Tony Abbott and Joe Hockey have been seen as herding the states and territories towards increasing the GST, rightly or wrongly. I suspect rightly.

Richard Denniss in the AFR says Forget GST, hit the rorts on super.

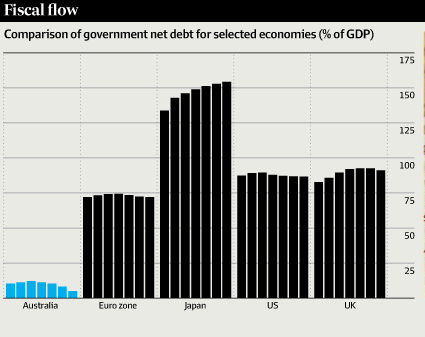

The Commonwealth government will collect $363 billion in taxes this year, with state and local governments collecting a further $83 billion in taxation. The GST accounts for around $51 billion, or 11 per cent, of total revenue. Increasing the GST to 12 per cent would collect an additional $10 billion or so. In an economy with a nominal GDP of $1521 billion and a population of more than 22 million it is, quite simply, small change.

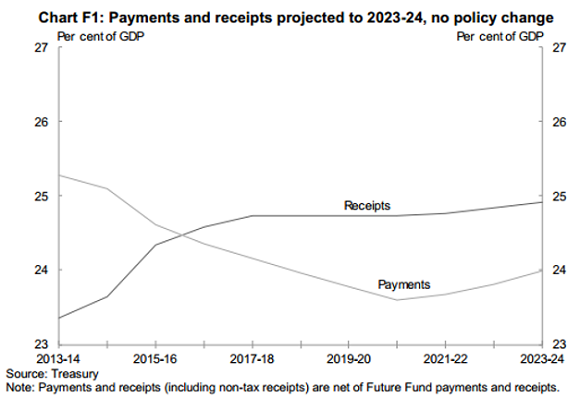

If raising the GST is “the solution” then ‘the problem can’t be very big, which, of course, is exactly what the World Bank, the IMF, the OECD and the rest of the world have been trying to tell us. Australia is a low tax, low-debt country.

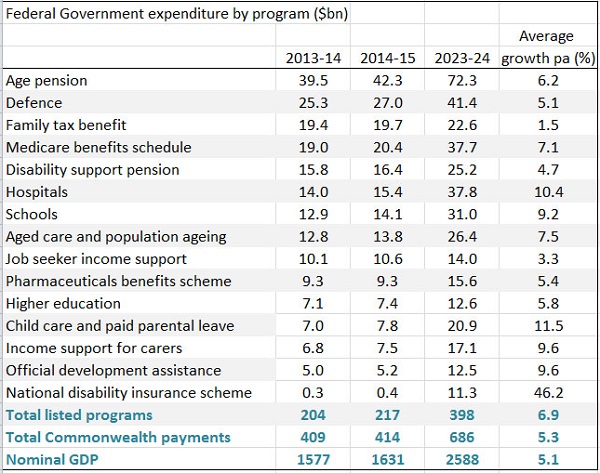

The pension is costing about $40 billion each year and is growing at 6% pa, only 1% faster than nominal GDP. Superannuation concessions, by contrast, cost about $35 billion, of which $13 billion flows to the richest 5%, and are growing at 12% pa.

Economists tend to favour taxing consumption, because it is efficient and less distorting than many other taxes. They tend to downplay the fact that it is regressive, once again selectively hitting those who can afford it least. They wave that argument away, saying that the needy can be compensated by increased transfer payments. Whether such payments would hit the mark is highly questionable. Moreover the better off in the community tend to see such payments as undeserving.

Denniss identifies other “rorts” such as the 50% capital gains concession, and the exemption of the family home, which can store massive value for the rich.

An alternative to increasing the rate is to increase the coverage. The list of exempt goods and services is actually quite large. I’ve copied it here for convenience:

- medical and other health services, hospital services, residential or community care and medical aids;

- education courses, course materials, student accommodation;

- child care services registered under the Childcare Rebate, eligible child care centres or other child care services

- exports of goods and services from Australia if exported within 60 days after the earlier of the day payment is received or the invoice is issued;

- religious services;

- non-commercial activities of charitable institutions;

- water and sewerage goods and services;

- sales of businesses as going concerns;

- sales of precious metals after refinement by the supplier and delivery to a precious metal dealer

- inwards duty free goods sales to a relevant traveller;

- sales of freehold interest in land or long-term lease made by a Commonwealth, State or Territory Government;

- subdivided farm land

- cars for use by disabled people.

I’m not sure about sales of precious metals and subdivided farmland, but I think Australia has its exemptions about right. It’s late but I can’t find food on the list. Most but not all food is exempt as explained here.

I’ve been explaining that Bowen and Rudd did not leave the budget in a mess (see ABC FactCheck). By adding $68 billion to the deficit, however, Hockey has created quite a mess of his own. Treasury boss Martin Parkinson explained that brave assumptions were required to fix it:

Prior to this budget, we were banking the house on 33 years of uninterrupted economic growth and there’s no precedent for that. We’re banking on another 10 years of fiscal drag and that being pocketed, and that has quite significant regressive impacts, and even then, we still don’t get back to surplus.

“Fiscal drag” means bracket creep.

Thanks Joe!

Tax the rich, I say. At least 80% for incomes of over half a million and a wealth tax for those who organise to have no income. Peter Martin points out that the wealthiest 75 have an average taxable income of $82.

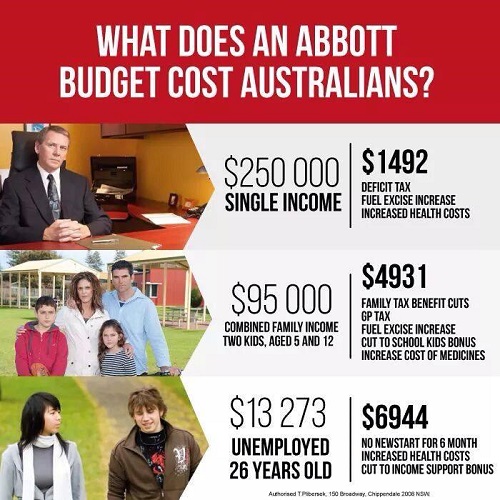

Meanwhile NATSEM modelling has found that low earners do most of the heavy lifting:

The budget hits 1.25 million low and middle income families with children on average by about $3000 a year in 2017-18 while it actually benefits upper middle and upper income families through removing the carbon price, according to modelling done by NATSEM at University of Canberra.

That’s apart from the young unemployed, where a 26 year-old loses $6944.

Clearly there is a need for a thorough review of the total tax system, which Labor undertook and then largely ignored. That was a major blot on the legacy of Swan’s treasurership and the Rudd/Gillard years, having commissioned the Henry review and then largely ignored it.