AGL, Origin and Energy Australia are gouging electricity retail prices, according to a report by The Grattan Institute titled Price shock: Is the retail electricity market failing consumers?.

AGL, Origin and Energy Australia are gouging electricity retail prices, according to a report by The Grattan Institute titled Price shock: Is the retail electricity market failing consumers?.

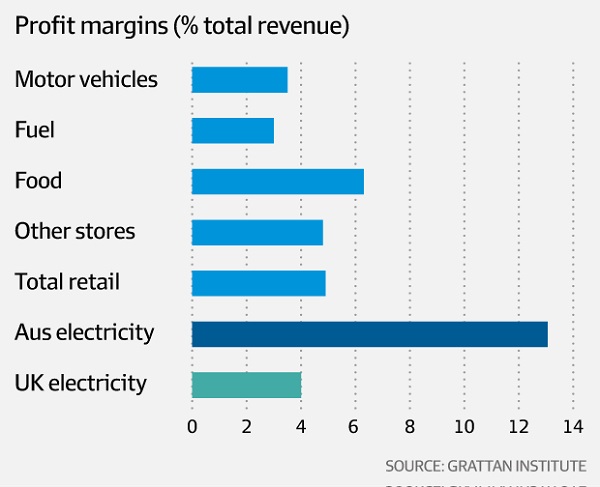

The report which focusses on Victoria finds that electricity retailers charge a margin double what other retailers make, for doing little other than marketing a service we are going to buy anyway, and sending out a bill.

There’s more at the ABC.

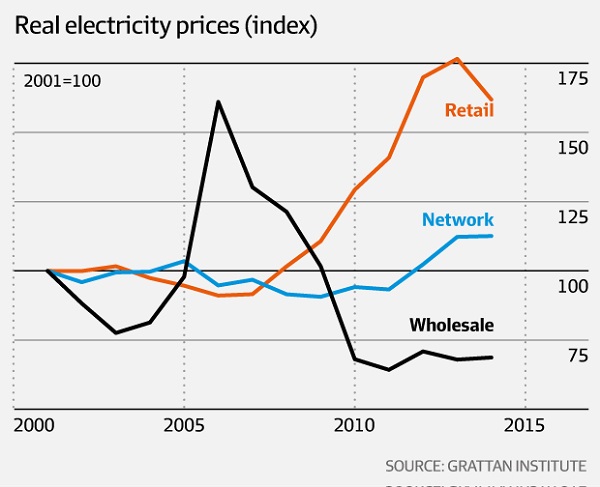

This graph shows that wholesale prices fell after 2005, and have been flat from 2010, network costs have risen moderately, but retail prices have rocketed:

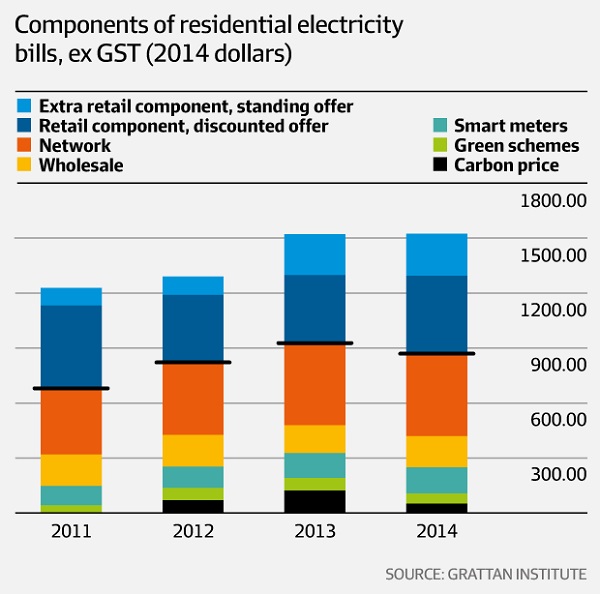

This graph gives more detail on the components of the charge:

The cost of all green schemes and the cost of installing smart meters combined is about 6 per cent. By contrast consumers who do not shop around and are on so-called “standing offers” are paying margins as high as 43 per cent. Consumers for a variety of reasons don’t shop around vigorously. If they did they could save between $94 and $164 a year. Half of all consumers haven’t changed retailers in the last five years.

This graph compares electricity retail margins with those of other retailers, and with electricity in the UK:

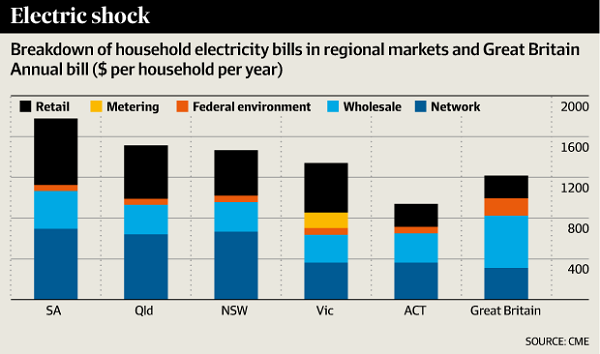

Bruce Mountain of energy consultancy CME took a look at the eastern state prices last year:

South Australia has high retail charges on top of the high generation charges. Possibly retailers there have to work harder selling more expensive electricity.

That article has some choice quotes:

- Matthew Warren, Australian Energy Council chief executive, said the Australian Energy Market Commission confirmed that “deregulation and competition deliver the best outcome for consumers” and would become more important as markets and technologies evolve.

According to an Origin spokesman, “We set energy prices based on real costs that we face, while remaining competitive and offering value for money”.

What to do?

- Facing similar problems Britain and Canada have both moved to partially re-regulate their electricity retail sector by mandating a basic tariff structure electricity sellers must offer to all customers.The Grattan report argues that Australia should not rush to follow this example because it could discourage important innovation such as bills that reward customers for using batteries and solar power.

Grattan says we should not give up on competition just yet. It argues that the Australian Consumer and Competition Commission should conduct an urgent inquiry into the electricity retail market. It suggests that in the absence of government regulation, retailers should be forced to report the data behind their profit margins to an independent agency such as the Australian Energy Market Commission.

I have to say that I have no confidence in the Australian Energy Market Commission. Remember:

- The AEMC has two roles in relation to the National Electricity Market – as rule maker and as a provider of advice to Ministers on how best to develop energy markets over time. The AEMC actively considers market development when it considers rule change proposals, policy advice and energy market reviews. These rules are binding on the Australian energy market and enforced by the Australian Energy Regulator.

They are the ones who have sat on their hands and allowed the present farcical situation with the electricity system to develop. In effect, the Finkel Review is an inquiry into them.

The Grattan report does not pick up on the events of the last two years, which have been quite dynamic. However, the report highlights the failure of the competitive market in the retail sector. It does not pick up on other influences of pricing, such as the rorts conducted by energy suppliers who bid in a half hour time slot, freeze out interstate competition, then withhold supply and sell into the artificially created peaks. Or the influence of the price of gas, which has been particularly important in South Australia, the state most dependent on gas.

Mountain’s survey shows power clearly cheapest in the ACT. I’m not sure this proves the efficacy of reverse auctions, but it does the argument no harm. Much depends on the timing, and I’m not sure of the dates of Mountain’s information in relation to the auctions undertaken by the ACT. Certainly, network costs are lower in demographically more dense places like the ACT, Victoria and Britain. Certainly also retail margins are low in the ACT.

Free market advocates may blame the people for not shopping around. However, free market advocacy is based on the notion that consumers act rationally at all times in their own interest, whereas it has always been blindingly obvious that they don’t. Moreover, the purpose of capitalist actors is to subvert reason and shovel rewards in their own direction. The deregulated electricity markets have offered them a new playground.

Brian, your last paragraph wins the web (for today at least).

ACT has had virtually no competition from interstate retailers. ActewAGL was formed in October 2000 when the Australian Gas Light Company (AGL) and ACTEW Corporation, a government-owned enterprise of the ACT Government, entered into Australia’s first utility joint venture – and has retained customer loyalty – very few switching out and why would they with relatively low retail prices. I suspect the joint venture arrangement has helped keep a lid on price increases. I doubt that the switch to renewable energy has yet had any real impact on prices as much of the construction of wind power and some of the solar is yet to take place

Thanks zoot, and thanks Douglas. That’s good and relevant information. Sounds like a good mix of government, private enterprise and community interest.

When these people ring up to say “you can save money by signing up to our twenty year supply plan” I say please double my electricity bill so I will have more incentive to go off grid. Kindly Mr Tesla is coming to my aid to make that plan more possible.

Get panels on roof: check

Get Tesla battery : shortly

Get Liquid Piston backup generator/water heater: coming in 5 years

Get off backside and convert rooftop PV to PVT: I have to order in the thermal tubes from Europe. Add to list.

Its not happening this year but there is movement towards my goal.

Renew economy had more to say about the middleman rip-off

and