital gains. Which I believe is where the Americans have always looked to.

Regional areas like Byron Bay are suffering real housing problems because work at homers find it very attractive with it hippie vibe. (Median house prices have shot above $m.)

Rental is very hard to get. A typical vacancy will attract about 100 applicants with some offering extra in the hope of scoring a home.

I suspect that the rush on rental is being driven by people who want to see how working at home in Byron works before they commit and buy. There are stories appearing from time to time about people who thought it was going to work then discover that there are problems.

The smart thing to do would be to try working at home where you lived pre covid and think about which location gives the best job searching if you lose your job or your boss decides that you need to spend at least a bit of time in the big city.

There is a lot of good material in your study, John D.

Had I known you were doing it I would have sent you some images of a warehouse parking lot with pre cast complete building segments stacked like toys.

I have a few comments. One is that most recent house designs are not suitable for “splitting” as was possible in Victorian (the era) houses.

The best example of how that can be achieved was the parents in law of a friend in the Northern Beaches, a Dutch person, who built his house in a way that allowed him to later build 4 independent single room flatettes underneath the elevated single dwelling. These were always let.

The problem with subdivision is that if a developer does the process the two subsequent dwellings will be presented at the same price as houses on double the land ie at a price that eliminates the advantage.

For that to work two separate people have to work together to purchase, subdivide, and develop the sections together for mutual benefit.

The comments under “runaway land prices undermine housing utility” outline much of the problem.

Frankly, I call this a lost cause largely because the people for whom it is a problem have no voice. To say they have a vote is a fallacy as neither political party has a meaning full solution, nor the will to change.

One strategy that does work in the standard high growth market model is pairs of people (rather than couples) buy a property together for common ownership just to get a toe hold. One such arrangement was the identical twin daughters of a friend in NZ took that approach, perhaps a special case. If you compare that outcome to the CGRPT option, I think the latter is the better. In the CGRPT structure both sisters would have had their own property at the outset even though the combined capital growth would have been lower. But they would not have to do the mid stage sale and split stage with all of the disruption that causes.

The other important perspective is that government could do all that you have suggested AND enable CGRPT titles as well for a better mix of options for lower income people. I’m not holding my breath.

Thanks ff rolex: We are having a real housing crisis at Byron Bay and other Northern NSW coastal centers. The problem is made worse by people who have discovered that they can work at home during the COVID crisis wanting to move to good places to live. The crisis is a shortage of accommodation, particularly a shortage of affordable accommodation – In the past too much effort has been put into mansions for the rich.

For example, The Northern River Times July 2021 said on Ballina Renting: “Ballina Council wants Crown Land for Housing.” The article points out:

1. “More property owners are trying to make money out of their property.

2. More houses are being made available for holiday housing.

3. Move to region in response to Covid.

4. “Critical shortage in affordable properties and a greater sense of insecurity for those who are currently renting.

5. Current rental vacancy rate is less than 1%.

6. Increasingly, when a home does become available for rent it is not uncommon for up to 50 applicants to apply. Often people are offering to pay over and above the listed price in order to secure the property.

7. The Covid pandemic in particular has increased the number of people moving to the area from capital cities.”

John, CM yesterday had spreadsheets of house and unit prices all over Qld. Prices are going up pretty much everywhere in a way the has got to be unsustainable.

Biggest increases, from memory, in Brisbane were Chandler, Pullenvale, Chelmer and Brookfield.

Today they reckon we are running out of land in SEQ.

BTW ff rolex was spam!