Richard Denniss at The Conversation takes a look at Menzies’ approach to debt financing.

Robert Menzies left Australia in far worse financial shape than he found it, at least according to current treasurer Joe Hockey’s favourite debt and deficit benchmark. Having inherited budget surpluses from the Chifley Labor government, the Menzies Coalition government ran small budget surpluses from 1949-50 to 1957-58.

But then Menzies’ “irresponsible profligacy” began, running budget deficits for the last nine years of his reign.

Menzies was interested in nation building rather than obsessing about budget deficits.

So, what was Menzies up to? He clearly wasn’t obsessed with the budget deficits or worried about numbers of public servants that so concern Hockey. The economy grew quite steadily, often growing at more than 6% in real terms. Unemployment was mostly around 2% or less, and only 1.6% when he retired. Over his time in power, you couldn’t even argue that Menzies was trying to balance the budget over the business cycle.

Menzies was interested in nation-building. He not only wanted rapid population growth, but he wanted infrastructure growth and growth in the health and education services that make a society both cohesive and productive.

Like any successful corporate leader, he was willing to use long-run debt financing to fund long-run investments. Menzies knew that a lot of his budget spending was for capital projects that would deliver benefits for decades, so why should he have funded them entirely out of one year’s revenue?

Hockey, on the other hand, wants to fund a big increase in infrastructure spending with no increase in tax and no increase in debt. He wants to fund more capital spending by cutting spending on essential services and income support for poor people.

The simplistic notion that a deficit is evidence that a government is “living beyond its means” is complete economic nonsense. Leaving aside that historic and international evidence provides no support for the claim that budget deficits cause long-run economic problems, the argument is contradicted by the corporate decision making that politicians pretend to emulate.

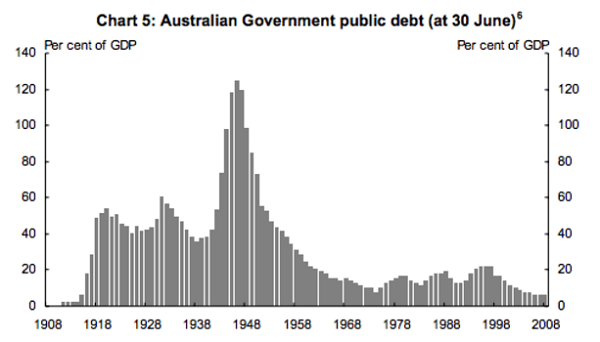

Historically substantial levels of public debt have been normal:

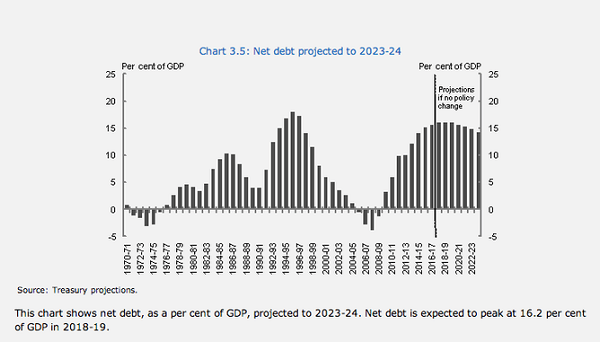

Commonwealth net debt stood at 12.5% of GDP in June. The following graph shows net debt projected out to 2013-24:

Government ministers are fond of household and corporate analogies.

It is perfectly normal for a family to borrow money to buy a house, up to 27 to 30% of annual income. Corporates that do not have debt of 30 to 60% of net worth are said to have ‘lazy’ balance sheets. Unless they take on respectable levels of debt, growth prospects are usually minimal.

Parents of a school wanting to build a swimming pool or other optional facility typically need to borrow money otherwise they will never get the use of the facility while their kids are at school.

Where would Brisbane be without the Story Bridge? According to Wikipedia the successful tender was ₤1,150,000. From memory the debt was finally paid off in 1997, when the payments were actually negligible.

Hockey, Abbott, Cormann and company take us for fools, insult our intelligence and generally carry on in a reprehensible manner! They are not acting in the national interest.

See also Hockey’s debt and deficit mess.

Menzies was prime minister at a point where Australia still had a positive vision of the future. A time where most of the adults had been traumatized by the depression and WWII. A time when leaders were scared of communism and that another depression could lead to a communist revolution.

Then there was the power of the communism in the union movement.

Given all of the above it was not surprising that Menzies was keen to see Australia grow both in population and economic performance. Keen to protect Australian industries and to be very wary of any growth in unemployment. (He nearly lost power to a poorly led Labor party when unemployment rose above 2%.)

He was also keen to invest in education and provide a path for the children of the workers to become part of the educated class. He introduced things like commonwealth scholarships and the expansion of the universities and was prime minister when there was a big surge in the number of working class children going to education.

Much of what he did seems quaint by today’s standards, but, by todays standards he was well to the left of the Labor party on a whole range of issues.

On the analogies

True, but, that’s to by a new country not renovate the country they already own.

And very few expand their owing year on year by spending more than they earn, that’ll lead to repossession by the lender.

Our Nation can’t claim a deduction of the interest payments of $12,000,000,000 p/a to offset ” net worth growth” taxes.

It’s a dead loss.

( Quick quiz; How many years of $ 12,000,000,000 surpluses would we need to reduce our debt by $1 [ silly graph by treasury not withstanding ])

Nations should borrow to build

swimming poolsdams and the users of the water thru newswimmerstax payers and economic activity.We don,t need

swimming poolsdams that don’t get used for 6 months of the year and generate no revenue from any of the users.Story Bridge ?

A good stimulus measure during the Great depression a 1.2m .

The $ 8.5 m suicide fence a bargain too and long over due.

( Quick quiz 2 ; How many suicides there since the 1940 opening ? )

I started work during the Menzies era Jumpy. I rather liked a system where my employer paid me to go to university and where the issue in my final year at school was working out what I wanted to be instead of wondering whether I would be able to get a job.

Sure, there were lots of things wrong during the Menzies era but there is a lot to be said for governments that do invest for the future and think that there is a crisis when unemployment goes above 2%.

John

I have no idea about Menzies, Whitlam or Sir Barton.

My kids have no clue about Frazer or Hawke.

But they have heard about spending more than they make, the difference between needs, wants and investments, good and bad debt, inheriting debt from predecessors and advantages of receiving interest rather than paying it.

You may have lived through the Goldilocks period of economic expansion periods, and good luck to ya, but will my kids ?

I fear not, but one thing is certain.

They will not inherit debt from me, but the debts they do inherit they will know who is responsible.

Jumpy, in all that the point you made that I’d accept is that in the long run we can’t spend, including on interest on debt, more than we earn. The real import of the two graphs is that current debt is not high by historical standards, certainly not a ‘disaster’ or a ‘mess’, and can be brought under control in the mid-term in an orderly manner. I’ve repeatedly shown that Labor was on course to do that.

The real argument is about how big the public sector should be. Hockey has arbitrarily decided it should be no more than 24% of GDP. Labor would probably lift that to 26% through bracket creep. Other countries have shown that they can have a civilised life and a vibrant economy with the public sector running as high as 50%.

I think we need to have a mature debate rather than all the ideological blather we get right now.

Brian: Quite right. We also need to have an adult conversation about what we would like Australia to be like and how we are going to pay for. Our problem at the moment is that our politicians are spooked by the tax word but somehow think it is OK to avoid increasing taxes by screwing the people at the bottom of the pile.

Jumpy: In retrospect I would be a lot better off now if I had borrowed to buy rental properties and controlled my debt level so that the borrowing could be paid off by the rent. If I had done so my kids would be better off when we die and may have benefitted in the short term from greater parental generosity. However, if I had gone berserk and borrowed to the point where a change in the economy or personal circumstances had forced me to sell houses during a major housing slump then I could have ended up bankrupt. It is all about balance and a conservative approach to risks.

Problem at the moment is that we have all these politicians and their supporters who think it will help hem if they declare a budget crisis even thoughit is stuffing the country.