Richard Denniss at The Conversation takes a look at Menzies’ approach to debt financing.

Robert Menzies left Australia in far worse financial shape than he found it, at least according to current treasurer Joe Hockey’s favourite debt and deficit benchmark. Having inherited budget surpluses from the Chifley Labor government, the Menzies Coalition government ran small budget surpluses from 1949-50 to 1957-58.

But then Menzies’ “irresponsible profligacy” began, running budget deficits for the last nine years of his reign.

Menzies was interested in nation building rather than obsessing about budget deficits.

So, what was Menzies up to? He clearly wasn’t obsessed with the budget deficits or worried about numbers of public servants that so concern Hockey. The economy grew quite steadily, often growing at more than 6% in real terms. Unemployment was mostly around 2% or less, and only 1.6% when he retired. Over his time in power, you couldn’t even argue that Menzies was trying to balance the budget over the business cycle.

Menzies was interested in nation-building. He not only wanted rapid population growth, but he wanted infrastructure growth and growth in the health and education services that make a society both cohesive and productive.

Like any successful corporate leader, he was willing to use long-run debt financing to fund long-run investments. Menzies knew that a lot of his budget spending was for capital projects that would deliver benefits for decades, so why should he have funded them entirely out of one year’s revenue?

Hockey, on the other hand, wants to fund a big increase in infrastructure spending with no increase in tax and no increase in debt. He wants to fund more capital spending by cutting spending on essential services and income support for poor people.

The simplistic notion that a deficit is evidence that a government is “living beyond its means” is complete economic nonsense. Leaving aside that historic and international evidence provides no support for the claim that budget deficits cause long-run economic problems, the argument is contradicted by the corporate decision making that politicians pretend to emulate.

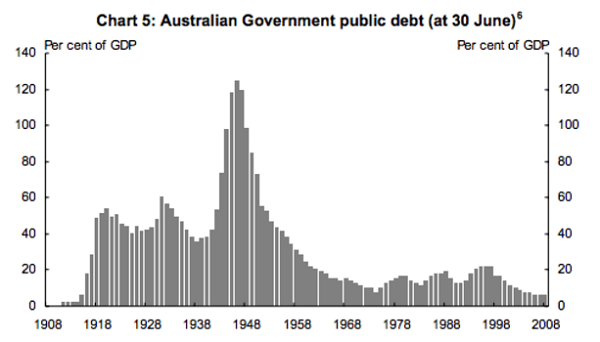

Historically substantial levels of public debt have been normal:

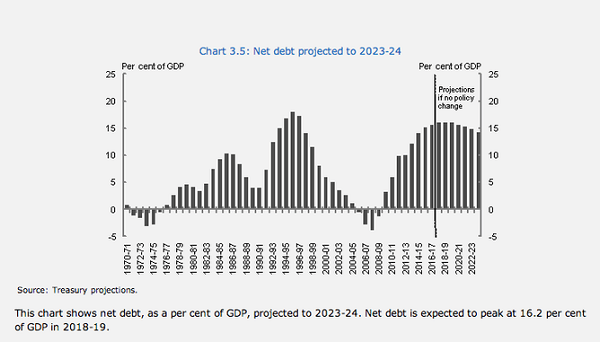

Commonwealth net debt stood at 12.5% of GDP in June. The following graph shows net debt projected out to 2013-24:

Government ministers are fond of household and corporate analogies.

It is perfectly normal for a family to borrow money to buy a house, up to 27 to 30% of annual income. Corporates that do not have debt of 30 to 60% of net worth are said to have ‘lazy’ balance sheets. Unless they take on respectable levels of debt, growth prospects are usually minimal.

Parents of a school wanting to build a swimming pool or other optional facility typically need to borrow money otherwise they will never get the use of the facility while their kids are at school.

Where would Brisbane be without the Story Bridge? According to Wikipedia the successful tender was ₤1,150,000. From memory the debt was finally paid off in 1997, when the payments were actually negligible.

Hockey, Abbott, Cormann and company take us for fools, insult our intelligence and generally carry on in a reprehensible manner! They are not acting in the national interest.

See also Hockey’s debt and deficit mess.