Many of you might like what Pope Francis had to say about the world economy. What would need to happen to get closer to an economy that is actually made for the benefit of man? Continue reading Pope Francis on the world economy

Category Archives: Politics & Government

Hockey’s debt and deficit mess

In their usual sloganeering fashion Abbott, Hockey, Cormann and others constantly refer to the ‘budget debt and deficit mess’ (or disaster) they inherited from Labor. In the post Resolving the budget ‘crisis’ I attempted to show that Labor left the budget in reasonably good shape. In so far as there is a mess or a crisis now, the author is Hockey and company.

From comments I may have not made the case plain. In what I hope is my last post on the budget of 2014, I lay out the case again, with additional information.

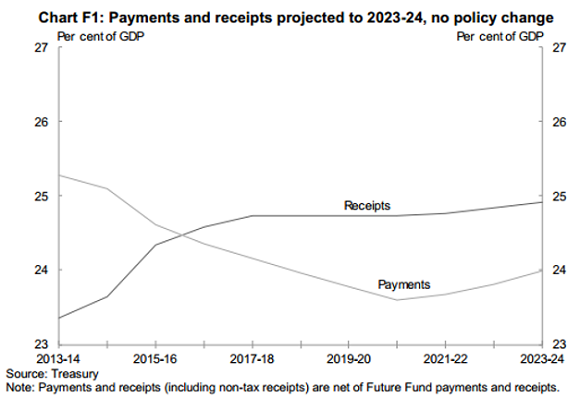

In the 2013 budget Wayne Swan went beyond the usual four-year projections to lay out expected receipts and payments over 10 years. He did this to reflect how the numbers would work out, given that the major payments for Gonski and NDIS did not cut in until after the four-year budget cycle. Swan left the budget in good fiscal shape.

When Bowen and Rudd took over from Swan/Gillard they had to rejig the budget to accommodate the early change from a fixed carbon price to carbon trading, plus some new policies. Labor’s legacy is reflected in the Pre-Election Fiscal Outlook (PEFO) prepared independently by Treasury and Finance and published under the charter of budget honesty in August 2013 before the last election is shown:

This graph has the budget back in surplus in 2015-16, an ongoing surplus of about 1% of GDP (about $16 billion) and a restoration of budget receipts to about 25% of GDP. The forecast assumed no tax cuts to offset bracket creep. In effect the government would take back some of the eight tax cuts delivered by Costello and the one delivered by Rudd.

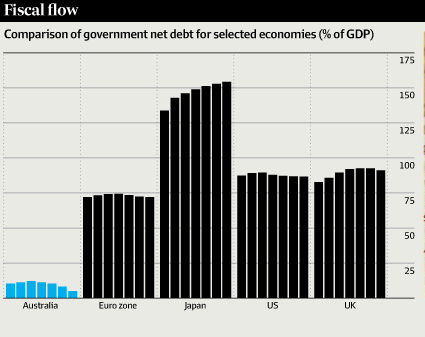

Six years of Labor had seen debt increase through the unaffordable tax cuts and Keynesian stimulation to counter the GFC. Nevertheless debt was modest by international standards.

Here’s Labor’s debt in context:

Hockey has done three main things.

First, he has added $68 billion in debt over the four-year budget cycle.

Second, he has delayed major cuts until the fourth year, as Ross Gittins has pointed out. (Ironically he has done this to stimulate the economy in transition from reliance on the resources boom. In fact consumer confidence tanked from the pre-budget talk of austerity and remains at levels of the 1991 recession.) Hence the budget does not reach surplus until 2016-17, one year later than Labor.

Third, Hockey has restrained receipts to 23.9% of GDP, according to Gittins, one election promise he has kept. Hockey has put the budget into a straight jacket entirely of his own making. This decision is based on his austerity/small government ideology.

The transition from Swan to Bowen to Hockey is reflected in this graph a form of which was published in the AFR at the time of the Mid-Year Forecast and Economic Outlook (MYEFO) last December.

Swan’s embarrassment and a fair bit of the negative view of Labor’s reputation as an economic manager is reflected in the difference between MYEFO for 2012 and the 2013 budget. Swan/Gillard had bravely forecast a budget surplus for 2012-13, but had to give up and defer for two years because of failing revenue. Treasury and Finance seemed to be completely blindsided by what was going on but the repeated failure of revenue to meet forecasts made the government look incompetent.

I understand revenue picked up a bit in the weeks before PEFO 2013, mainly due to better receipts from the mining and carbon taxes. I believe it was stable between PEFO 2013, Labor’s legacy, and MYEFO 2013, Hockey’s mess.

You will recall that the from ABC Factcheck confirmed Bowen’s contention that Hockey added $68 billion of debt to the forward estimates:

In the overall narrative the focus should be on what Hockey has done in increasing the deficit and in establishing a 23.9% of GDP limit on receipts. Instead we have sloganeering and a welter of numbers in an attempt to sheet home the entire blame to Labor. The LNP keeps saying that they gave us the budget the country needed and that there was no choice. There was choice in the overall budget framework as well as the allocations within it, which privileges the rich and the corporates and punished everyone else. Infrastructure and defence have also received increases, beyond normal inflation, though the former is limited to roads, neglecting public transport.

One sloganeering tactic is to state (true) that we are paying $1 billion in interest every month, and then rattle off what could be achieved with $12 billion extra in the budget. This entirely overlooks the need for debt to counter the GFC and the state we would have been in had we followed LNP policies.

Another is to say that if nothing were done then in 10 years the debt would be $667 billion pa. No economic commentator has had a good look at this claim, but it’s based on the Hockey mess, not Labor’s as such.

Based on that $667 number, they now have dazzled everyone with a ‘blizzard’, to borrow Bernard Keane’s description, of numbers derived from it. The interest bill becomes $2.8 billion per month, or $25,000 for each man, woman and child in the country, $100,000 for a family of four. Each Australian’s share of the interest would be $9,400 over the next 10 years, and so on and on.

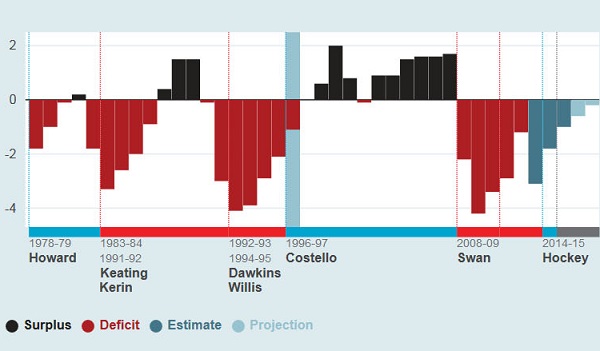

Keane says it’s a Howard trick, although Howard had the gumption to stick to one number. Does anyone remember the ‘Beazley black hole’, the gigantic deficit left to the Howard government in 1996? This graph shows the budget balance history going back to when Howard was treasurer:

The graph is interactive. I’ve taken a screen shot with the blue marker bar over the socalled “Beazley black hole” It wasn’t a black hole and it wasn’t even Beazley’s as he was finance minister; Ralph Willis was treasurer. The deficit in that year was a benign 1.1% of GDP.

[This graph has replaced the less good one I had in the original post.]

The Tories have form, they specialise in lies. I’m inclined to think this present lot are liars, clunkheads or both, Laura Tingle’s assessment in 2010, and unfit for government.

Update: ABC FactCheck have done a thorough analysis of Hockey’s claim that

“At the moment we’re paying a billion dollars a month – one billion dollars every month in interest, in interest on the debt that Labor has left.”

Labor only incurred 75% of the current debt and there is a difference between gross debt and net debt. The verdict:

Using either gross debt or net debt, Mr Hockey’s claim that at the moment Australia is paying a billion dollars every month in interest on the debt that Labor left is exaggerated.

A nice way of saying he’s lying.

Previous posts on Budget 2014:

On a mission to upset everyone

Poll anger or a shift in the tectonic plates?

Cap super, says Richard Denniss

See also especially Hockey’s morality play.

Brandis protects hate speech

During the last week in March, before this blog came to life, Attorney General George Brandis introduced to parliament an exposure draft of changes to the S18c of the Racial Discrimination Act. Brandis goes beyond everyone’s “right to be a bigot”. He seeks effectively to protect the right of individuals, especially those working in the media, to use hate speech.

During the last week in March, before this blog came to life, Attorney General George Brandis introduced to parliament an exposure draft of changes to the S18c of the Racial Discrimination Act. Brandis goes beyond everyone’s “right to be a bigot”. He seeks effectively to protect the right of individuals, especially those working in the media, to use hate speech.

Much of the discussion and commentary has been in terms of free speech. I agree with Mark that this is to mistake fundamentally the aim of legislation against hate speech.

Its purpose is to provide redress against harm, harm felt by specific individuals and groups.

It’s not about freedom of speech. It protects speech which is justified on several grounds – including literary and artistic merit (so the argument about Salman Rushdie is entirely specious). It’s about not doing harm through the expression of hateful speech.

If we consider the effects of actually existing racism (or any other form of hate), it doesn’t take too much reflection to see that hurt leads to harm pretty quickly – it’s demonstrable in the impacts of hate speech on identity and thus wellbeing, and there’s a path from wounded identity to self harm, even suicide. (My bold)

Comments on the draft are now being considered by the Government. There’s a whisper that they reconsidering, but the question is still open. You can send Abbott/Brandis a message by signing this petition against hate speech.

In the following section I’ve laid out the nuts and bolts of the proposed changes.

Proposed changes to S18c

Simon Rice explains that the current test for racial vilification is “conduct causing offence, insult, humiliation or intimidation”. Offence, insult and humiliation have been dropped in the proposed changes. Verboten now is an act which is reasonable likely

(i) to vilify another person or a group of persons; or (ii) to intimidate another person or a group of persons.

Intimidate means to cause fear of physical harm:

(i) to a person; or (ii) to the property of a person; or (iii) to the members of a group of persons.

Vilify means to incite hatred against a person or a group of persons.

For an act to be unlawful it must must be “otherwise than in private” and must be done

“because of the race, colour or national or ethnic origin of that person or that group of persons.”

So the focus is now to be on vilification and intimidation (causing fear of physical harm). It’s OK to cause offence, insult and humiliate.

Vilification and intimidation are permissible if they involve:

words, sounds, images or writing spoken, broadcast, published or otherwise communicated in the course of participating in the public discussion of any political, social, cultural, religious, artistic, academic or scientific matter.”

Reasonableness

“is to be determined by the standards of an ordinary reasonable member of the Australian community, not by the standards of any particular group within the Australian community.”

The actual feelings of the target person or group are irrelevant.

Acts are to be judged independently of their actual effects, rather on what their effects would be if perpetrated on some mythical average member of the dominant group in society.

Discussion

To me, humiliating someone means putting them down, diminishing their esteem in their own eyes and in the eyes of others. To do that on the basis of race, colour or national or ethnic origin is to cause personal and social harm, is racist and frankly appalling. It’s a form of bullying, is tantamount to violence and should be illegal.

Some might argue that to tell the truth can involve offence and insults. Nevertheless I would argue that to offend or insult someone in relation to race, colour or national or ethnic origin means that you regard them as defective or inferior on those grounds. Again harm is done and I have no difficulty in making such acts illegal.

Truth telling appears to have no relevance to Brandis’s notion of free speech. A person can be humiliated, in public, by someone telling a pack of lies, and that’s OK.

Hate speech, racial intimidation and vilification in the public sphere is acceptable in Brandis’s world. To quote Michelle Grattan

In other words, anything goes in the name of free speech, accurate or not.

Vic Alhadeff reminds us that we will never have completely free speech:

“The late Justice Lionel Murphy said: ‘Freedom of speech is what is left over after due weight has been accorded to the laws relating to defamation, blasphemy, copyright, sedition, obscenity, use of insulting words, official secrecy, contempt of court and parliament, incitement and censorship’.”

That’s eleven categories imposing limits on what we are permitted to say in public.

All in all Brandis has cooked a rather nasty brew, emanating I’m afraid from a rather nasty cook. Brandis should remember that the robustness of parliament has resulted in suicide attempts. He seems to want to live in “a world of unrestrained biffo all round”, to borrow a phrase from Grattan.

“I think George saying this is about the rights of the bigots really laid bare the philosophy behind these changes.

“For them, it seems to be an abstract philosophical or legal argument. For them it’s a game, it’s a debate about words and abstract principles.

“For people who have experienced racism, it is a deeply personal debate, and it’s actually a debate about real people and real hurt.

“It’s a debate about real people in Australia, what happens on our buses and our trains, in the pubs on the football fields and on our streets. It’s about the message that our parliament sends and what I find missing, apart from the very offensive things in the debate, is empathy and compassion.”

Brandis has struck a blow for bigots, especially one bigoted journalist – Andrew Bolt.

Elsewhere

That was Ben Eltham at New Matilda.

Dennis Altman at The Conversation

Cristy Clark at The Conversation

Resolving the budget ‘crisis’

We definitely have a looming political budget crisis. Whether there is a fiscal/economic crisis is a separate question. First the politics.

Mark has an excellent post wherein he poses three alternative scenarios. I have only two, because I don’t see Abbott, Hockey et al being able to negotiate the maze that faces them in the senate. Nor do I see the Liberals changing leaders. There simply isn’t anyone. Hockey has broken his brand. Turnbull isn’t interested and not enough will have him. They couldn’t choose Morrison, could they, although his stocks are said to be riding high, having stopped the boats.

1. Abbott fails to negotiate important elements of the budget, such as eliminating the carbon ‘tax’, the proposed changes to Newstart and Youth Allowance, the changes to the age pension etc. As promised, Abbott would call a double dissolution election, after some bipartisan changes to senate voting practices. But note well, Antony Green for complex reasons says:

In my opinion there is not going to be a double dissolution in the near future, and even in the more distant future, I cannot see any possibility of a double dissolution before late 2015 or the first months of 2016.

2. Antony Green thinks that Abbott will only call a double dissolution if he thinks he can win. In this scenario Abbott fails to negotiate the senate, and the polls stay unfavourable. Abbott wimps out and limps on to a regular election in the second half of 2016.

I would discount the second option. Someone pointed out recently that when challenged, Abbott becomes more determined; if you like, more pugilistic. Moreover it would be manifestly foolish to struggle on with a government that lacks authority in the parliament and can’t effectively govern without Clive Palmer, who would maximise his leverage.

Of course, the polls might change. Apparently the feedback from the electorate to the party room was horrendous. For example the Oz gives us a taste:

JOE Hockey’s friends say he has been taken aback by the poor response to his budget from Coalition MPs. Well, Treasurer, you’d be horrified to know what some of them really think.

“There’s been no narrative. It’s been all over the shop. One minute we say there’s an emergency, the next there’s $8 billion for the Reserve Bank, $12bn for fighter jets, and we’re still splashing out on the paid parental leave scheme,” says one.

Now the government is considering a budget ad campaign. Except that there won’t be any radio, TV or newspaper ads. The campaign will fill our letter boxes with letters and pamphlets. Apparently the recalcitrant and benighted voters need to understand that this was the budget that the country needed. Needed, that is, to fix the “Labor debt and deficit mess”. You’ll hear that phrase a million times before the next election.

Which brings us back to whether there is a crisis in the fiscal/economic sense.

Jacob Greber and Phil Coorey had an article on the front page of the AFR Budget crisis is real, says PBO:

Parliament’s independent budget adviser has rejected Labor and Greens’ claims the Abbott government has concocted a budget crisis, saying without action Australia’s debt will grow at one of the fastest rates in the developed world.

In remarks that effectively endorse government warnings that if left unchecked, gross debt would balloon to $667 billion, Parliamentary Budget Officer Phil Bowen said it was time to begin the return to surplus to protect the economy against future crises.

“It is time to start coming out [of debt and deficit], otherwise the longer you leave it the more exposed you become and the harder it is to wind it back,” he told The Australian Financial Review.

This is sad, really sad. On page 47, buried in the middle of a tiny opinion piece by Andrew Leigh we had the truth. Labor in the Pre-election Fiscal and Economic outline had the budget coming back to surplus in 2016-17 in an orderly way. Hockey plans to do it by 2017-18, with the most horrendous cuts.

The document Leigh refers to was prepared by Finance and Treasury and released in August 2013 as part of the charter of budget honesty. Remember this table from ABC Factcheck?

Mainstrean journalists are too thick or too lazy to look at the facts. Instead they accept the LNP narrative.

With friends like that who knows what the polls will do?

Sensible people realise that there is no crisis, though we do need to bring the budget back to surplus within a reasonable time. After the confusion and sense of affairs out of control under Swan/Gillard, few seem to understand that finally, under Rudd/Bowen order had been restored. According to the independent umpire. Hockey has added the chaos and crisis in so far as it exists.

I’m inclined to think that Hockey/Abbott et al have fractured the basic contract with the people, that the people will not want to go back to the world of the pre-Whitlam era, which is where Trevor Cook compellingly thinks the reactionary tea party is aspiring to take us:

When they attack the so-called age of entitlement, they are really attacking the pillars of modern, Whitlamite Australia where concerns about access were more important than reducing the tax rate for business and rich individuals.

And the biggest stalking horse of all is Abbott’s efforts to get rid of Labor’s commitment to a national system of government and revert to a pre-federation style competition between increasingly impoverished states.

The intended victims of this charade are the poor and the middle class.

Abbott knows the states will be forced to cut spending – he wants them to do it.

Australia is at a turning point. And Abbott is no moderate, no centrist, not even a genuine conservative.

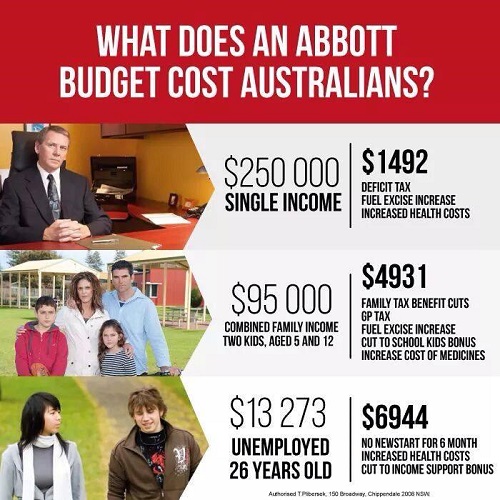

Perhaps the tea party utopia is best captured in this image from an anti-liberal site via Mark’s Facebook:

To GST or not to GST

Tony Abbott and Joe Hockey have been seen as herding the states and territories towards increasing the GST, rightly or wrongly. I suspect rightly.

Richard Denniss in the AFR says Forget GST, hit the rorts on super.

The Commonwealth government will collect $363 billion in taxes this year, with state and local governments collecting a further $83 billion in taxation. The GST accounts for around $51 billion, or 11 per cent, of total revenue. Increasing the GST to 12 per cent would collect an additional $10 billion or so. In an economy with a nominal GDP of $1521 billion and a population of more than 22 million it is, quite simply, small change.

If raising the GST is “the solution” then ‘the problem can’t be very big, which, of course, is exactly what the World Bank, the IMF, the OECD and the rest of the world have been trying to tell us. Australia is a low tax, low-debt country.

The pension is costing about $40 billion each year and is growing at 6% pa, only 1% faster than nominal GDP. Superannuation concessions, by contrast, cost about $35 billion, of which $13 billion flows to the richest 5%, and are growing at 12% pa.

Economists tend to favour taxing consumption, because it is efficient and less distorting than many other taxes. They tend to downplay the fact that it is regressive, once again selectively hitting those who can afford it least. They wave that argument away, saying that the needy can be compensated by increased transfer payments. Whether such payments would hit the mark is highly questionable. Moreover the better off in the community tend to see such payments as undeserving.

Denniss identifies other “rorts” such as the 50% capital gains concession, and the exemption of the family home, which can store massive value for the rich.

An alternative to increasing the rate is to increase the coverage. The list of exempt goods and services is actually quite large. I’ve copied it here for convenience:

- medical and other health services, hospital services, residential or community care and medical aids;

- education courses, course materials, student accommodation;

- child care services registered under the Childcare Rebate, eligible child care centres or other child care services

- exports of goods and services from Australia if exported within 60 days after the earlier of the day payment is received or the invoice is issued;

- religious services;

- non-commercial activities of charitable institutions;

- water and sewerage goods and services;

- sales of businesses as going concerns;

- sales of precious metals after refinement by the supplier and delivery to a precious metal dealer

- inwards duty free goods sales to a relevant traveller;

- sales of freehold interest in land or long-term lease made by a Commonwealth, State or Territory Government;

- subdivided farm land

- cars for use by disabled people.

I’m not sure about sales of precious metals and subdivided farmland, but I think Australia has its exemptions about right. It’s late but I can’t find food on the list. Most but not all food is exempt as explained here.

I’ve been explaining that Bowen and Rudd did not leave the budget in a mess (see ABC FactCheck). By adding $68 billion to the deficit, however, Hockey has created quite a mess of his own. Treasury boss Martin Parkinson explained that brave assumptions were required to fix it:

Prior to this budget, we were banking the house on 33 years of uninterrupted economic growth and there’s no precedent for that. We’re banking on another 10 years of fiscal drag and that being pocketed, and that has quite significant regressive impacts, and even then, we still don’t get back to surplus.

“Fiscal drag” means bracket creep.

Thanks Joe!

Tax the rich, I say. At least 80% for incomes of over half a million and a wealth tax for those who organise to have no income. Peter Martin points out that the wealthiest 75 have an average taxable income of $82.

Meanwhile NATSEM modelling has found that low earners do most of the heavy lifting:

The budget hits 1.25 million low and middle income families with children on average by about $3000 a year in 2017-18 while it actually benefits upper middle and upper income families through removing the carbon price, according to modelling done by NATSEM at University of Canberra.

That’s apart from the young unemployed, where a 26 year-old loses $6944.

Clearly there is a need for a thorough review of the total tax system, which Labor undertook and then largely ignored. That was a major blot on the legacy of Swan’s treasurership and the Rudd/Gillard years, having commissioned the Henry review and then largely ignored it.

Poll anger or a shift in the tectonic plates?

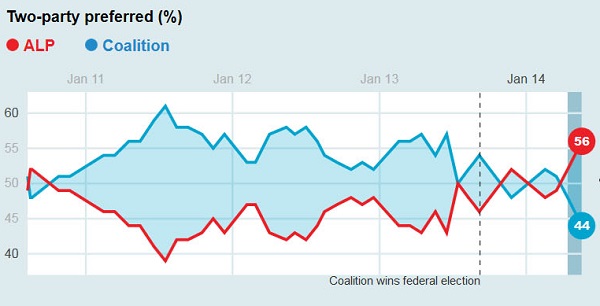

The polls are disastrous for the LNP. Nielsen is 56-44 to Labor, Newspoll is 55-45 and Morgan is a staggering 56.5 to 43.5. Historically Morgan tends to favour Labor, Nielsen was the most accurate at the last election.

The question is now whether these results represent short term anger at the budget or whether the tectonic plates have shifted. Laura Tingle comes out in favour of the latter:

Just every so often in politics there is a moment when you can almost hear the tectonic plates shift, and they don’t necessarily come with elections.

We saw one of these in 2010 when it emerged that Kevin Rudd was dumping his commitment to an emissions trading scheme.

The Fairfax-Nielsen poll suggests the 2014 budget is proving another such moment when politics can be turned on its head.

It is not just the dramatic slump in the government’s primary and two-party preferred vote, or the fact that Labor is, for the first time, the major beneficiary of this slump. It is not just that voters – in spectacular, angry numbers – think the budget is both unfair and not good for the country.

It is not even that Tony Abbott’s barefaced refusal to confront the fact he is breaking promises has enraged voters in a way that makes his position with them unrecoverable.

It is the fact that this poll suggests Tony Abbott and Joe Hockey will have little choice but to go back and rethink the entire political and economic strategy on which this budget is built.

Unfairness, not good for the country, broken promises, lies.

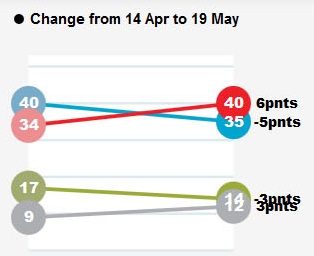

We are often told that Labor needs a 4 in front of its first preference vote in order to win. Suddenly it has one, for the first time since 2010, and the LNP doesn’t. There has been a cross-over:

Perhaps notably, the Greens have lost three points and the indies have picked up three.

This graph shows the Nielsen two-party preferred vote, ending with May 19:

Labor lost its way when Gillard announced the carbon ‘tax’ early in 2011. It looks as though there has been a shake-out since Rudd’s second coming, with the latest poll marking a decisive shift. Time will tell, but Tingle thinks the LNP will need to rethink it’s entire economic and political strategy.

In other aspects of the poll:

-

The only demographic where the LNP tops Labor is in the 55+, were it is now 43-39 to the LNP compared to 49-33 in April.

-

Shorten is now ahead of Abbott as preferred PM 51-40.

Abbott’s approval rating has gone from a net -7 to -28. Only 34% approve whereas 62% disapprove.

Shorten’s approval rating has gone from +2 to +12.

A staggering 63% say the budget is unfair, the first time ever there was a majority, compared with 33% who say it was fair. Gillard/Swan in 2013 scored 43-46.

-

53% thought the budget was good for Australia, again the first majority ever, compared with 42% who say it was good. Gillard/Swan scored 42-44.

Abbott said that the LNP was in a similar position after Howard’s first budget in 1996. He lied.

Abbott said there would be no cuts to health and education for several years. Again he lied. There will be $1.8 billion in hospital cuts from July.

Finally I want to emphasise again that Abbott, Hockey, Cormann and company are lying about Labor leaving a budget mess. This ABC FactCheck shows that Bowen and Rudd left the budget in good shape:

Elsewhere Mark’s excellent post stresses the unfairness of the 2014 budget and its attack on a foundational Australian value. It’s not too much to say, I think, that it has breached the social compact on which the Australian polity is based.

Shredding the fig leaf

Direct Action was always a fig leaf for a government pretending to have a climate policy. Now the climate change denialists in Abbott’s cabinet have taken the opportunity to shred the fig leaf to the complete embarrassment of Greg Hunt.

Giles Parkinson thinks the 2014 budget is Abbott settling old scores, and dumping clean energy in favour of the asphalt economy.

With proposals to repeal the carbon price, dismantle the Climate Change Authority and the Clean Energy Finance Corporation, and the dilution of the Renewable Energy Target already in train, these budget measures – which include the closure of ARENA, the dumping of the million solar roofs program (both contrary to election promises) and the research funding cuts at the CSIRO, Bureau of Meteorology and elsewhere – mean that the obliteration of the Clean Energy Future package will be complete, if it can get past the Senate.

Dumping ARENA is particularly stupid, as the fund was leveraging private investment at the rate of $2.50 to one and doing much to support the off-grid activities of the mining industry.

ARENA will maintain funds of $1 billion for around 190 projects – mostly R&D – that have already been contracted since its creation in 2012, but it will have a measly budget of just $15 million over each of the next two years for new projects.

Some 150 of its 180 projects already allocated are in support of research and development, a core competency not valued by the Government.

The Emissions Reduction Fund ($2.55 billion) has been spread over 10 years, rather than four. Tristan Edis explains that $2.55 billion will be allocated over the next four years, but the scheme only pays on completion. However, this does call into question the efficacy of the scheme.

Clive Palmer wants to divert the funds to pensions and is prepared to vote it down.

The million solar roofs scheme was a featured election promise.

The million solar roofs program, once a $1 billion centrepiece of Direct Action to bring solar to lower-income earners and renters, has sunk without trace — replaced by a derisory $2.1 million program to install solar on RSLs and bowling clubs in seven electorates, many of them marginal (yes, really).

But not to worry we still have “$525 million to pay up to 15,000 under-25s to pick up litter at below-award wages under the guise of the Green Army”.

Parkinson further reports

the abrupt closure of the Energy Efficiency Opportunities, as well as rejecting calls for the revival of Low Carbon Australia, which also supported investments in energy efficiency. It has also brought an end to support for ethanol and algae fuel programs.

The Energy Efficiency Opportunities program, which was to cost $20 million to run over the next five years, had helped deliver more than $1 billion a year in savings since 2006.

Alan Pears at The Conversation has more. He says the Clean Energy Finance Corporation which has already mobilised $2.5 billion of mostly private funding for low-emission energy and agriculture projects would make a profit for the government if allowed to continue. Like ARENA the CEFC will continue trading until stopped by legislation.

Pears says that leaves the Renewable Energy Target (RET) scheme as “the last major remaining piece of federal government policy that supports ongoing investment.” It has already led to $20 billion worth of investment, but is under review with climate sceptic Dick Warburton at the helm.

There’s more at The Guardian and at Planet Oz. There Graham Readfearn tells of the axing of a small $1.3 million program, which has been supporting more than a 150 local and state-based conservation groups across the country since 1973. Such is the depth and thoroughness of the attack on the environment.

Meanwhile global renewable energy jobs surged to almost 6.5 million in 2013. In Germany, where the government strategy was to take first mover advantage, renewable energy production reached 74% the other day.

We are striving to be last.

A crisis in trust

Politics is broken, is the shorter message of Mark’s post at The new social democrat. Mark, writing before Hockey’s budget speech predicted that the budget would be “horrible”.

He was right. There may have been a feeling that the bad news had been leaked early. In fact the true horror is being revealed in the detail coming out after the speech.The speech sounded like severe belt tightening with a raft of cuts (summary here). In the interview after the speech Sarah Ferguson nailed Hockey on at least two major points. The first is that ordinary folk will carry a bigger burden than the rich, not just proportionately, but in actual dollars. On one count $1400 for the rich and $3000 to $5000 for lower to middle income families.

In fact middle Australia, the poor, the young and the marginalised will be hammered in Hockey’s vision of an age of opportunity, rather than entitlement.

Take the young unemployed:

The Abbott government’s first budget revealed job seekers applying for Newstart or Youth Allowance, who have not been previously employed, will face a six-month waiting period of no income support before they are eligible for payments by undertaking 25 hours a week in the Work for the Dole program.

Once they have spent six months on the program, they will lose income support for another six months unless they undertake training or study.

People under 25 will not be eligible for the dole and instead will have to apply for Youth Allowance which is about $100 less a fortnight. Newstart and Youth Allowance will also be frozen for the next three years.

The hourly rate on Work for the Dole will be $10.20 for Newstart and $8.29 for Youth Allowance.

In the six months applicants for Newstart and Youth Allowance do not receive income support, they will be required to undertake government-funded job seeking programs.

For those thrown out of work Newstart will be limited. With some exceptions:

Newstart applicants will receive one month of income support for every year they worked before applying for the dole and exceptions to the six months…

I don’t think we can talk in terms of a general safety net any longer. We have instead active harassment in the name of stimulating greater personal responsibility. We are leaving a system where all are looked after in favour of a system where only the deserving are supportis severely conditional and incomplete.

Family payments will save a whopping $7 billion, but hardest hit will be:

Sole parents, single parents and parents of disabled children will be hardest hit under changes to family tax benefits, designed to save money and get primary carers back to work.

More harassment.

The second point coming out of the Ferguson/Hockey interview was that the Abbott government is intent on forcing the states to increase the GST by cutting the funding for schools and hospitals by $80 billion over the next 10 years. Hockey’s response was “States runs schools and states run the hospitals” and “All the GST goes to the states so it is up to them.”

That’s clear enough, but not what voters expected or were told to expect.

Mark quotes EMC research:

this week’s Essential Report suggests voters are expecting to take the fall for a budget emergency that is really just a false alarm.

Without believing the central premise of the budget, voters are left with a sick feeling they’ll pay for a budget that doesn’t fix the economy but rather punishes ordinary people in favour of the wealthy.

Mark says (read the whole post!):

The most important thing about this Budget is that it symbolises the brokenness of Australian politics. It’s a tipping point, a crisis moment for the political class.

Everything they [the Government] think they learnt in politics school is wrong, and the focus groups must be feeding this back. We can see this reflected through the inconsistent and panicked messaging from the government.Confected austerity economics will not work in a crisis of trust. Nor will “let’s all pull together” work in an age of upper middle class entitlement, generously fostered by John Howard’s electoral/fiscal calculus.

I still have some faith in Chris Bowen, who seems to me principled, articulate and genuine. I’d rather he gave the budget reply speech, but there is some hope for Shorten. He sounds less like a politician than many and that may eventually play in his favour.

Abbott has calibrated his message to mask his detailed promises about no cuts “full stop”. For example, he promised no cuts the the ABC and SBS, Instead $43.5 million is being taken out of their budget over the forward estimates. That’s 1% of general funding, plus cancellation of the Australia Network contract one year in, halving its budget. The ABC used the Australia Network funding to enhance its threadbare foreign coverage for the network generally.

Abbott is a silver tongued politician, master of slogans, but is sounding more and more like a salesman, inherently untrustworthy.

You don’t build a stronger Australia by shredding safety nets and increasing inequality.

Update: I thought I’d add here from this post the ABC FactCheck verdict showing how Hockey has added $68 billion to the deficit and essentially confected a budget ‘crisis’, as shown in this table:

See also Hockey’s morality play.

Also see Mark on Hockey’s social dystopia and John Quiggin on the mess of contradictions, meanness, trickiness and tribalism that is the Abbott-Hockey Government’s first budget.

Budget explainer

ABC Online has put together a neat budget explainer, telling us what is already on the record, what to watch out for and what might happen tonight.

Yesterday we heard that a further 36 government bodies will go in addition to the 40 already axed, at least on paper. Amongst them Ivor Frischknecht (literally ‘fresh servant’) had a lot to say about the expected demise of ARENA, the Australian Renewable Energy Agency. The audit commission recommended that ARENA be dissolved and its activities rolled into the Department of Industry.

Frischknecht seems to be taking the view that ARENA is legally obliged to keep operating until its governing legislation is changed. That will depend on the Senate.

The Government seems to be taking the view that decision-making and service delivery will be cleaner, more streamlined and more accountable if the Government does less. In my humble opinion burying the activities of separate, identifiable, dedicated agencies in the bowels of government departments will have the reverse effect.

Meanwhile Abbott gave backbenchers and newbies ‘love and reassurance’, but they still have to go out and sell the crock Hockey and co have cobbled together. They should sound about as convincing as sales people and be held in similar regard.

On a mission to upset everyone

Having upset the rich with their ‘debt levy’, and with 72% of people thinking it a broken promise, Abbott and Hockey are on a mission to upset the rest of us by re-indexing the fuel excise.

Richard Denniss told the 7.30 Report that the tax was good policy.

Sinclair Davidson told Waleed Aly that if you must tax, then taxing consumption is better than taxing production. The fuel excise taxes consumption. He forgets that sole traders (like me) driving a ute or a van would pay the tax. Nevertheless the LNP backbencher Ken O’Dowd in the linked article appears to be wrong:

A Federal Government MP has spoken out against plans to raise the fuel excise, warning it will force up the cost of everyday groceries.

Farmers and miners don’t pay fuel excise. That tax concession is worth some $13 billion, which the Greens would like to abolish.

Davidson also pointed out that fuel excise was a regressive tax, it disadvantages the poor. Those with time to ring up are letting Mr O’Dowd know:

“The phones haven’t stopped, especially with our older folk. We got off on the wrong leg, talking about increasing the pension age, I don’t think it was explained too good. It really concerned a lot of old people that they were going to lose their rights.”

It hardly matters now what the budget detail turns out to be – the damage has been done.

Meanwhile company directors are losing faith. Only 30% of company directors expected the new administration to have a positive impact on their business decision making, down from 70% when the LNP took over. Furthermore:

This loss of confidence has also translated into a fall in the proportion of directors who believe the Federal Government understands business – from 55 per cent last year to 48 per cent now.

Fully 80% say that achieving a budget surplus in the next three years is not a priority.

Wayne Swan says he left the budget in good shape. Chris Bowen has been saying that Joe Hockey has doubled the deficit by changes to Government spending and changes to Government assumptions. The ABC FactCheck verdict:

Since the election, the official forecast deficit has doubled. The economic assumptions are different from those used before the election, and spending decisions have been made that were not in the previous forecasts. Mr Bowen’s claim checks out.

Here’s the table that tells the story:

The PEFO of August 2013, prepared independently by Treasury and Finance, shows a surplus for 2016-17. Leaving aside Hockey’s moral austerity crusade, it does appear that he has confected the crisis.

Beware of right wing revolutionaries calling themselves conservatives

Rob Burgess had an interesting post in the May 2 Business Spectator on the commision of audit. He discusses the competing, and very different ideological positions dividing the political right as well as pointing out that “Australia has more to lose from radical change than just about any country in the world.”

The competing ideological divisions within the right wing of Australian politics might be described as:

- The revolutionary neo-liberal position that says that “the system is fundamentally flawed and needs fixing.” Their preferred fix are the radical steps required to remove the the restraints on our economy caused by the “dead hand of government.” Vs

- The conservative liberal position that says we are actually doing quite well and we should limit our efforts to incremental change. They might say something like: “In this situation it doesn’t make sense to be risking our gains by making unnecessarily dramatic changes. If you like: “If it aint broke why fix it?””

There is a similar division on the left of politics between those who want radical change (Think the end of capitalism) and those who favour incremental improvements.

The key question here is whether the current state of the Australian economy really justifies the sort of radical fix advocated by the Audit Commission. A comparison between Australia and other developed countries might be a good start:

- According to The Conversation, Commonwealth net debt “is about 11% of GDP, the third lowest in the OECD (the average is 50%), and low by historical standards” Not a crisis.

- Rob Burgess provided the following:

- Combined federal, state and local tax rates ran at a bit over 30 per cent during the Howard years, dropping to about 27 per cent during the Rudd/Gillard years. (State taxes account for around 4 per cent of GDP, and local taxes (rates) hover around 1 per cent of GDP.) By comparison, Singapore’s total tax-to-GDP ratio is around 14 per cent, the US 27 per cent, Switzerland 29 per cent, and Canada 32 per cent. Not a crisis but it would be interesting to know the reasons behind the low Singaporean rate. It is worth noting that people may actually be better off in a “high taxing” country if the high taxes mean that the state pays for services that other, lower taxing countries make people pay for themselves.

-

In terms of GDP corrected for purchasing power parity (PPP) we rank 10th on the World Bank and IMF scales. We could do better. A key factor here is how expensive it is to rent/buy a house in Australia compared with places like the US or Spain where house prices were really hit by the GFC. In our case, the problem really took off when Peter Costello offered negative gearing to people who could afford to borrow money to buy investment properties. His first home buyer schemes also tended to push up the price of houses rather than help first home buyers. However, fixing home prices is no win territory. It is a bit challenging to please existing homeowners and new home buyers at the same time when it comes to prices.

-

Australia does much better when we use the ‘human development index’, which factors in longevity (as a proxy for good health), educational attainment, gross national income and, in recent years, measures of inequality. On that scale we jostle for the number one spot with Norway. Not 6th or 10th. Number one. Definitely not a crisis.

- Best news of all is that last year’s Credit Suisse survey showed Australia having the highest median wealth per adult citizen of any nation. Definitely not a crisis although inflated home prices may have helped a bit here.

Conclusion: Australia’s alleged budget crisis is either the product of a fevered imagination or a deliberate attempt by neo-liberals to justify the imposition of their questionable ideas.

None of this mean that there aren’t many things in Australia that would benefit from radical change. However, the case for these radical changes should be justified by fact based, logical conversations about the specific issues. Definitely not based on ideological assertions about the dead hand of governments or private is best.

Elites rule

The USA can no longer be considered a democracy, according to a Princeton University study. Researchers Martin Gilens and Benjamin I. Page argue that America’s political system is effectively an oligarchy, where wealthy elites wield most power.

Using data drawn from over 1,800 different policy initiatives from 1981 to 2002, the two conclude that rich, well-connected individuals on the political scene now steer the direction of the country, regardless of or even against the will of the majority of voters

They say:

“The central point that emerges from our research is that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy,” they write, “while mass-based interest groups and average citizens have little or no independent influence.”

This phenomenon has been a long term trend, at least from 1980, with no difference depending whether Democrats or Republicans were in power. The phenomenon is therefore part of the natural order of things, hard to perceive let alone change.

Ordinary folk also have wins, but only when the elites agree.

Questions raised include why, how do you define ‘elite’ and is the American experience replicated here?

As to why, I can only point to two factors. Firstly, the lobbying industry is alive and well. Big Pharma are said to have more lobbyists on Capitol Hill than there are politicians.

Secondly, I recall in reading about trade matters some 10 years ago that very few Democrat senators were not dependent on business support to finance their campaigns.

In this interview author Martin Gilens identifies the role money plays in the political system and the lack of mass organizations that represent and facilitate the voice of ordinary citizens. Interestingly they found that

policies adopted during presidential election years in particular are more consistent with public preferences than policies adopted in other years of the electoral cycle.

As to defining elites, I would have been interested in the policy preferences of the top one or two percent, who are the real elites in my book. This exchange was enlightening:

Would you say the government is most responsive to income earners at the top 10 percent, the top 1 percent or the top 0.1 percent?

This is a great question and it’s not one we can answer with the data that we used in the study. Because we really don’t have good info about what the top 1 percent or 10 percent want or what issues they’re engaged with. As you can imagine, this is not really a group that’s eager to talk with researchers.

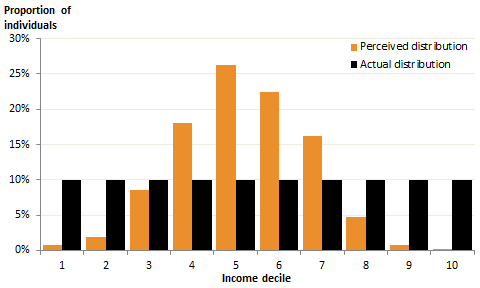

John Davidson drew to my attention this post by Matt Cowgill. Defining the elite by income is no simple matter.

First we have perceptions of income versus reality:

Some 83% of people think they’re in the middle four deciles of the income distribution, whereas by definition only 40% can be. It seems most of us think we are middle class. The rich especially have little idea of how privileged they are.

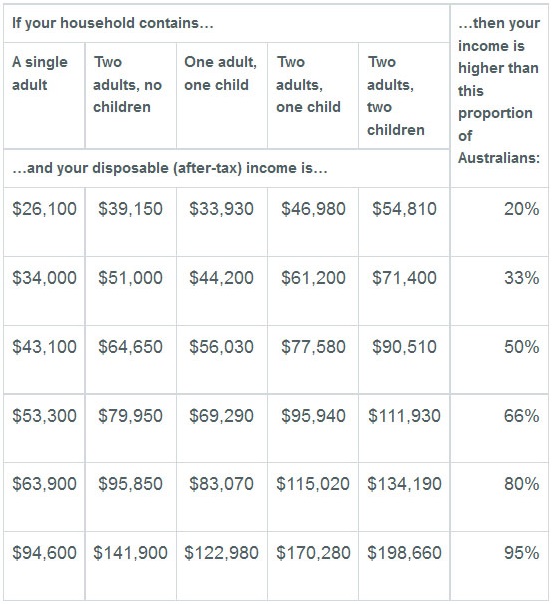

Cowgill leads us through the complexities of analysing wage and income distribution. Of most interest was this table which takes into account household circumstances:

In terms of straight taxable income the top 10% cut in at about $105,000. If we are to do similar research to the Princeton study in Australia, I’d suggest targeting senior executives, I’m guessing in the range of $200,000 plus. They are likely to sit in the top 5% of incomes. They are also likely to reflect the views of the top 2% whose views Gilens found to be unknowable.

If government is to be accountable to the electors, then the Princeton research suggests that universal franchise is a necessary but not a sufficient condition for democracy. We need to think carefully about how democracy works, lest we be left with the form rather than the substance.