Bernard Keane at Crikey has done some fact-checking (paywalled) on Scott Morrison’s the statements on the government’s fiscal policy and has found the Treasurer telling a few porkies. Continue reading Mr Morrison, would you please stop lying?

Tag Archives: Budget 2015

Saturday salon 19/12

1. Almost 600 major corporations did not pay tax last financial year

Companies not paying tax include include Qantas, Virgin Australia, General Motors (owner of Holden), Vodafone, petrol company ExxonMobil, online betting shop William Hill, Warner Bros Entertainment, property developer Lend Lease and media company Ten Network Holdings. Continue reading Saturday salon 19/12

Gittins on the budget and sundry matters

Phillip Adams in interviewing Ross Gittins recalled that Paul Keating described Ross Gittins as the only economics commentator worth feeding. Continue reading Gittins on the budget and sundry matters

Budget 2015: the environment

Ironically one of the biggest benefits to the environment could come from “Tony’s tradies” in the form of rooftop solar. One of the benefits to small business is the ability to write off immediately as a tax deduction business expenditure to the extent of $20,000. Continue reading Budget 2015: the environment

Abbott back in the game after the budget

Newspoll, which is the poll pollies are said to take notice of, moved from 52-48 in favour of Labor to 53-47 after the budget. Not that you’d know from ABC radio, which was spruiking the Fairax/Ipsos poll which came in at 50-50. A month ago it was 54-46 in favour of Labor. Continue reading Abbott back in the game after the budget

Saturday salon 16/5

- HarperCollins Australia has apologised and agreed to pulp unsold copies of its flagship 2015 release – Paul Keating: The Biography by David Day – to settle a fierce legal battle with the former Labor prime minister. Continue reading Saturday salon 16/5

What people want from politics: Shorten’s budget reply

Listening to Bill Shorten’s budget reply speech, I was reminded on my son Mark’s statement of what people want from politics in his book Queensland: Everything you ever wanted to know, but were afraid to ask. Continue reading What people want from politics: Shorten’s budget reply

Politics trumps policy? Budget 2015

Judith Sloan said the budget was “a classic case of politics trumping policy”, with a focus on the Coalition’s core constituency. Paul Kelly is on a similar theme: Continue reading Politics trumps policy? Budget 2015

Joe’s big-spending budget

In this post I’ll highlight some of the features of Joe Hockey’s big-spending budget. Tonight our little family celebrates a birthday. After that I might try to round up some of the commentary. Continue reading Joe’s big-spending budget

Positioning the budget sales pitch

No doubt the focus groups have been consulted and the slogans are already upon us. Tony Abbott:

-

“I am absolutely convinced that on budget night it will be seen as responsible, measured and fair. It is a budget which is going to deliver jobs, growth and opportunity. Continue reading Positioning the budget sales pitch

Abbott explodes his economic credibility

Barrie Cassidy has called it a breathtaking shift in economic management.

Laura Tingle took the gloves off in an article Being governed by fools is not funny:

A bit like the old story of the frog that gets boiled alive because the temperature of the water in which it sits rises only gradually, we don’t seem to quite be able to take in the growing realisation that we actually are being governed by idiots and fools, or that this actually has real-world consequences.

We finish the week with a Prime Minister who has lost his bundle and is making policy and political calls that go beyond reckless in an increasingly panicked and desperate attempt to save himself; a government that has not just utterly lost its way but its authority; and important policy debates left either as smouldering wrecks or unprosecuted.

When debt under Labor reached 13% of GDP Abbott characterised it as a “disaster”, likely to send the economy down the Greek path. Suddenly, with 20% of his 2014 budget savings stalled in the senate, we have “done the heavy lifting” and the prospect of debt 50 to 60 per cent of GDP “is a pretty good result looking around the world”.

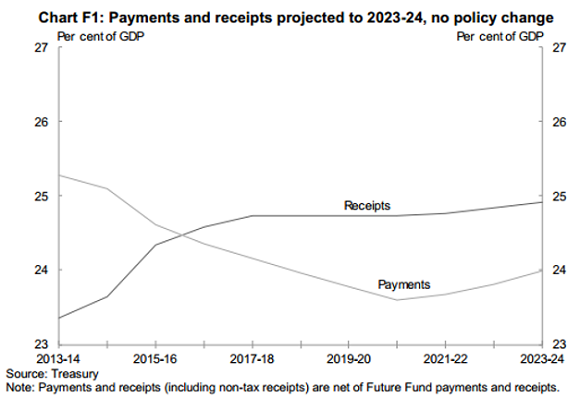

Here’s the graph of the forecast underlying budget cash balance from the Intergenerational Report:

It shows the “currently legislated” path reaching a deficit of 6% of GDP in 40 in years.

Here’s Abbott, pointing to the wrong line, showing us that we’ve done the heavy lifting:

Standard and Poor have warned that if debt, federal and state, goes beyond $30 billion we can expect to lose our prized AAA credit rating.

Laura Tingle and Phillip Coorey say that the federal budget’s forecast bottom line has gone backwards by at least $80 billion since the Coalition came to office.

Abbott and Hockey would have us believe that the bottom line on that graph represents the legacy from Labor. In fact the following set of graphs from Tingle’s article shows the deterioration in the hands of Abbott and Hockey. The first set on the left represent Labor’s legacy:

To emphasise the point about Labor’s legacy, this is the 10-year projection from the Pre-Election Fiscal Outlook (PEFO) prepared independently by Treasury and Finance and published under the charter of budget honesty in August 2013 before the last election is shown:

That’s from this post.

Laura Tingle says that Labor’s focus groups keep throwing up the word “idiot” in relation to Tony Abbott. Swinging voters in Western Sydney in polling commissioned by Fairfax described the Prime Minister as “incompetent, an international embarrassment and a fool”. She thinks that there are “signs that our political system really is in deep trouble – not as a polemic point, but in a very real sense.”

Peter Martin tells us that:

In Labor’s last financial year in office, spending exceeded revenue by 5.4 per cent. This year it will exceed it by 13 per cent.

The budget does have to be fixed. The Reserve Bank Governor, Glenn Stevens, recently warned that in a recession a deficit of 3% of GDP will quickly balloon out to 6 to 7%. That allows no space for government stimulus of the economy.

Apparently Hockey has been sitting on a tax white paper for several months which is to be released next Monday, after the NSW election. Peter Martin looks to the savings available from super:

Treasury’s most conservative estimate has the concession for contributions to super funds costing $15.5 billion this financial year, climbing to $18 billion over three years. The tax concession for the earnings of funds costs $12 billion and is set to almost double to $22 billion. By way of comparison, Medicare costs $20 billion.

Peter Lloyd, Professor of Economics at University of Melbourne, puts forward some ideas, including:

- Eliminating negative gearing for housing investments

- Restricting the allowable deductions for depreciation and other business expenses

- Revising rules relating to income from trusts

- Tightening the rules for fringe benefit taxation

- Reforming the taxation of super contributions and income

- Reducing tax concessions for not-for-profit organisations

As he says, each one of these will meet objections from tax payers. But then the art of taxation was always plucking the goose without too much squawking.

A prime minister fighting for political survival appears to have thrown in the towel.

Update: I meant to mention that Labor had the budget remaining in surplus over the remaining part of a 10-year projection in order to show how Gonski and NDIS would be paid for, whereas Abbott/Hockey planned to slash schools and Hospital funding by $80 billion dollars.

Abbott is now saying that a surplus will be achieved within 5 years, whereas Mathias Cormann is saying “as soon as possible”.

IGR – garbage in, garbage out

I’ve borrowed the title from The Australia Institute because it reflects how I feel about the Intergenerational Report.

Hockey told a business briefing “When people see some of the graphs in the intergenerational report they are going to fall off their chairs.” Richard Denniss said, yes, “we’re rolling around on the floor laughing”. He finds it “a deeply flawed document based on deeply flawed assumptions.”

Peter Martin warned us that when governments lose their authority, they try to scare us. Michelle Grattan warned that the government wanted the public to take several political messages out of the IGR:

Stated crudely, these are: first, that Labor’s policy settings would have taken us to hell in a hand basket; second, that but for the pesky Senate, the budget would have been in good shape relatively soon; and third, that despite the obstacles, the government is making progress towards bringing us to fiscal health.

She was right.

The Intergenerational Report is accessible here. See also the ABC article and The Conversation’s panel of experts.

Three scenarios

The Report paints three scenarios. The first dubbed “Proposed Policy” is the Abbott Government’s 2014 Budget. It would bring a surplus within five years. That is, if the revenue stream holds up as predicted, which we know it hasn’t. Also some ‘saves’ of the budget have been abandoned. That’s the first bit of fiction.

The second scenario is termed “Currently Legislated Policy”. That’s what the Opposition, the Greens and crossbench senators have passed. That will lead to a deficit of 6% of GDP in 2055.

The shock horror is in the third scenario, called “Previous Policy”. We are meant to believe that this is what the LNP inherited from Labor. In 2055 on this scenario the annual deficit would be a whopping 11.7% of GDP, with net debt at 122% of GDP.

The deception here is that the Report has not used Labor’s legacy as reflected in the Pre-Election Fiscal Outlook (PEFO) prepared independently by Treasury and Finance and published under the charter of budget honesty in August 2013 before the last election, which had the budget coming into surplus in 2015-16. It has used Hockey’s first Budget Update, after he had added billions of dollars of debt.

The IGR is a document compiled by the Treasurer, not the Treasury. Chris Bowen says that Labor would legislate to have it compiled by the Parliamentary Budget Office to take out the politics.

Affordability

The Report has put in some scary figures like number of centenarians will grow from 5,000 or so now to almost 40,000 in 2055, spending on aged care and pensions will from from 2.9% of GDP to 3.6%. That’s an increase of 24% when our average income is forecast to lift from $66,400 today to $117,300, or 76%. If that is true (I have my doubts) then we can live very decently and still afford welfare.

Dependency ratio

A really scary figure given is the dependency ratio, which is the number of people of working age (15-65 year-olds) to aged people (65+). The dependency ratio is 4.5 now and will reduce to 2.7.

Again I say, why should we worry that the number of workers is reduced by 45% when each worker will be earning 76% more.

John Quiggin reckons it’s a weird trick that proves the IGR is nonsense. The concept assumes:

* Children aged 14 and under cost nothing to raise and required no public expenditure on schools, daycare etc

* Children leave school at 15. After this, they not only support themselves, but contribute to the support of those over 65

* People retire become eligible for age pensions at 65.

All three are wrong.

Climate change, the environment and population growth

Richard Denniss says the Report is unrealistic because it “barely talks about the threats of climate change or the enormous cost of building the new infrastructure that rapid population growth will require.”

Ian Lowe says:

There is no sign the government even recognises the most serious threats to future generations: liquid fuel security, climate change, water shortages, loss of productive land and loss of biodiversity. These issues require planning and commitment of resources now.

Rapid population growth to reach 39.7 million is taken as a given, not something we have a choice about.

On climate change Ben Eltham says:

Climate change is the dominant geopolitical fact of the future. It will shape the future more surely than tax takes or pension liabilities. It will reshape the global economy, threaten food yields, increase natural disasters, lay waste to Australia’s region and generate hundreds of millions of refugees.

Such blunt realities are absent everywhere from the 2015 IGR. It’s denial writ large, pure and simple. A larger blind spot – a more willful inapprehension of reality – is hard to envisage.

I’d have to agree with his bottom line:

You don’t have to take such shoddy work seriously, and as a busy citizen, you shouldn’t. The Intergenerational Report is not a serious attempt to make projections about government policy. It is an ornament, a prop in a policy theatre, a bell-and-whistle for the next Treasury lockup.

Like most such reports, the IGR will be quickly forgotten.

Update: The Parliamentary Library site Flagpost has a useful comparison of the four IGR reports so far.