Climate action 01 is the first of a series of posts which will be the Climate action equivalent to Climate clippings. This post concentrates on housing, energy efficiency and rooftop solar. Continue reading Climate action 01

Daily Archives: April 29, 2014

Hockey’s morality play

Joe Hockey has mightily offended Bernard Keane by making his austerity a moral issue, evoking a trenchant critique. The shorter Keane is that if you turn budgeting into a moral issue you are held to a higher standard. On this basis Hockey comes out as a prize hypocrite.

More of Keane later, first let’s wrangle some numbers.

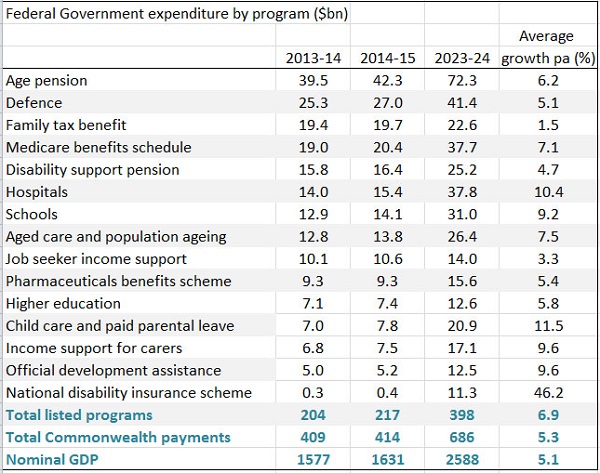

I’ve made a table of the 15 major expenditure items identified by the National Commission of Audit as causing concern over the long term, omitting the eight years of 2015-16 to 2013-24 for convenience. The intervening data does tell some stories. For example, after growth spurts both Schools and the NDIS settle to much flatter growth in the out-years. The table was reprinted in the AFR.

To me the most important numbers are the two in the bottom right. When all is said and done total Commonwealth payments would grow by 0.2% of GDP over 10 years. In today’s dollars that’s about $3 billion dollars. Sounds a lot, but in a $400 billion budget it’s a rounding error.

Hockey is trying to achieve two main goals. (Here I’m drawing mainly from Phillip Coorey, but also Laura Tingle in the AFR.)

First, he is aiming at a small surplus in 2019-20 and a surplus of one per cent of GDP by 2023-24. Economists and others can argue about timing and quantum but this aim seems to me fair enough.

Secondly, Hockey wants to shrink expenditure as a proportion of GDP. This is ideological, not moral.

Hockey claims that if he takes his hands off the wheel expenditure will grow by 3.75% per annum, reaching 26.5% of GDP by 2023-4. From memory, I think that’s roughly where it was under Howard and Costello.

The CIA’s world Factbook has a country comparison of tax and other revenues as a proportion of GDP. Obviously they use a particular definition (probably includes GST) since Australia comes in at 33.2%. By contrast we have Canada at 37.7%, New Zealand at 38.5%, the UK at 40.4%, then follow the Europeans up to the Scandinavians at above 50%. If Australia’s share was lifted to Canada’s the government would have an extra $55 billion available.

All I’m saying here is that lifting the share by a few percentage points is not self-evidently a crime against the people, immoral or even economically foolish.

The audit commission has assumed that tax receipts must remain limited to 24% of GDP, for reasons unknown.

Before the election Hockey was saying that he would take 1% off tax receipts as a proportion of GDP. He hasn’t nominated a percentage now that I know of, but he has deemed that growth in expenditure will be limited to 1.75% per annum. That’s harsh. Tingle says Labor’s aim, not always achieved, was for a 2% limit, also austere.

Again we are told this 1.75% limit is right, responsible and moral, without any supporting argument.

Labor’s plans

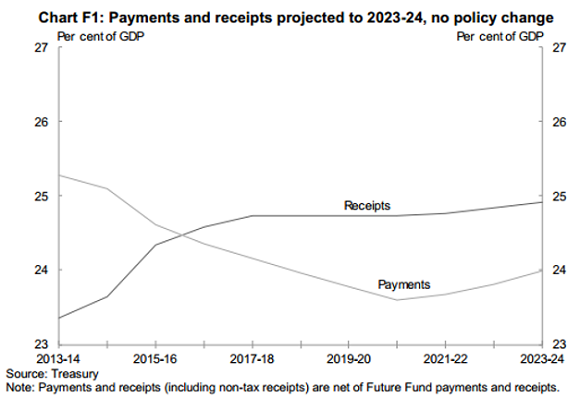

Wayne Swan, I understand, reduced outlays by a couple of percentage points of GDP. His problem was that revenues were a couple of percentage points shy of outlays. Still, Labor had a long-term plan back to the black. The following graph is from the Pre-Election Fiscal Outlook (PEFO) published under the charter of budget honesty before the last election. I displayed it in my ‘liars and clunkheads’ post back then.

I understand it involved allowing bracket creep. One has to ask why Hockey’s self-imposed austerity path is supposed to be superior.

Hewson on tax concessions

One way of fixing the budget would be to allow bracket creep, ruled out by the audit commission and Hockey.

Another way, suggested by John Hewson, would be to take a look at tax concessions, especially in superannuation.

A startling fact is that the percentage of retired folk receiving at least a part pension is projected to remain at 80%. Hewson says that superannuation policy robs the poor in favour of the rich, and in amounts that matter. He calculates super tax concessions at around $44 billion, roughly the same as the aged pension but growing faster.

Tax concessions overall are around $120 billion rising to $150 billion by 2016/17. Today’s AFR identifies some of the budget sacred cows, leading with $15 billion in protecting the family home from capital gains, $13 billion in not broadening the GST. Tightening the age pension means test to include the family home would save $7 billion.

By contrast the mooted ‘deficit levy’ would only yield hundreds of millions even if implemented widely. It’s small change. Such a move must be regarded a political rather than economic.

Keane’s critique

Keane asked Hockey what he was going to tell his granchildren about what he did to prevent global warming. They will pay.

Why were Labor’s efforts to reign in middle class welfare either not commented on or termed “class warfare” or “the politics of envy”?

Why did the LNP fight tooth an nail cutting back the private healthcare rebate to high-income earners?

In November, Hockey abandoned Labor’s plan to reduce the extravagant tax concessions enjoyed by superannuants earning over $100,000 a year, costing billions. He also restored a fringe benefits tax rort, an actual rort, for novated leases, again worth billions.

Hockey wants to cut carbon pricing and the mining tax.

Hockey is talking to us about the “moral imperative” of fiscal discipline while handing billions to large companies, wealthy retirees and tax rorters.

One minute Hockey is complaining about

a “massive increase” in defence spending beyond forward estimates and that it was a budget boobytrap, a fiscal “tsunami coming across the water” created by Labor.

The next minute he’s committing billions to F-35s which “wouldn’t cost anything” because it’s already in the budget.

Then of course there is the rolled gold parental leave scheme.

Keane reckons Hockey has cut revenue by about $15 billion. He would have increased spending by a similar amount. Then he complains about a budget mess and dresses up his austerity program as a moral crusade.

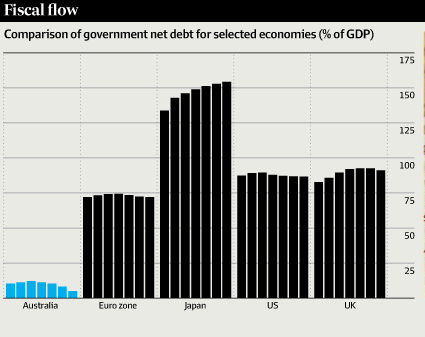

By the way here’s Labor’s Budget debt in context:

I think we’ve been short of revenue since Rudd matched Howard’s tax cuts in the 2007 election campaign. There’s nothing broken about the budget that a steady hand, a mature review of priorities and a gradual return to revenue levels prevailing under the Howard government would not fix, together with a modernisation of the whole tax regime. Time to look seriously at Ken Henry’s review.

Elsewhere, Peter Martin has some tips.

Update:

In the Weekend AFR Phillip Coorey in an article The budget crunch is John Howard’s baby too reckons the budget problems date back that far. Apart from generous handouts to middle Australia in the previous years, Howard/Costello promised a $31.5 billion tax cuts in the May 2007 budget. One day into the election campaign he added a promise of $34 billions worth of further tax cuts (we’re talking four-year budget cycles). Rudd matched him, in addition to his own spending plans. The half-year budget update did find an extra $59 billion worth of revenue.

No-one foresaw the GFC and the end of the salad days.

Also Chris Bowen has an article pointing out that scrapping the low income superannuation contribution (LISC) and deferring the increase in the superannuation guarantee will take $55 billion out of our national savings pool over the next 7 years. These policies, he says, were designed to reduce the numbers of middle and low income earners requiring pension support in the future. Do this rather than lift the retirement age, he says.

Bowen’s comment received specific support from Tony Shepherd, chair of the audit commission.

See also John Davidson’s post, plus Richard Holden on why Australia does not have a debt crisis.

Update – posts on Budget 2014:

On a mission to upset everyone

Poll anger or a shift in the tectonic plates?