ABC Factcheck looked at Christopher Pyne’s claim that university graduates, over a lifetime, earn 75 per cent more than someone who doesn’t go to university. Factcheck found that the financial case for going to university varies considerably depending on who did the calculations, assumptions, the profession and the grades obtained. This post uses some of the Factcheck data to ask whether going to university makes sense. Continue reading Does getting a degree make sense?

Category Archives: Sundries

Posts on sundry matters of life the universe and everything: Culture, Environment, Life, Politics & Government, Science, Social Science and Society, Technology etc.

State of Origin 1

I decided I want to be there (here) as the dream continues, or, as it inevitably must, comes to an end. Also, there may even be one or two readers who are interested and care.

We are told that Qld have won the last five at “the cauldron”, that NSW hasn’t won a series opening here since 2003, but make no mistake, many recent games have been close. For example in 2012 it was one game all and Qld looked OK close to home in the decider at 20-14, when NSW put up an attacking bomb. The Qld player looked to have it covered when Josh Morris flew through the air, took it out of the Qld player’s hands and scored in the corner:

The try was converted from the sideline, so suddenly it’s 20 all. Greg Inglis then almost slid over for a try, but hit the goal posts. Then Cooper Cronk sank the Blues’ hopes with a field goal at the death.

So either side can win.

A lot could be said about selection. Qld have gone light and perhaps mobile in the forward pack with only one big bopper (110kg or over). NSW have three.

Last year we had the disgraceful incident where Gallen punched Myles in the face, twice, and only missed one club match:

Gerard Whately said he would have got 7 weeks in the AFL. It took until Sunday on Debbie Spillane’s program before anyone mentioned “One punch can kill!”

There won’t be any of that rubbish tonight.

Finally it is almost certain that we will be talking about the referees after the game. This year more than ever games are being decided on faulty or questionable refereeing decisions.

It should be a good game. In this part of the world there is only one other rivalry that comes close. That’s Australia vs NZ at netball.

Resolving the budget ‘crisis’

We definitely have a looming political budget crisis. Whether there is a fiscal/economic crisis is a separate question. First the politics.

Mark has an excellent post wherein he poses three alternative scenarios. I have only two, because I don’t see Abbott, Hockey et al being able to negotiate the maze that faces them in the senate. Nor do I see the Liberals changing leaders. There simply isn’t anyone. Hockey has broken his brand. Turnbull isn’t interested and not enough will have him. They couldn’t choose Morrison, could they, although his stocks are said to be riding high, having stopped the boats.

1. Abbott fails to negotiate important elements of the budget, such as eliminating the carbon ‘tax’, the proposed changes to Newstart and Youth Allowance, the changes to the age pension etc. As promised, Abbott would call a double dissolution election, after some bipartisan changes to senate voting practices. But note well, Antony Green for complex reasons says:

In my opinion there is not going to be a double dissolution in the near future, and even in the more distant future, I cannot see any possibility of a double dissolution before late 2015 or the first months of 2016.

2. Antony Green thinks that Abbott will only call a double dissolution if he thinks he can win. In this scenario Abbott fails to negotiate the senate, and the polls stay unfavourable. Abbott wimps out and limps on to a regular election in the second half of 2016.

I would discount the second option. Someone pointed out recently that when challenged, Abbott becomes more determined; if you like, more pugilistic. Moreover it would be manifestly foolish to struggle on with a government that lacks authority in the parliament and can’t effectively govern without Clive Palmer, who would maximise his leverage.

Of course, the polls might change. Apparently the feedback from the electorate to the party room was horrendous. For example the Oz gives us a taste:

JOE Hockey’s friends say he has been taken aback by the poor response to his budget from Coalition MPs. Well, Treasurer, you’d be horrified to know what some of them really think.

“There’s been no narrative. It’s been all over the shop. One minute we say there’s an emergency, the next there’s $8 billion for the Reserve Bank, $12bn for fighter jets, and we’re still splashing out on the paid parental leave scheme,” says one.

Now the government is considering a budget ad campaign. Except that there won’t be any radio, TV or newspaper ads. The campaign will fill our letter boxes with letters and pamphlets. Apparently the recalcitrant and benighted voters need to understand that this was the budget that the country needed. Needed, that is, to fix the “Labor debt and deficit mess”. You’ll hear that phrase a million times before the next election.

Which brings us back to whether there is a crisis in the fiscal/economic sense.

Jacob Greber and Phil Coorey had an article on the front page of the AFR Budget crisis is real, says PBO:

Parliament’s independent budget adviser has rejected Labor and Greens’ claims the Abbott government has concocted a budget crisis, saying without action Australia’s debt will grow at one of the fastest rates in the developed world.

In remarks that effectively endorse government warnings that if left unchecked, gross debt would balloon to $667 billion, Parliamentary Budget Officer Phil Bowen said it was time to begin the return to surplus to protect the economy against future crises.

“It is time to start coming out [of debt and deficit], otherwise the longer you leave it the more exposed you become and the harder it is to wind it back,” he told The Australian Financial Review.

This is sad, really sad. On page 47, buried in the middle of a tiny opinion piece by Andrew Leigh we had the truth. Labor in the Pre-election Fiscal and Economic outline had the budget coming back to surplus in 2016-17 in an orderly way. Hockey plans to do it by 2017-18, with the most horrendous cuts.

The document Leigh refers to was prepared by Finance and Treasury and released in August 2013 as part of the charter of budget honesty. Remember this table from ABC Factcheck?

Mainstrean journalists are too thick or too lazy to look at the facts. Instead they accept the LNP narrative.

With friends like that who knows what the polls will do?

Sensible people realise that there is no crisis, though we do need to bring the budget back to surplus within a reasonable time. After the confusion and sense of affairs out of control under Swan/Gillard, few seem to understand that finally, under Rudd/Bowen order had been restored. According to the independent umpire. Hockey has added the chaos and crisis in so far as it exists.

I’m inclined to think that Hockey/Abbott et al have fractured the basic contract with the people, that the people will not want to go back to the world of the pre-Whitlam era, which is where Trevor Cook compellingly thinks the reactionary tea party is aspiring to take us:

When they attack the so-called age of entitlement, they are really attacking the pillars of modern, Whitlamite Australia where concerns about access were more important than reducing the tax rate for business and rich individuals.

And the biggest stalking horse of all is Abbott’s efforts to get rid of Labor’s commitment to a national system of government and revert to a pre-federation style competition between increasingly impoverished states.

The intended victims of this charade are the poor and the middle class.

Abbott knows the states will be forced to cut spending – he wants them to do it.

Australia is at a turning point. And Abbott is no moderate, no centrist, not even a genuine conservative.

Perhaps the tea party utopia is best captured in this image from an anti-liberal site via Mark’s Facebook:

A Coast to Coast odyssey – where it all started

It must be around 2 years ago now that a group of four friends and I first spoke about completing the Coast to Coast (C2C) walk across northern England. And so here we all are, eager to get going on our C2C odyssey on 26 May, 2014!

The walk starts at the small village of St Bees on the Cumbrian coast and ends at Robin Hoods Bay on the North Sea coast. It was devised in 1971/72 by noted English fell-walker, Alfred Wainwright and the details of the walk were published in his 1973 book – A Coast to Coast Walk (a revised edition is still in print!). Since then the C2C has achieved international popularity and around 10,000 people from all parts of the world now complete it each year. For example, we came across a chap from the USA down in the village this-morning. He told us that he and his 78 year-old mother are starting the walk tomorrow! We may well see them on the track. A recent survey of long-distance walkers rated the C2C as the second-best long-distance walk in the world!

But it isn’t without it’s challenges. It is just over 300 km long (varies with the precise route taken – there are several alternatives in a number of places, frequently a high altitude option (with expansive, spectacular views) and a low altitude, more intimate parallel option). As well, there are plenty of hills and mountains to climb, with the total ascent required over the walk around 7,000 m. And maybe even more important, the amount of descent is the same (assuming sea-level is the same in the Irish and North seas!).

So with these challenges in mind, we decided to complete a series of one and two-day training walks around South-east Queensland (Australia – where we all live), starting about 12 months ago. Over this period we have walked close to 200 km as a group, mostly along the excellent National Park network of walks. These walks culminated in a 45 km 2-day trek along the ‘Border Track’ from O’Reilly’s to Binna Burra and return. Here we are at Binna Burra about to set out on the return journey on the second day of our walk.  And so on Saturday, 24th May, we all converged on Manchester Airport from various parts of the world (Rome, Paris, London), meeting at the Delice de France Café, Terminal 3. Here we are, all looking excited in anticipation of what is to come!

And so on Saturday, 24th May, we all converged on Manchester Airport from various parts of the world (Rome, Paris, London), meeting at the Delice de France Café, Terminal 3. Here we are, all looking excited in anticipation of what is to come!  The couple on the left are Doug and Tricia Smith, while the couple on the right are Laurie and Tricia Sheahan – both have been close family friends for nearly 40 years! While we have had many very enjoyable experiences together, this is the first time we have engaged in an activity as enterprising as this. But I must say that our preparatory walks together have been most enjoyable. My wife, Nola, is a great Anglophile and I’m sure would have enjoyed many things about this trip. But she is not a keen long distance walker ….. so stayed at home this time.

The couple on the left are Doug and Tricia Smith, while the couple on the right are Laurie and Tricia Sheahan – both have been close family friends for nearly 40 years! While we have had many very enjoyable experiences together, this is the first time we have engaged in an activity as enterprising as this. But I must say that our preparatory walks together have been most enjoyable. My wife, Nola, is a great Anglophile and I’m sure would have enjoyed many things about this trip. But she is not a keen long distance walker ….. so stayed at home this time.

From Manchester, we travelled by train to Barrow-in-Furness and then up the very picturesque Cumbrian coast to St Bees.

We then spent Sunday 25th May relaxing in St Bees, readying ourselves to start our great adventure. Opposite the Fairladies Barn, our B&B accommodation in the main street of St Bees, is the little pub …. see below. Here, we have had lashings of home-cooked fare on the last two evenings, along with a pint or two. Roast beef and Yorkshire Pudding, meat pies (with plenty of meat), and blackberry, apple and rhubarb pie have variously kept us (too well) fed and ready to go.  The C2C from west to east starts on the beach at St Bees and proceeds immediately up onto the high cliffs of the St Bees Headland. If you were sitting in the tea-house in the building on the left in the picture below, you would see us disappearing into the distance along this high cliff-top 0n the start of our journey. After several hours we will turn inland towards the Lake District and ultimately, the North Sea coast. We intend to travel at a leisurely pace compared with many who complete this walk. Our plan is to spend 20 days walking (averaging 15 km/day) and have three rest days along the way.

The C2C from west to east starts on the beach at St Bees and proceeds immediately up onto the high cliffs of the St Bees Headland. If you were sitting in the tea-house in the building on the left in the picture below, you would see us disappearing into the distance along this high cliff-top 0n the start of our journey. After several hours we will turn inland towards the Lake District and ultimately, the North Sea coast. We intend to travel at a leisurely pace compared with many who complete this walk. Our plan is to spend 20 days walking (averaging 15 km/day) and have three rest days along the way.  We found to our surprise that the tea-house listed a slice called ‘Australian Crunch’ among its delicacies. It must be popular since it was sold out. So I can’t tell you what it was like. But the ‘Bakewell Slice’ was delicious!

We found to our surprise that the tea-house listed a slice called ‘Australian Crunch’ among its delicacies. It must be popular since it was sold out. So I can’t tell you what it was like. But the ‘Bakewell Slice’ was delicious!

My plan is to make regular posts along the way. But I can’t promise any particular frequency since it will all depend on many factors, including internet access (or lack of it) in some of the small villages. And there may be other activities that compete for my time along the way as well!

Saturday salon 24/5

An open thread where, at your leisure, you can discuss anything you like, well, within reason and the Comments Policy. Include here news and views, plus any notable personal experiences from the week and the weekend.

For climate topics please use the most recent Climate clippings.

The gentleman in the image is Voltaire, who for a time graced the court of Frederick II of Prussia, known as Frederick the Great. King Fred loved to talk about the universe and everything at the end of a day’s work. He also used the salons of Berlin to get feedback in the development of public policy.

Fred would only talk in French; he regarded German as barbaric. Here we’ll use English.

The thread will be a stoush-free zone. The Comments Policy says:

The aim [of this site] is to provide a venue for people to contribute and to engage in a civil and respectful manner.

Cap super, says Richard Denniss

Treasury secretary Martin Parkinson says the superannuation system is being used as a wealth creation vehicle for the rich.

Paul Drum from Certified Practising Accountants Australia says there is nothing wrong with wealth creation as such. If you want to provide income for the future you need to create a pile of wealth. (By my calculations, for example, if you don’t buy a house and need to pay $400 per week in rent, then you’ll need capital of at least $416,000 with growth capacity at least equivalent to the CPI. Of course if you buy an equivalent dwelling it will cost you more than $416,000 in most places around the country.)

Drum says we need to look at equity aspects, but doesn’t elaborate.

Richard Denniss of the Australia Institute says we’ve created an intergenerational wealth transfer system rather than a retirement incomes system:

So if we want to create a system that helps the majority of Australians have slightly higher incomes when they retire, that’s fine, we can talk about that.

But the idea that superannuation is used as a tax minimisation vehicle of very high income earners to pay far less tax than we’ve deemed fair, and then in turn to pass tens of millions of dollars onto their children, this isn’t the retirement income scheme, this is a intergenerational wealth transfer scheme.

The Treasurer himself said that in 2050 the proportion of people getting a pension or part pension will be about the same as now – roughly 80%. As a retirement incomes system super is a failure.

Tax concessions for super are about to pass total expenditure on pensions and in a few years will exceed the GST. Something needs to be done.

Part of the problem here is that superannuation assets are not included in the will and are not sold up when a superannuant dies. The benefits simply flow on to the next of kin. Directly held shares, on the other hand, must be sold, triggering capital gains tax.

When one spouse dies the benefits go to the other. Also, if I’m right the other spouse could cash out the super, tax free.

Family trusts provide similar intergenerational tax free wealth transfer.

Richard Denniss says cap super, to limit the call on the public coffers.

That is one change among others that is certainly needed, but what should the limit be?

When super was an issue with the Gillard government in 2013, we were told that a pile of $1 million would provide a ‘comfortable’ retirement income of $50,000 for a couple who owned a house.

In calculating income from super the rule of thumb is that you can draw an income of 5% of capital, so $2 million could produce an income of $100,000 per annum. That’s about 50% above average household income. More than enough, I should think!

Do it, please, Labor, when you get the chance and ignore the cries of class warfare. The LNP are more likely to be concerned about those who ‘waste’ their super on trips away, then rely fully on the pension.

Dark matter – forget it!

For a change of pace, this is about the universe and everything.

Supposedly dark matter makes up 80% of the universe, yet no-one has ever seen even a little bit of it.

The time has come to give up on the idea altogether, according to Mordehai Milgrom in an interview with Marcus Chown for the New Scientist (paywalled, but Google him and you’ll find plenty).

Dark matter was inferred to explain the movement of stars in a galaxy. Stars at ever greater distance from the centre should move more slowly because there is less gravity, according to Newtonian physics. But that doesn’t happen. The reason hypothesised is that each galaxy is embedded in a ‘halo’ of dark matter which enhances gravity at the outer regions.

Problem is, there is no consistency. Each galaxy needs its own arbitrary quantum of dark matter distributed in a unique way to explain what actually happens.

Moreover there is no predictive power in the theory.

Among other things, it predicts that we should see many more dwarf galaxies orbiting our Milky Way than we actually do.

I wonder if he means stars.

Milgrom has been on the case for quite a while and in 1981 came up with his alternative modified Newtonian dynamics (MOND) concept. He says:

The meagre data we had then could be explained if at a critical acceleration – a mere hundred billionth of a g – gravity switched from a type that weakens in line with the familiar Newtonian law to a type that falls off more slowly, following a different law. That alternative law is MOND.

He published three papers on his theory which were met with silence.

He says dark matter is the hypothesis of least daring. Just tip in some gravitating stuff that gives out no light. MOND appalled people because it tampered with the basic laws of physics. To be taken seriously it needed to be made compatible with Einstein’s principles of relativity.

This had to wait for one Jacob Benkenstein in 2004. He came up with a theory known as TeVeS (tensor-vector-scalar).

TeVeS describes gravity with three fields and made MOND compatible with Einstein’s relativity. After it was introduced, people started to take MOND more seriously.

Is MOND more elegant than dark matter?

It is certainly far more economical. For every galaxy, dark matter theorists must fit a made-to-measure amount and distribution of dark matter. So, if we understand 10 galaxies, we still don’t understand an 11th. Dark matter explains only after the fact. MOND predicts things ahead of time. This is key.

Also:

A single MOND formula perfectly describes every spiral galaxy, even though the birth of each one is chaotic, complex and unique. It is hard to see how the dark matter model can explain this.

Literally hundreds of MOND predictions have been vindicated and some 700 papers on the theory have been published in the last few years.

So if you hear about dark matter, unless the story is that the stuff has finally been found, take it with a grain of salt. It’s an old idea that doesn’t work very well. If you hear about MOND, then listen carefully, we could be getting closer to a theory of the universe and everything.

Just for fun here’s Andromeda Galaxy:

To GST or not to GST

Tony Abbott and Joe Hockey have been seen as herding the states and territories towards increasing the GST, rightly or wrongly. I suspect rightly.

Richard Denniss in the AFR says Forget GST, hit the rorts on super.

The Commonwealth government will collect $363 billion in taxes this year, with state and local governments collecting a further $83 billion in taxation. The GST accounts for around $51 billion, or 11 per cent, of total revenue. Increasing the GST to 12 per cent would collect an additional $10 billion or so. In an economy with a nominal GDP of $1521 billion and a population of more than 22 million it is, quite simply, small change.

If raising the GST is “the solution” then ‘the problem can’t be very big, which, of course, is exactly what the World Bank, the IMF, the OECD and the rest of the world have been trying to tell us. Australia is a low tax, low-debt country.

The pension is costing about $40 billion each year and is growing at 6% pa, only 1% faster than nominal GDP. Superannuation concessions, by contrast, cost about $35 billion, of which $13 billion flows to the richest 5%, and are growing at 12% pa.

Economists tend to favour taxing consumption, because it is efficient and less distorting than many other taxes. They tend to downplay the fact that it is regressive, once again selectively hitting those who can afford it least. They wave that argument away, saying that the needy can be compensated by increased transfer payments. Whether such payments would hit the mark is highly questionable. Moreover the better off in the community tend to see such payments as undeserving.

Denniss identifies other “rorts” such as the 50% capital gains concession, and the exemption of the family home, which can store massive value for the rich.

An alternative to increasing the rate is to increase the coverage. The list of exempt goods and services is actually quite large. I’ve copied it here for convenience:

- medical and other health services, hospital services, residential or community care and medical aids;

- education courses, course materials, student accommodation;

- child care services registered under the Childcare Rebate, eligible child care centres or other child care services

- exports of goods and services from Australia if exported within 60 days after the earlier of the day payment is received or the invoice is issued;

- religious services;

- non-commercial activities of charitable institutions;

- water and sewerage goods and services;

- sales of businesses as going concerns;

- sales of precious metals after refinement by the supplier and delivery to a precious metal dealer

- inwards duty free goods sales to a relevant traveller;

- sales of freehold interest in land or long-term lease made by a Commonwealth, State or Territory Government;

- subdivided farm land

- cars for use by disabled people.

I’m not sure about sales of precious metals and subdivided farmland, but I think Australia has its exemptions about right. It’s late but I can’t find food on the list. Most but not all food is exempt as explained here.

I’ve been explaining that Bowen and Rudd did not leave the budget in a mess (see ABC FactCheck). By adding $68 billion to the deficit, however, Hockey has created quite a mess of his own. Treasury boss Martin Parkinson explained that brave assumptions were required to fix it:

Prior to this budget, we were banking the house on 33 years of uninterrupted economic growth and there’s no precedent for that. We’re banking on another 10 years of fiscal drag and that being pocketed, and that has quite significant regressive impacts, and even then, we still don’t get back to surplus.

“Fiscal drag” means bracket creep.

Thanks Joe!

Tax the rich, I say. At least 80% for incomes of over half a million and a wealth tax for those who organise to have no income. Peter Martin points out that the wealthiest 75 have an average taxable income of $82.

Meanwhile NATSEM modelling has found that low earners do most of the heavy lifting:

The budget hits 1.25 million low and middle income families with children on average by about $3000 a year in 2017-18 while it actually benefits upper middle and upper income families through removing the carbon price, according to modelling done by NATSEM at University of Canberra.

That’s apart from the young unemployed, where a 26 year-old loses $6944.

Clearly there is a need for a thorough review of the total tax system, which Labor undertook and then largely ignored. That was a major blot on the legacy of Swan’s treasurership and the Rudd/Gillard years, having commissioned the Henry review and then largely ignored it.

Poll anger or a shift in the tectonic plates?

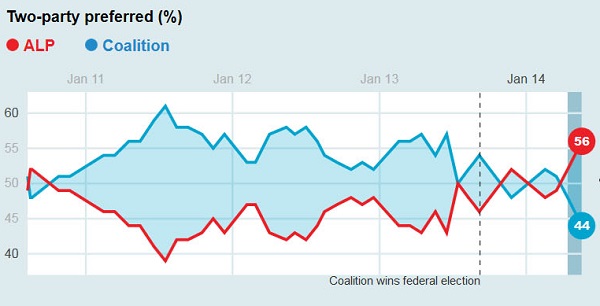

The polls are disastrous for the LNP. Nielsen is 56-44 to Labor, Newspoll is 55-45 and Morgan is a staggering 56.5 to 43.5. Historically Morgan tends to favour Labor, Nielsen was the most accurate at the last election.

The question is now whether these results represent short term anger at the budget or whether the tectonic plates have shifted. Laura Tingle comes out in favour of the latter:

Just every so often in politics there is a moment when you can almost hear the tectonic plates shift, and they don’t necessarily come with elections.

We saw one of these in 2010 when it emerged that Kevin Rudd was dumping his commitment to an emissions trading scheme.

The Fairfax-Nielsen poll suggests the 2014 budget is proving another such moment when politics can be turned on its head.

It is not just the dramatic slump in the government’s primary and two-party preferred vote, or the fact that Labor is, for the first time, the major beneficiary of this slump. It is not just that voters – in spectacular, angry numbers – think the budget is both unfair and not good for the country.

It is not even that Tony Abbott’s barefaced refusal to confront the fact he is breaking promises has enraged voters in a way that makes his position with them unrecoverable.

It is the fact that this poll suggests Tony Abbott and Joe Hockey will have little choice but to go back and rethink the entire political and economic strategy on which this budget is built.

Unfairness, not good for the country, broken promises, lies.

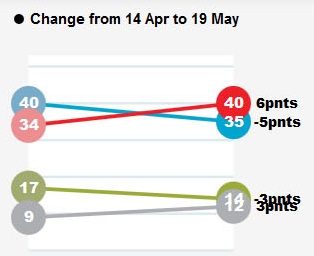

We are often told that Labor needs a 4 in front of its first preference vote in order to win. Suddenly it has one, for the first time since 2010, and the LNP doesn’t. There has been a cross-over:

Perhaps notably, the Greens have lost three points and the indies have picked up three.

This graph shows the Nielsen two-party preferred vote, ending with May 19:

Labor lost its way when Gillard announced the carbon ‘tax’ early in 2011. It looks as though there has been a shake-out since Rudd’s second coming, with the latest poll marking a decisive shift. Time will tell, but Tingle thinks the LNP will need to rethink it’s entire economic and political strategy.

In other aspects of the poll:

-

The only demographic where the LNP tops Labor is in the 55+, were it is now 43-39 to the LNP compared to 49-33 in April.

-

Shorten is now ahead of Abbott as preferred PM 51-40.

Abbott’s approval rating has gone from a net -7 to -28. Only 34% approve whereas 62% disapprove.

Shorten’s approval rating has gone from +2 to +12.

A staggering 63% say the budget is unfair, the first time ever there was a majority, compared with 33% who say it was fair. Gillard/Swan in 2013 scored 43-46.

-

53% thought the budget was good for Australia, again the first majority ever, compared with 42% who say it was good. Gillard/Swan scored 42-44.

Abbott said that the LNP was in a similar position after Howard’s first budget in 1996. He lied.

Abbott said there would be no cuts to health and education for several years. Again he lied. There will be $1.8 billion in hospital cuts from July.

Finally I want to emphasise again that Abbott, Hockey, Cormann and company are lying about Labor leaving a budget mess. This ABC FactCheck shows that Bowen and Rudd left the budget in good shape:

Elsewhere Mark’s excellent post stresses the unfairness of the 2014 budget and its attack on a foundational Australian value. It’s not too much to say, I think, that it has breached the social compact on which the Australian polity is based.

Climate Action 03

Saturday salon 17/5

An open thread where, at your leisure, you can discuss anything you like, well, within reason and the Comments Policy. Include here news and views, plus any notable personal experiences from the week and the weekend.

For climate topics please use the most recent Climate clippings.

The gentleman in the image is Voltaire, who for a time graced the court of Frederick II of Prussia, known as Frederick the Great. King Fred loved to talk about the universe and everything at the end of a day’s work. He also used the salons of Berlin to get feedback in the development of public policy.

Fred would only talk in French; he regarded German as barbaric. Here we’ll use English.

The thread will be a stoush-free zone. The Comments Policy says:

The aim [of this site] is to provide a venue for people to contribute and to engage in a civil and respectful manner.

Shredding the fig leaf

Direct Action was always a fig leaf for a government pretending to have a climate policy. Now the climate change denialists in Abbott’s cabinet have taken the opportunity to shred the fig leaf to the complete embarrassment of Greg Hunt.

Giles Parkinson thinks the 2014 budget is Abbott settling old scores, and dumping clean energy in favour of the asphalt economy.

With proposals to repeal the carbon price, dismantle the Climate Change Authority and the Clean Energy Finance Corporation, and the dilution of the Renewable Energy Target already in train, these budget measures – which include the closure of ARENA, the dumping of the million solar roofs program (both contrary to election promises) and the research funding cuts at the CSIRO, Bureau of Meteorology and elsewhere – mean that the obliteration of the Clean Energy Future package will be complete, if it can get past the Senate.

Dumping ARENA is particularly stupid, as the fund was leveraging private investment at the rate of $2.50 to one and doing much to support the off-grid activities of the mining industry.

ARENA will maintain funds of $1 billion for around 190 projects – mostly R&D – that have already been contracted since its creation in 2012, but it will have a measly budget of just $15 million over each of the next two years for new projects.

Some 150 of its 180 projects already allocated are in support of research and development, a core competency not valued by the Government.

The Emissions Reduction Fund ($2.55 billion) has been spread over 10 years, rather than four. Tristan Edis explains that $2.55 billion will be allocated over the next four years, but the scheme only pays on completion. However, this does call into question the efficacy of the scheme.

Clive Palmer wants to divert the funds to pensions and is prepared to vote it down.

The million solar roofs scheme was a featured election promise.

The million solar roofs program, once a $1 billion centrepiece of Direct Action to bring solar to lower-income earners and renters, has sunk without trace — replaced by a derisory $2.1 million program to install solar on RSLs and bowling clubs in seven electorates, many of them marginal (yes, really).

But not to worry we still have “$525 million to pay up to 15,000 under-25s to pick up litter at below-award wages under the guise of the Green Army”.

Parkinson further reports

the abrupt closure of the Energy Efficiency Opportunities, as well as rejecting calls for the revival of Low Carbon Australia, which also supported investments in energy efficiency. It has also brought an end to support for ethanol and algae fuel programs.

The Energy Efficiency Opportunities program, which was to cost $20 million to run over the next five years, had helped deliver more than $1 billion a year in savings since 2006.

Alan Pears at The Conversation has more. He says the Clean Energy Finance Corporation which has already mobilised $2.5 billion of mostly private funding for low-emission energy and agriculture projects would make a profit for the government if allowed to continue. Like ARENA the CEFC will continue trading until stopped by legislation.

Pears says that leaves the Renewable Energy Target (RET) scheme as “the last major remaining piece of federal government policy that supports ongoing investment.” It has already led to $20 billion worth of investment, but is under review with climate sceptic Dick Warburton at the helm.

There’s more at The Guardian and at Planet Oz. There Graham Readfearn tells of the axing of a small $1.3 million program, which has been supporting more than a 150 local and state-based conservation groups across the country since 1973. Such is the depth and thoroughness of the attack on the environment.

Meanwhile global renewable energy jobs surged to almost 6.5 million in 2013. In Germany, where the government strategy was to take first mover advantage, renewable energy production reached 74% the other day.

We are striving to be last.