1. China drives electric vehicles boom

An AFR article about investors piling into lithium and graphite mining stocks tells a tale. With our focus on Tesla we are missing the story of China.

- Although the Western world’s focus is on Tesla’s progress, it is China’s EV push – it makes up 38 per cent of the global EV fleet, an increase from just 8 per cent in 2012 – that is really turning the dial.

Argonaut’s Hong Kong-based analyst Helen Lau says the massive subsidies available in the Chinese EV market to curb carbon emissions and lessen that country’s reliance on oil imports make electric cars up to 15 per cent cheaper to buy than conventional, internal combustion ones.

Battery packs make up about a third of the cost of an EV.

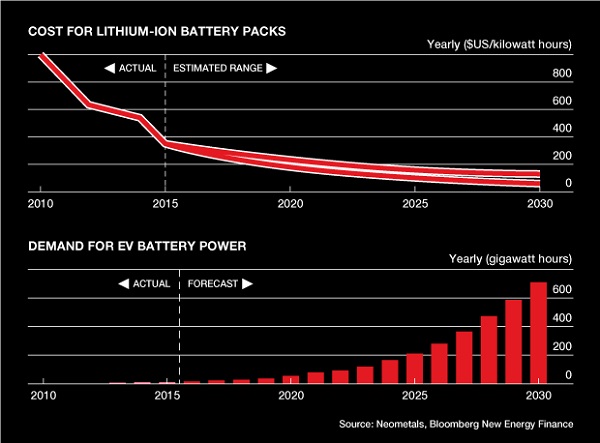

- Lau estimates the global demand for EV batteries will see a compound annual growth rate of 34 per cent until 2020. By 2025, EV batteries will absorb 62 per cent of the world’s lithium carbonate equivalent (or LCE, the industry measure for global lithium supply and demand) – up from just 17 per cent today, she says.

Here are Bloomberg’s estimates of cost and demand:

2. The renewable energy investment drought has broken

The link is to an article by Tristan Edis, who works for Green Energy Markets, an outfit which assists clients make informed investment, trading and policy decisions in the areas of clean energy and carbon abatement. One of the things they monitor is Large-Scale Generation Certificates (LCGs), which trade in a market which hangs off the Large-Scale Renewable Energy Target, part of the RET. The RET is set by legislation and both Greg Hunt and Josh Frydenberg have assured that it will remain.

It seems that firms that deal in the power system need to have LGC’s and some risk non-compliance, so the price is going up, making renewables more cost competitive.

Edis says larger power retailers are stepping back into the market offering long-term power purchase agreements (PPAs) or investing directly in projects.

There are some tentative signs of financiers willing to take merchant risk.

Also State Government initiatives are providing contracts that provide long-term revenue security.

Edis says:

- Of vital importance to investor confidence, the government left the RET out of the scope of the terms of reference for the Climate Change Policy Review.

All the while costs are coming down. So prospects for renewable energy are looking up, with an impressive list of projects planned or being developed, but:

- Unfortunately there are signs this government may be contemplating a scare campaign around Labor’s 50% renewable energy. If they’re not careful this will scare investors away again and in doing so undermine a key source of jobs and growth in regional Australia.

3. Australia’s energy rule maker hasn’t a clue about renewable energy

Giles Parkinson bells the cat.

- The Australian Energy Market Commission is the nominally independent body that sets the rules for the country’s energy markets. You’d expect, given the importance of its role, that it would have some basic understanding about the costs of the technologies that it is dealing with.

In the case of wind and solar, it is becoming increasingly obvious that it has no idea. Over the last few days, the AEMC has released important and influential reports that simply take the breath away for the depth of its ignorance.

For example, Frontier Economics, on whom they rely for costings and modelling, assumes a capacity factor of 22 per cent for large-scale solar. Current projects are already getting 26 per cent, and most new ARENA projects – because they are using single axis tracking – will get capacity factors of more than 30 per cent and up to 32 per cent.

- That is probably the principal reason why Frontier – and through it, the AEMC – thinks that the cost of large-scale solar is around 50 per cent more than it actually is, and in 2040 (in their projections) will still not fall to actual current levels.

If the facts are wrong, the tone is even worse. The recent reports done by CSIRO and the Energy Networks Australia, plus the separate one by the chief scientist Alan Finkel, seem to be in a different century and about a different planet.

COAG has been grumbling about the AMC, but Parkinson says COAG should kick them out along with their modellers, “and find people with a finer grip on reality, and with a focus on the future, not the past.”

4. Donald Trump nominates former Texas governor Rick Perry to be energy secretary

Perry, who is close to the oil industry with corporate positions in two companies, is to be in charge of a federal department he proposed eliminating during his bid for the 2012 Republican presidential nomination.

Employees in the Energy Department feel threatened because the Trump transition team has asked for the names of staff supporting Obama’s climate policies.

Ryan Zinke who has been asked to be Secretary of the Interior is a climate denier.

Then we have Rex Tillerson as Secretary of State:

- As CEO of ExxonMobil, Rex Tillerson presided over the world’s largest publicly traded oil and gas company — a company that has come to represent, for climate activists, the very antithesis of climate action.

There are others, of course. Trump seems very keen on delivering on his climate change denial policies.

Matthew Kahn looks at How China will run rings around Trump on Green Energy, and Win Big

The US doesn’t look like a good place for climate action at the moment. On the other hand some of Trump’s appointments sound like people who really could make things happen if they decide this is what is necessary. (I live in hope.)

John, Trump seems very determined to promote coal and fossil fuels.

It could be that coal is unrevivable, and the many states have initiatives to promote renewables and EVs. Trump may end up going with the strength.

However, he won’t give any leadership internationally, and I think there is about $3 billion pa of aid to developing countries that will go down the gurgler.

Here’s Climate Central on Rex Tillerson as Secretary of State and the problem of conflict of interest:

Surely he will not give up all that to work for the government. The biggest problem, however, is his relationship to Putin and what the company could gain from regularising relationships.

Surely the Senate would have to have a close look when his nomination comes up.

Tillerson probably has more money that he needs and will make the sacrifices in return for being able to do something like be secretary of state. What happened to Hillary’s money when she was secretary of state?