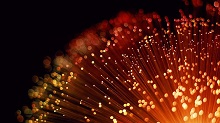

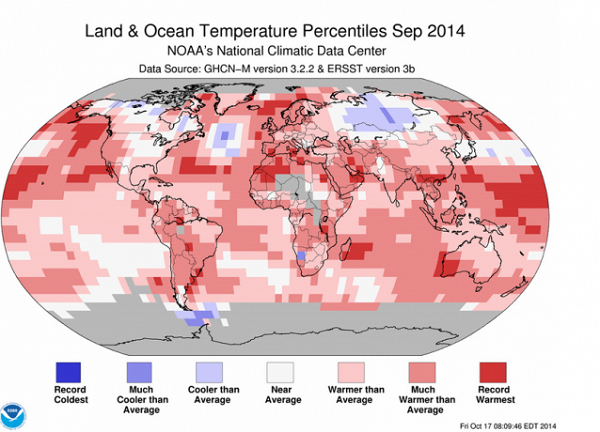

1. Record warmth

September followed August as record heat for the month worldwide. The period January-September was equal hottest with 1998 and 2010. The 12 months from October 2013 to September 2014 was the hottest 12-month period on record. The heat was just about everywhere, except for central Russia, some areas in eastern and northern Canada, and a small region in Namibia:

2. Coal is good for humanity!

Thus spake Tony Abbott, repeating lines imprinted on his mind by coal industry lobbyists.

In an important post Graham Readfearn tells how big coal is hijacking the energy poverty issue

telling the world that the only way the poorest nations can pull themselves out of poverty is by purchasing lots of their product.

The point that those same people will likely be hit earliest and hardest from the impacts of climate change being driven by that same product, is neatly swerved or underplayed.

So we have Peabody Energy “fueling the world with energy essential to sustain life”.

Pardon me while I have a quiet chunder!

3. New 2030 climate targets for the EU

On the whole climate campaigners are disappointed with the new emissions targets set by the EU – 40% reduction in emissions, 27% cut in energy use and 27% of energy must be from renewables.

The ETS is seen as essential in reaching these targets, so it will be reformed in an as yet undesignated way.

Rich countries like Germany, the UK and France will have to do better than the designated cuts to compensate for the continued reliance on coal by the likes of Poland, Bulgaria and Romania.

At Climate Progress it seems the American reaction is more favourable. They point out that the targets are the first substantive offer from any member of the international community ahead of the UN climate talks to be held in Paris in 2015. The Americans and the Chinese are unlikely to go so far.

Personally when they aim for net zero emissions by 2030 and aim for 350 CO2e ppm by 2050 I’ll say they are reconnecting politics with reality.

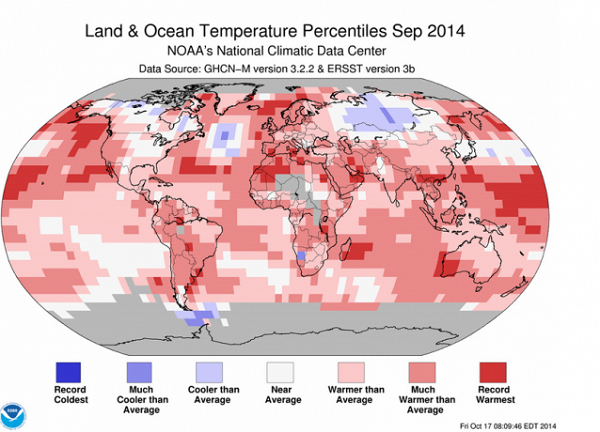

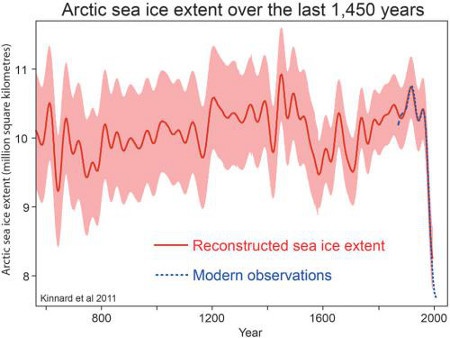

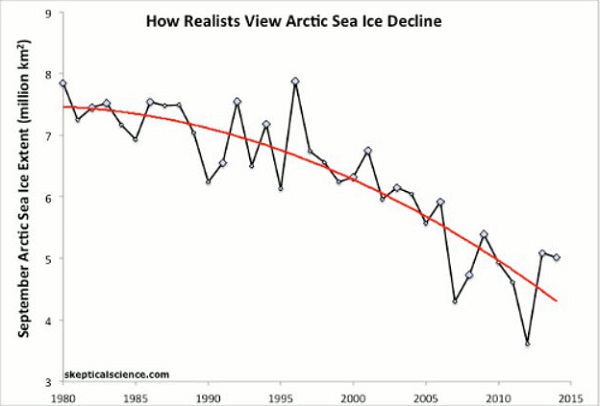

4. Arctic sea ice escalator

BilB drew attention to Skeptical Science’s Arctic sea ice escalator:

He’s right, the next break downwards could shock some doubters.

Perhaps enough to shake pollies of all stripes out of their torpor.

If you look at the trend from the late 1990s it looks even more dramatic.

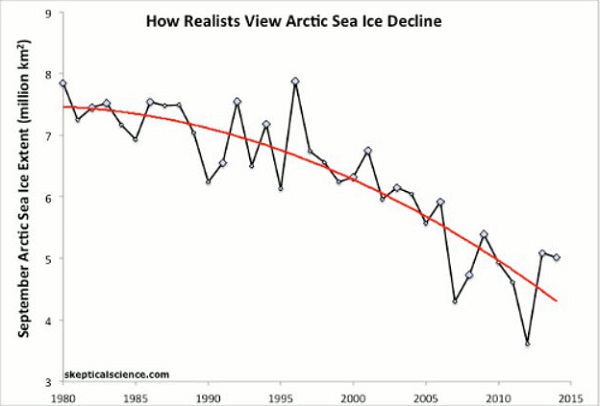

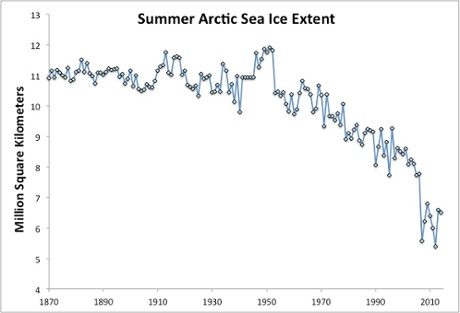

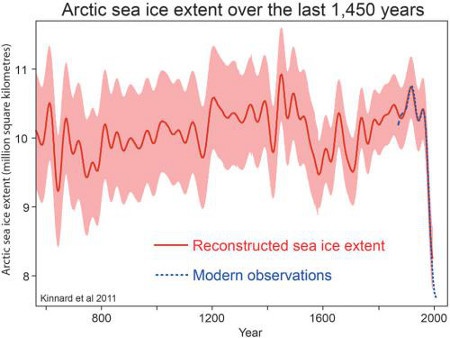

The full article has two further graphs:

Actually there’s something wrong with both. The y axis should go below 4. It’s like where you have a graph on a wall and the line falls off the graph and onto the wall.

5. Pacific warriors blockade Newcastle

Climate Change Warriors from 12 Pacific Island nations paddled canoes into the world’s largest coal port in Newcastle, Australia, Friday to bring attention to their grave fears about the consequences of climate change on their home countries.

The 30 warriors joined a flotilla of hundreds of Australians in kayaks and on surfboards to delay eight of the 12 ships scheduled to pass through the port during the nine-hour blockade, which was organised with support from the U.S.-based environmental group 350.org.

The warriors came from 12 Pacific Island countries, including Fiji, Tuvalu, Tokelau, Micronesia, Vanuatu, The Solomon Islands, Tonga,

Samoa, Papua New Guinea and Niue.

6. Norway takes to electric cars

Norway, not a member of the EU, now has 15% electric cars. Since 2011 Nissan LEAF has become the nation’s third best-selling car.

Norway is not a member of the EU. It gets 98% of its power from renewables. Presumably it doesn’t go around preaching that oil is good for humanity!

7. How to build without bricks and cement

Just print houses out of mud!

Thanks to John Davidson for those last two items.